Spotlight: Demographic Shifts in Northeast Minnesota’s Workforce

by Carson Corecki

January 2025

The population of Northeast Minnesota has been growing and evolving over the last decade. The major demographic trends of aging and racial and ethnic diversification have large implications for the region's workforce and economy. Shifts by gender and education deserve attention as well. Over the long run, population trends generally are reflected by employment demographic trends. A large disruptive event like the COVID pandemic, however, acted as a bit of a wildcard and at times an accelerant in how overall population trends translated down to the workforce. Some workers saw increased opportunity and took advantage while others either were unable or unwilling. These individual decisions and outcomes added up to some interesting cumulative changes in the region's workforce, some not completely in line with the larger population shifts.

Fortunately, there are two great sources of local workforce demographics at our disposal. The first is the U.S. Census Bureau's Quarterly Workforce Indicators (QWI). QWI provides employment counts, flows, and earnings for detailed industries in the characteristics of age, race, ethnicity, education, and gender down to the county level. As the title implies, these data are available quarterly as well as annually. It is a fantastic resource for many difference workforce questions and will make up the bulk of the analysis in this article. The other source is DEED's own Quarterly Employment Demographics (QED). QED is similar in many ways to QWI, but the data, sources, and methods differ slightly. For example, QED is limited to shares of employment by age and gender, and is derived from actual wage record and drivers license records in Minnesota. What QED can provide that QWI cannot is median hours worked and median wage by each category. Primarily using QWI and supplementing with QED, this article explores how Northeast Minnesota's workforce has evolved over recent years and decades.

Age

In 2013 62.2% of the 143,700 jobs in the region were held by workers between the ages of 25 and 54. That share was down from 68.4% a decade earlier, as the 55-64 age group swelled from 12% to a 19% share of employment with aging Baby Boomers (see Table 1). The trend of an aging workforce continued over the next decade, but impacted the prime-age workforce less as most Boomers passed the typical retirement age of 65. As a result, the share of the workforce aged 65 or older expanded from 4.1% to 6.9% from 2013 to 2023 while the 25-54 share declined less then two percentage points to 60.5%.

The number and share of the youngest workers also grew relatively rapidly. Workers 18 years old or younger took advantage of the increased opportunities afforded by an increasingly tight labor market, especially in the wake of the pandemic. Despite the rapid increases of workers aged 18 or younger and 65 or older, those cohorts accounted for just under 11% of total regional employment as of 2023.

| Table 1. Employment Change by Age Group in Northeast Minnesota, 2013-2023 | |||||||

|---|---|---|---|---|---|---|---|

| Age Group | 2013 Employment | 2023* Employment | 2013 Employment Share | 2023 Employment Share | Percent Change in Employment Share 2013-2023 | Change in Employment Count | Percent Change in Employment Counts |

| 14-18 | 3,986 | 5,729 | 2.8% | 4.0% | +44.6% | +1,743 | +43.7% |

| 19-21 | 7,934 | 8,191 | 5.5% | 5.7% | +3.9% | +257 | +3.2% |

| 22-24 | 9,272 | 8,465 | 6.5% | 5.9% | -8.1% | -807 | -8.7% |

| 25-34 | 29,727 | 27,701 | 20.7% | 19.4% | -6.2% | -2,026 | -6.8% |

| 35-44 | 27,415 | 31,157 | 19.1% | 21.8% | +14.4% | +3,742 | +13.6% |

| 45-54 | 32,204 | 27,480 | 22.4% | 19.3% | -14.1% | -4,725 | -14.7% |

| 55-64 | 27,234 | 24,197 | 19.0% | 17.0% | -10.6% | -3,038 | -11.2% |

| 65-99 | 5,883 | 9,828 | 4.1% | 6.9% | +68.1% | +3,945 | +67.0% |

| Total | 143,655 | 142,746 | 100% | 100% | N/A | -909 | -0.6% |

| *2023 consists of Q2-Q4 2023 and Q1 2024, the latest data available at publication. Source: US Census Quarterly Workforce Indicators | |||||||

Not all industries experienced the same aging trends in their workforces. Perhaps unsurprisingly, most sectors saw their 65+ share grow over the last decade. Only Management1 saw the oldest worker share decrease. Some, such as Manufacturing and Construction saw their share of the oldest workers more than double over 10 years. Interestingly, but also unsurprising given the overall trends, the other age groups of these sectors that saw relatively large increased workforce shares were 14-18, 19-21, and 22-24-year-olds. The Construction and Manufacturing workforces simultaneously added relatively more of the oldest, and youngest, workers. These trends track with the overall regional workforce, but to a much greater extent.

