SWIFT Update March 24, 2022

MMB is hiring a Finance Accounting Supervisor

Minnesota Management and Budget (MMB) is hiring a Finance Accounting Supervisor for the Vendor Payments Support team.

The Vendor Payments Support Supervisor position supports MMB's SWIFT Vendor Payments Unit within the Accounting Services Division. The Vendor Payments Support team includes operational staff responsible for managing and supporting the enterprise vendor file, processing and supporting enterprise payments (both warrant and EFT), ensuring compliance with state and federal tax reporting requirements, and ensuring agencies comply with statutory encumbrance requirements. This team supports all state agencies and 300,000 vendors.

Please share this position opening with colleagues and friends who may be interested.

Notice on New Local Taxes

The Minnesota Department of Revenue will be administering the following new sales and use taxes effective April 1, 2022: Koochiching County 0.5% Sales and Use Tax.

The sales and use tax rate changes apply to sales made on or after April 1, 2022. They will be in addition to all other taxes in effect. Local sales tax applies to retail sales made and taxable services provided within the local taxing area (county/city limits). The tax applies to the same items that are taxable under the Minnesota sales and use tax law.

Purchase orders entered in SWIFT on or after April 1, 2022 will calculate the new tax rates for each county/city. Existing purchase orders and/or their vouchers will need to be adjusted to pay the correct tax if delivery occurs after various dates. Please note that the dates will be different based on whether goods or construction materials are being delivered. Check the tax notice for the affected city for the correct dates.

For assistance in changing the sales tax on a purchase order, please consult the Update the Sales Tax Settings on an Existing Purchase Order quick reference guide. You can also view the Update Sales Tax on an Existing Purchase Order video.

Impact of the New Local Tax on Accounts Payable

Vouchers entered in SWIFT on or after the tax effective date will calculate the new tax rates for each county/city if the Invoice Date is on or after the tax effective date. If the Invoice Date is before the tax effective date, SWIFT will exclude the new tax rates. Please review the tax calculation carefully prior to payment on all vouchers with Ship To locations within these jurisdictions.

Please see the Minnesota Department of Revenue tax notice for the appropriate city for guidance in handling orders and payments during the transition period: Koochiching County 0.5% Sales and Use Tax.

SWIFT will be updated with the new tax codes for all existing Ship To addresses located in the affected cities. New purchase orders, created on or after Friday, April 1, 2022, will calculate the new rate of tax for the ship to addresses within those counties/cities. Existing purchase orders may or may not need to have the tax code updated on it if the payment can be processed during any allowed grace period(s). Again, see the general notice for each county/city.

Previously any Ship To addresses in affected cities may have used the tax code of 0000, State Tax only. To calculate the new combined rate, state, and local tax rate, the tax code(s) on the purchase order must be updated to the new tax code(s) from the 0000 tax code. Because of the various transition rules, these codes will not be updated by SWIFT and must be updated by the purchase order buyer.

Data Warehouse Security Change to an HCM Subject Area

MMB's Statewide Payroll Services updated the security to the HCM – Payroll – Roster Staffing Subject Area for the Data Warehouse. They posted this change on their Current Payroll Bulletins page. Please refer to the bulletin dated March 21, 2022, to see this security change for the roster staffing information.

Help Desk Hot Topic: Find Help in a SWIFT Module

Help Desk Hot Topics feature Frequently Asked Questions (FAQs) answered by the SWIFT Help Desk. Use these as a friendly reminder of a process or as an opportunity to learn something new!

Question: How can I find help in a SWIFT module?

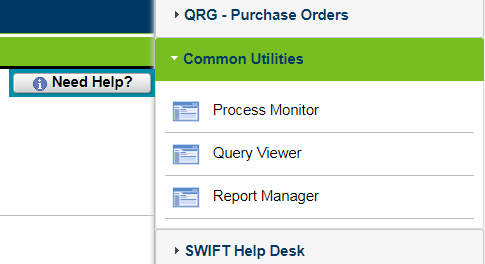

Answer: The Need Help? button is available in all SWIFT modules when you use a page. It includes Quick Reference Guides (QRG) specific to that module, SWIFT Help Desk information, and Common Utilities. Common Utilities include the Process Monitor, Query Viewer, and Report Manager.

These help pages will open up in a separate window so you can review the resource while you are working on a transaction. To close the Need Help window, select the Need Help? button again.

SWIFT Training

The SWIFT Training team offers online training through webinars, training guides, video tutorials, eLearning, and one-on-one sessions.

- Webinars/Labs: Enroll in online training for SWIFT and the EPM Data Warehouse on Enterprise Learning Management (ELM). See Upcoming SWIFT Training below. Webinars and labs run for 60 to 120 minutes. They include live demos of SWIFT and EPM Data Warehouse processes. SWIFT training options are webinars. Some of the EPM training are labs so that you can follow along and create and save your own reports or My Dashboard.

