Federal Budget Information

Federal Shutdown

On November 12, 2025, President Trump signed HR 5371 ending the longest federal shutdown in history. HR 5371, also known as the Continuing Appropriations, Agriculture, Legislative Branch, Military Construction and Veterans Affairs, and Extensions Act, 2026 includes three full-year appropriations bills, extends most expiring funding through January 30, 2026 and a number of additional provisions.

Reconciliation

Minnesota State Agency Assessment of Initial Impacts

Minnesota Programs Impacted by the 2025 Reconciliation Bill (Public Law 119-21)

This information is sourced from Public Law No: 119-21 and curated in collaboration with Minnesota state agencies. It is for informational use only. Last updated on 10/28/25.

Importance of Federal Funding to Minnesotans

Impacts of 2025 Reconciliation on Medicaid, SNAP, and Clean Energy

Medicaid in Minnesota

Supplemental Nutrition Assistance

Program

Clean Energy Initiatives

Federal Taxes: Key Changes and Impacts to State Revenue

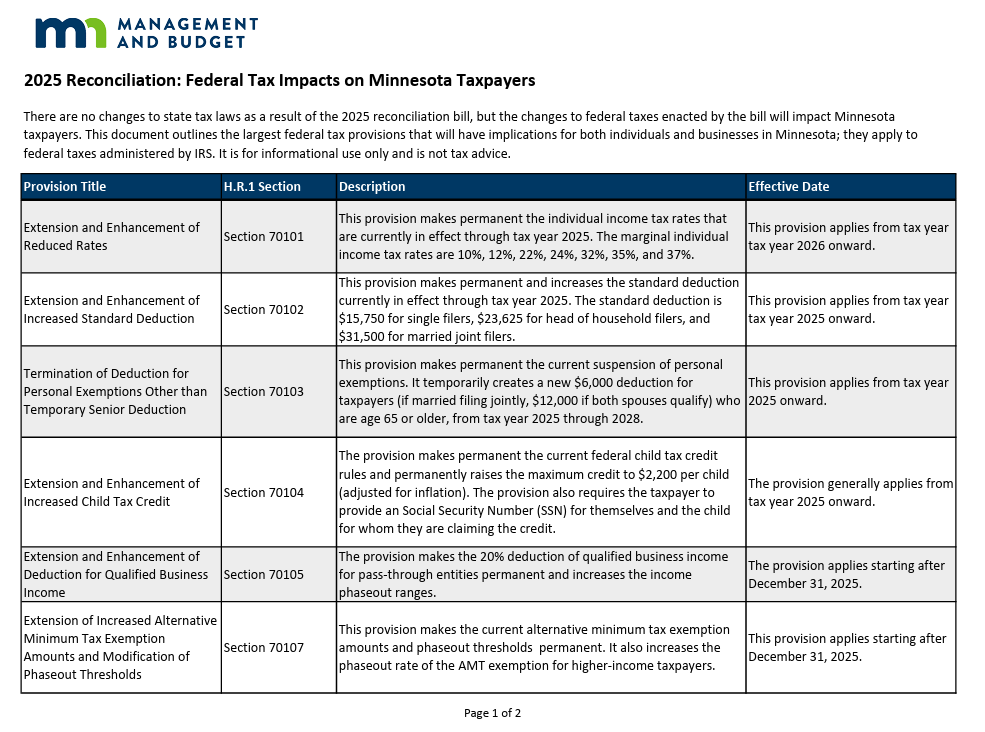

Key Changes to Federal Tax Policy

There are no changes to state tax laws as a result of the 2025 reconciliation bill (Public Law 119-21), but the changes to federal taxes enacted by the bill will impact Minnesota taxpayers. This document outlines the largest federal tax provisions that will have implications for both individuals and businesses in Minnesota; they apply to federal taxes administered by IRS. It is for informational use only and is not tax advice.