Within the 25-34, 35-44, and 45-55 prime working-age cohorts there were differing trends. While the number of 35–44-year-olds employed rose over the decade by more than 3,700, the number of 25–34-year-olds fell by 2,028, and the number of 45–54-year-olds decreased by 4,724 (See Table 2). Together these trends equated to a net loss of about 3,000 prime-age workers.

Industries that added the most prime-age workers were Public Administration, Construction, Professional, Scientific, and Technical Services, and Educational Services. The Construction sector, which added the second-most prime-age workers, saw that share of its workforce decline as the other age groups grew even faster over the decade. The same thing occurred in the Professional, Scientific, and Technical Services sector as the share of prime-age workers fell while the number expanded.

Conversely, Utilities saw its share of prime-age workers grow the most despite a numeric decline, pointing to larger losses in other Utilities cohorts. As a result, Utilities, at nearly 75%, had the second highest share of its workforce between the ages of 25 and 54, just behind Mining. Next highest were Professional, Scientific, and Technical Services, Management and Public Administration. Construction, which had the highest prime-age worker share in 2013, fell down the ranks to 6th. The Information sector saw the largest relative decline of prime-age worker share, falling 10 percentage points to 58.3%. Finance and Insurance, Arts, Entertainment, and Recreation, and Retail also saw relatively large declines of prime-age worker shares. For Arts, Entertainment, and Recreation and Retail this is notable because those sectors already had two of the three lowest prime-age worker shares in 2013. They joined Accommodation and Food Services as the only sectors with a prime-age workforce share under 50%.

| Table 2. Employment Change for Prime-Age Workers (25-54) in Northeast Minnesota | ||||||

|---|---|---|---|---|---|---|

| Industry | 2023 Employ-ment | Numeric Change 2013-2023 | Percent Change 2013-2023 | 2013 Employ-ment Share | 2023 Employ-ment Share | Change in Employ-ment Share |

| Construction | 5,568 | 378 | 7.3% | 73.5% | 66.6% | -6.9% |

| Finance and Insurance | 2,363 | -1,035 | -30.5% | 72.4% | 67.0% | -5.4% |

| Professional, Scientific, and Technical Svcs. | 3,528 | 346 | 10.9% | 72.1% | 70.6% | -1.5% |

| Utilities | 1,326 | -67 | -4.8% | 70.6% | 74.6% | 4.0% |

| Management | 493 | 39 | 8.6% | 69.7% | 68.2% | -1.6% |

| Agriculture, Forestry, Fishing and Hunting | 295 | -99 | -25.1% | 69.5% | 65.6% | -3.9% |

| Manufacturing | 5,479 | -982 | -15.2% | 69.3% | 65.8% | -3.5% |

| Information | 558 | -689 | -55.3% | 68.3% | 58.3% | -10.0% |

| Wholesale Trade | 2008 | -177 | -8.1% | 68.2% | 64.1% | -4.1% |

| Public Administration | 6,292 | 418 | 7.1% | 66.7% | 67.5% | 0.8% |

| Transportation and Warehousing* | 4,308 | -561 | -11.5% | 64.7% | 61.8% | -4.4% |

| Health Care and Social Assistance | 21,565 | -261 | -1.2% | 64.5% | 63.6% | -0.8% |

| Educational Services | 8,228 | 303 | 3.8% | 63.1% | 64.9% | 1.8% |

| Admin. Support and Waste Mgmt. Svcs. | 2,137 | -431 | -16.8% | 62.4% | 58.1% | -4.3% |

| Total, All Industries | 86,338 | -3,009 | -3.4% | 62.2% | 60.5% | -1.7% |

| Other Services (except Public Admin.) | 3,030 | 164 | 5.7% | 58.4% | 55.5% | -2.9% |

