Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Most of the manufacturing base centers on mining and forest products industries. More than half of the sector's employment is in paper and machinery manufacturing.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

Hours worked are on the decline in Northeast Minnesota.

10/23/2025 11:08:05 AM

Carson Gorecki

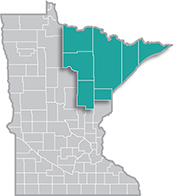

Hours worked are on the decline in Northeast Minnesota. As provided by DEED's /deed/data/data-tools/qed/index.jspQuarterly Employment Demographics, median hours worked per quarter in 2024 were 387, down from pre-pandemic levels in the 400s (see Figure 1). The overall decline is rather small at first glance, down eleven hours on average per quarter from 2021, equivalent to about an hour less per week. What is perhaps more notable is who is working less and by contrast, who is working more.

While hours have declined overall in recent years, groups such as women and younger and older workers have been spending more time at work. Compared to 2019, women and workers aged 65 years or older were working 3 additional hours per quarter at the median (see Table 1). Workers younger than 19 worked 2 more hours per quarter. The largest absolute and relative increase, however, occurred for workers aged 20-24, who saw their median hours per quarter grow by 29, or 13% compared to 2019. That is equal to almost four additional eight-hour days per quarter, or almost 15 more days over the year.

| Table 1. Median Hours Worked per Quarter by Group in Northeast Minnesota, 2019-2024 | |||||

|---|---|---|---|---|---|

| Group | 2024 Median Hours Worked per Quarter | 2019-2024 | 2023-2024 | ||

| Numeric Change | Percent Change | Numeric Change | Percent Change | ||

| Total, All Workers | 387 | -14 | -3.5% | -5 | -1.3% |

| Women | 368 | 3 | 0.8% | -1 | -0.3% |

| Men | 434 | -22 | -4.8% | -6 | -1.4% |

| Under 19 | 118 | 2 | 1.7% | -6 | -4.8% |

| 20 to 24 years | 260 | 29 | 12.6% | 0 | 0.0% |

| 25 to 44 years | 433 | -15 | -3.3% | -5 | -1.1% |

| 45 to 54 years | 450 | -29 | -6.1% | -6 | -1.3% |

| 55 to 64 years | 440 | -22 | -4.8% | -8 | -1.8% |

| 65 years and over | 218 | 3 | 1.4% | -2 | -0.9% |

| Source: DEED Quarterly Employment Demographics | |||||

At the same time, men saw median hours decline 5% between 2019 and 2024, from 456 to 434. Declines of similar magnitude occurred for workers aged 45-54 and 55-64, with the largest numeric decline for 45-54-year-old workers at 29 fewer hours. Prime-age workers, aged 25-44, saw hours decline by a relatively smaller 3.3% over five years. However, these workers represent 42% of the workforce, so even a small decline in hours worked in this group can have an outsize impact.

To help explain it better, here is an example: In 2024 there were about 59,000 jobs held by prime-age workers (42% of 140,500 total jobs) in the region. If each of those workers on average worked 15 hours fewer per quarter (60 fewer hours per year), the cumulative impact would equal somewhere in the realm of 3,540,000 fewer hours per year. This of course assumes that the number of workers and jobs was steady over the time period of comparison and that each worker saw hours decline by 15.

A change of the median hours worked does not always equal a change in the average hours worked, and employment actually declined by 3,200 jobs from 2019-2024. Nonetheless you can see how even seemingly small changes in median hours worked may represent much larger shifts in worker and employer behavior, with large implications for the regional economy.

Lastly, the trends of increased hours we saw in some groups following 2020 in response to an extremely tight labor market have largely abated or reversed. From 2023-2024, median hours worked were down for all groups mentioned above excepting 20-24-year-olds, which saw hours stay flat. This more recent downward trend could be an early sign of cooling in the labor market, restructuring of schedules and/or an increased desire by workers to work less.