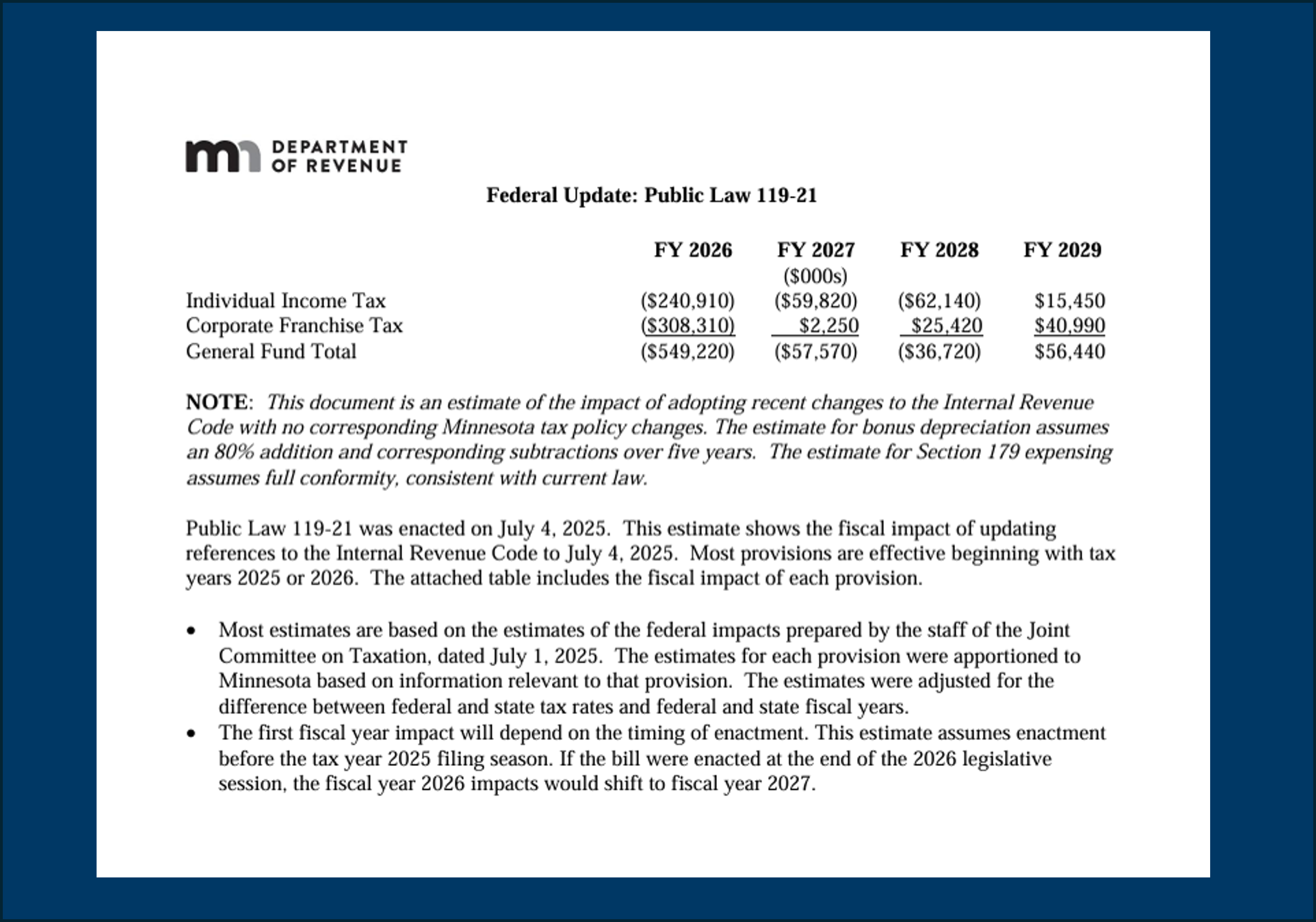

Federal Tax Impacts on State Revenue

There are no changes to state tax laws resulting from changes to the Internal Revenue Code enacted by the 2025 reconciliation bill (Public Law 119-21). This document contains estimated impacts to Minnesota state revenue if Minnesota chose to adopt certain federal tax changes into state law; it is not a comprehensive list of all federal tax changes and is not tax advice.

Contact Us: federal.investments.mmb@state.mn.us