| Real Estate and Rental and Leasing | 739 | 17 | 2.4% | 57.0% | 57.5% | 0.5% |

| Arts, Entertainment, and Recreation | 1,744 | -268 | -13.3% | 54.2% | 49.4% | -4.7% |

| Retail Trade | 7,318 | -1,592 | -17.9% | 51.7% | 46.7% | -5.0% |

| Accommodation and Food Services | 6,486 | -375 | -5.5% | 48.5% | 46.6% | -1.9% |

| Mining, Quarrying, & Oil and Gas Extraction | 2,872 | n/a | n/a | n/a | 75.4% | n/a |

| *Due to a break in the data, 2014 data was used for Transportation and Warehousing. Source: US Census Quarterly Workforce Indicators | ||||||

The changing age of a workforce is more than simply a change of numbers. A younger (or older) workforce will bring different needs, skills, and experiences that often dictate the effectiveness of different recruitment, retention, management, and communication approaches.

Race and Ethnicity

As by age, there have been some stark employment trends by race and ethnicity in Northeast Minnesota. Just as the overall population is becoming more racially and ethnically diverse, so is the workforce. In fact, the workforce is diversifying more quickly. Since 2013, the population of color grew 37% while employment of color expanded 47%. In 2013, the worker of color share was 6.6% of the workforce. A share that, in tandem with a decline in white employment, increased by more than three percentage points over a decade to 9.7%. In 2023 4,343 more workers identified as people of color than in 2013.

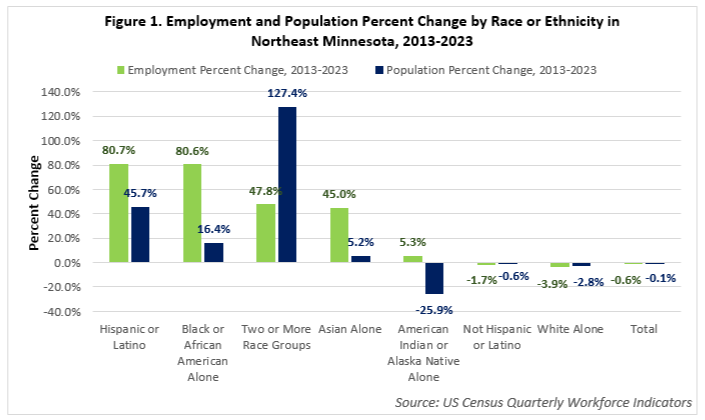

Leading the employment growth were Hispanic or Latino workers which added 1,447 workers over the decade, a percent increase of 80.7% (see Figure 1). That increase just edged out the 80.6% growth of Black or African American employment in the region with an addition of 1,132 workers. Population growth also occurred for residents identifying with Two or More Races, rising 127%. Employment for workers of Two or More Races grew more slowly but was still well above average at 48%. Asian employment expanded 45%, but that growth was the fastest relative to that group's corresponding population growth over the period.

American Indian or Alaska Native employment grew 5% which countered a population decline of nearly 26%. However, that population decline may be more reflective of changing perceptions and responses to the Census' survey questions than an actual physical decline of Native people in the region. White Alone (-3.9%) and Not Hispanic or Latino (-1.7%) were the only groups to see employment declines. It is worth pointing out that while the increases in employment for workers of color is a positive trend, significant disparities in labor force participation and unemployment persist for many of these groups in the region.

All but three sectors saw percent and numeric growth in people of color employment2. Only two sectors – Utilities and Arts, Entertainment, and Recreation – saw white employment grow faster (or decline more slowly) than people of color employment (see Table 3). The largest number of workers of color were added in Health Care and Social Assistance (978), also the largest sector overall. Other sectors with rapidly growing people of color workforces were the relatively small Real Estate Rental and Leasing, Wholesale Trade, and Other Services. After Health Care and Social Assistance, the Accommodation and Food Services (633), and Retail (524) sectors added the most workers of color.