- SWIFT Training Guides and Video Tutorials: Find quick reference guides and a user guide on our Training Guides page and video tutorials on our Training Videos page.

- EPM Data Warehouse Training: Locate quick reference guides on our EPM Warehouse Training page. Topics include the most common EPM Data Warehouse processes and SWIFT reports.

- eLearning: Complete self-paced training in ELM. After learning the material at your own pace and passing the quiz, you’ll receive a Certificate of Completion. Currently, Introduction to SWIFT eLearning is available.

- One-On-One Sessions: Still feeling stuck? Request a one-on-one training session by emailing us at SWIFTHelpDesk@state.mn.us.

Upcoming SWIFT Webinars

To enroll in a SWIFT webinar or eLearning class, sign in to Self Service or the Administrative Portal and select the Learning Management tile.

- On the Find Learning tile, enter “SWIFT” in the search field, and press the Search button.

- From the Search Results, select the webinar you would like to take.

- Press the Enroll button, and check your email later for an invitation with instructions on how to attend the webinar.

Currently, there are seats still available for the following webinars and eLearning.

|

Module |

Webinars/eLearning |

Date |

Time |

|

INTRO |

Introduction to SWIFT eLearning |

Anytime |

Self-Paced Class |

|

SS |

Strategic Sourcing eLearning |

Anytime |

Self-Paced Class |

|

EPM |

Build a My Dashboard for SWIFT Reports lab |

Mar. 29, 2022 |

9:00 a.m. - 10:30 a.m. |

|

EPM |

Create and Save the All Receipts Report lab |

Apr. 06, 2022 |

9:00 a.m. - 10:15 a.m. |

|

EPM |

Create an All Expenditures SWIFT Report lab |

Apr. 07, 2022 |

9:00 a.m. - 10:30 a.m. |

|

PO |

Overview of Purchase Orders webinar |

Apr. 12, 2022 |

9:00 a.m. - 10:30 a.m. |

|

EPM |

Create and Save the Manager's Financial Report lab |

Apr. 13, 2022 |

9:00 a.m. - 10:15 a.m. |

|

PO |

Close and Cancel Purchase Orders webinar |

Apr. 14, 2022 |

10:00 a.m. - 11:30 a.m. |

|

EPM |

Use Standard SWIFT Reports in EPM lab |

Apr. 19, 2022 |

9:00 a.m. - 10:30 a.m. |

|

BI |

Billing Part 1 webinar |

Apr. 20, 2022 |

9:00 a.m. - 10:30 a.m. |

|

BI |

Billing Part 2 webinar |

Apr. 21, 2022 |

9:00 a.m. - 10:30 a.m. |

|

EPM |

Understand the SWIFT Data in the EPM Data webinar |

Apr. 26, 2022 |

9:00 a.m. - 10:30 a.m. |

|

EPM |

Create and Save a New Analysis lab |

Apr. 27, 2022 |

9:00 a.m. - 10:15 a.m. |

|

KK |

Budget Journal Administration webinar |

Apr. 28, 2022 |

9:00 a.m. - 11:00 a.m. |

|

AR |

Create, Correct and Verify Direct Journal Deposits webinar |

May 10, 2022 |

9:00 a.m. - 10:30 a.m. |

|

AP |

Create Vouchers Overview in Accounts Payable webinar |

May 10, 2022 |

9:00 a.m. - 10:30 a.m. |

|

AR |

Enter Deposits and Apply Payments for SWIFT Invoices webinar |

May 11, 2022 |

9:00 a.m. - 10:30 a.m. |

|

AR |

Use Maintenance Worksheets to Manage Customer Accounts webinar |

May 12, 2022 |

9:00 a.m. - 10:30 a.m. |

|

EPM |

Introduction to the EPM Data Warehouse for SWIFT Reports webinar |

May 17, 2022 |

9:00 a.m. - 10:30 a.m. |

|

SC |

Create Contract Shell webinar |

June 14, 2022 |

9:00 a.m. - 10:00 a.m. |

SWIFT Help Desk

Contact the SWIFT Help Desk for any SWIFT-related questions or issues.

Email: SWIFTHelpDesk.MMB@state.mn.us

Phone: 651-201-8100, option 2

Hours: 7:30 a.m. to 4:00 p.m., Monday through Friday (closed holidays)

When contacting the SWIFT Help Desk, make sure to include details about your question or issue, including:

- Your Business Unit

- Description of the issue/question

- SWIFT Module (Accounts Payable, Purchase Orders, etc.)

- Transaction ID (Voucher ID, PO ID, etc.)

- Error message print screen

Additional assistance can be found on the SWIFT Training Guides page.