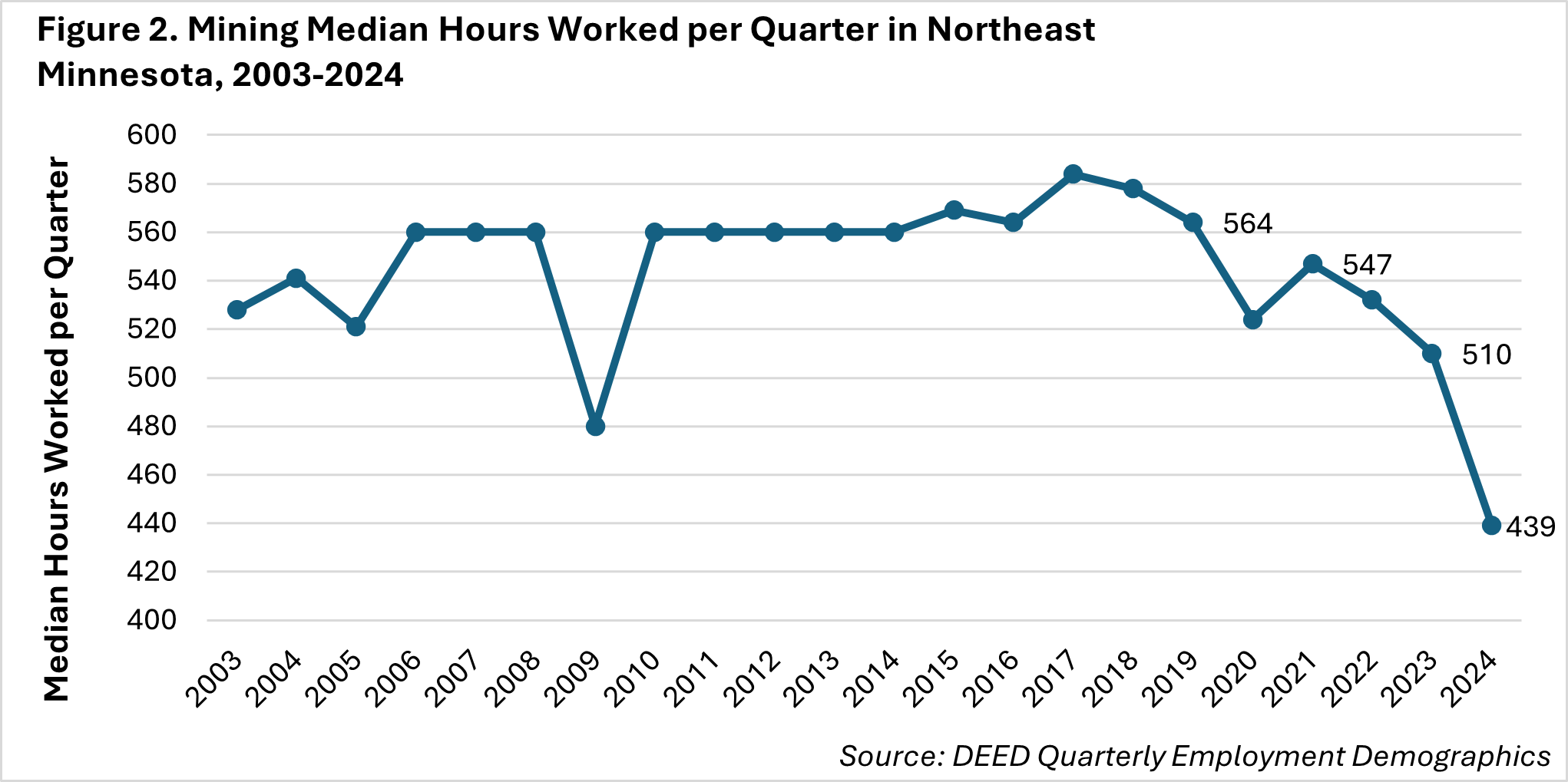

An example in support of the first of these hypotheses is the recent downward trend of hours worked in Mining, traditionally one of the industries with the highest median hours (see Figure 2). From 2021-2024, median hours worked in Mining fell by more than 100 and nearly 20%, the largest decline among industries in the region over this period. This downward trend may have been an early sign of a slowdown in the industry. Indeed, 600 miners were laid off earlier this year.

Hours worked are another useful indicator in our labor market information toolbox. Feel free to reach out if you have any questions on hours in your industry or field.

For more information about Quarterly Employment Demographics in Northeast Minnesota, contact Carson Gorecki at Carson.Gorecki@state.mn.us.