Despite a decrease in people of color employment, the Arts, Entertainment, and Recreation sector retained its position as the sector with the highest workers of color share at nearly 17%. The growth in Transportation and Warehousing bumped it up to the second spot while Accommodation and Food Services moved up a spot to third. Public Administration, which was in second, fell to fourth and Administrative Support and Waste Management stayed in fifth. Among the sectors for which data were available, Utilities, Mining, Finance and Insurance, and Information had the lowest worker of color shares. Utilities was the only sector with a below average worker of color share to also see that share decline over the decade.

| Table 3. People of Color Employment by Industry in Northeast Minnesota, 2013-2023 | |||||

|---|---|---|---|---|---|

| Industry | 2023 Employ-ment | 2013 People of Color Share | 2023 People of Color Share | Percent Employment Change 2013-2023 | Numeric Change 2013-2023 |

| Real Estate and Rental and Leasing | 91 | 3.5% | 6.9% | +107% | +47 |

| Wholesale Trade | 216 | 3.4% | 6.9% | +98% | +107 |

| Other Services (except Public Admin.) | 542 | 6.1% | 9.9% | +81% | +243 |

| Manufacturing | 569 | 3.5% | 6.8% | +73% | +240 |

| Construction | 568 | 4.9% | 6.8% | +63% | +220 |

| Retail Trade | 1,452 | 5.4% | 9.3% | +56% | +524 |

| Professional, Scientific, and Tech. Svcs. | 413 | 6.1% | 8.3% | +54% | +144 |

| Finance and Insurance | 175 | 2.4% | 4.9% | +54% | +61 |

| Health Care and Social Assistance | 2,954 | 5.8% | 8.7% | +49% | +978 |

| Educational Services | 942 | 5.1% | 7.4% | +47% | +299 |

| Total, All Industries | 13,776 | 6.6% | 9.7% | +46% | +4,343 |

| Accommodation and Food Services | 2,082 | 10.2% | 15.0% | +44% | +633 |

| Transportation and Warehousing* | 1,073 | 10.3% | 15.4% | +38% | +296 |

| Public Administration | 1,178 | 11.9% | 12.5% | +11% | +121 |

| Admin. Support and Waste Mgmt. Svcs. | 432 | 9.9% | 11.8% | +6% | +24 |

| Utilities | 37 | 2.5% | 2.1% | -24% | -12 |

| Arts, Entertainment, and Recreation | 592 | 21.4% | 16.8% | -25% | -202 |

| Information | 63 | 4.9% | 6.6% | -32% | -29 |

| *Due to a break in the time series, 2014 data was used for Transportation and Warehousing. Source: US Census Quarterly Workforce Indicators | |||||

Gender

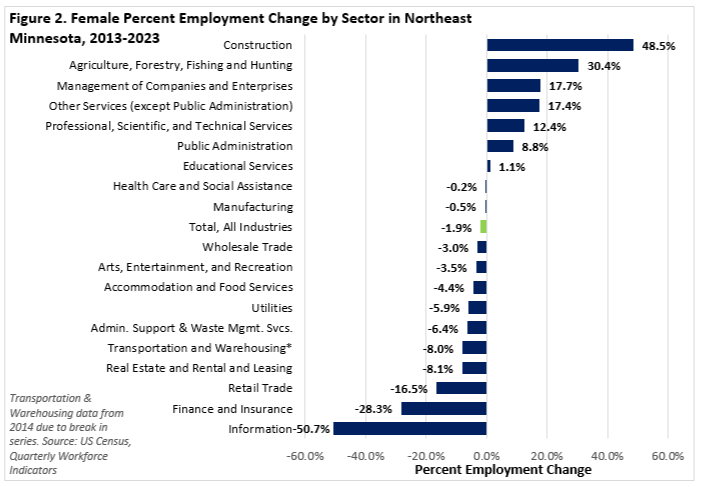

Since 2013 overall male employment in the region grew slightly while female employment declined modestly (see Figure 2). As a result, the female share of employment fell 0.6 percentage points, but retained the slim majority at 50.7% in 2023. Beneath the totals, the major trend by gender was that industries that had high concentrations of employment by one gender tended to see that concentration decrease. The clearest examples of this trend are in the Agriculture, Forestry, Fishing, and Hunting and Construction sectors. These two sectors had the lowest shares of female workers in 2013, but then saw the largest, and second-largest percent change through 2023 (see Figure 2).

Despite robust growth, Construction remained the sector with the lowest share3 of women at 13.2%. Transportation and Warehousing, which fell to the second-lowest female workforce share at 18.9%, was one of only two sectors with less than 50% women in 2013 and saw their shares fall into 2023. The other sector was Information, which fell slightly from 42.5% to 41.4%. Finally, two sectors saw majority female workforces flip to majority male workforces: Retail Trade and Real Estate Rental and Leasing.

The sectors that saw the largest numeric increases in female employment were Other Services (441), Construction (361), and Public Administration (334). Given that the overall trend was that of female employment decline, the sectoral losses were much larger. Leading the numeric losses were Retail Trade (-,468), Finance and Insurance (986), and Information (407). Despite relate lively large losses, Finance and Insurance remained the sector with the second highest female workforce share at 70.7%. The highest share of female workers belonged to Health Care and Social Assistance, with 76.8%. The only other sector with a female workforce share greater than 60% was Educational Services (66.9%).

Education

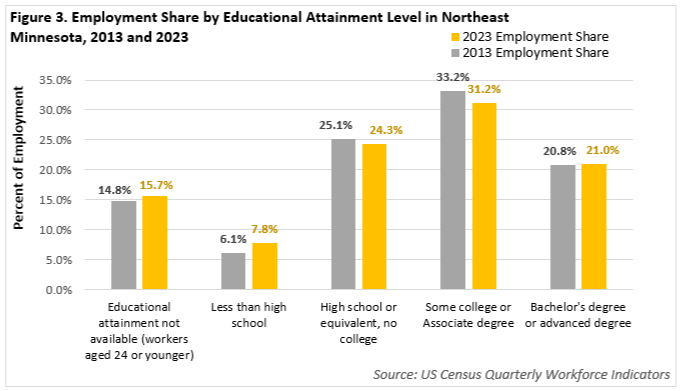

The level of educational attainment that grew the most relative to total employment was less than high school. The number of jobs filled by workers with less than a high school degree expanded 28% over the last decade. The number of workers where educational attainment was unavailable (workers aged 24 or younger) also grew faster than average, increasing 6.3%. Jobs filled by workers with at least bachelor's degrees grew slightly (0.8%). Decreasing faster than average were the number of jobs filled by workers with some college or associate degrees (5.9%) or with high school or equivalent (3.3%). These changes corresponded with employment changes by age. The youngest workers, who are more likely to fall into the educational attainment not available category saw relatively large increases. Workers aged 65 years or older, who are much more likely to have less than a high school education than the average worker, also increased.

While the percent increase in jobs held by those with less than a high school degree was relatively sizeable, the overall numeric increase was just under 2,400. That increase equated to an increase in the share of employment from 6.1% to 7.8% (see Figure 3). The numeric increase for workers with educational attainment unavailable (workers aged 24 or younger) was just under 1,200, and the share increased from 14.8% to 15.7%. The number of workers holding bachelor's degrees or above increased by less than 60, leading to a minimal change in share to 21%. The decrease in the number of workers with some college or associate degrees was a bit larger (3,140), corresponding to a loss of share from 33.2% to 31.2%. The decrease for those with a high school education or equivalent was smaller (1,420) and the share shrunk less than a percentage point to 24.3%.

Despite relatively little movement in the overall shares of employment by educational attainment, changes were more discernible at the sector level. Just as by gender, sectors marked by relatively high concentrations of one educational level were more likely to experience redistribution. Table 4 below shows the largest shifts in employment shares by educational attainment level and sector.

In almost every instance the largest growth was seen in sectors with the lowest 2013 employment shares in each educational attainment category. The three sectors with the largest increases in workers with bachelor's degrees or above are also the three that had the lowest shares of those workers in 2013. All began the decade with shares under 10% and finished it above.

| Table 4. Employment Share by Educational Attainment Level for Select Sectors in Northeast Minnesota 2013-2023 | |||||

|---|---|---|---|---|---|

| Education Level | Industry | 2013 Employment Share | 2023 Employment Share | 2013-2023 Numeric Employment Change | 2023 Employment |

| Bachelor's degree or advanced degree | Accommodation and Food Services | 7.9% | 11.7% | +514 | 1,632 |

| Construction | 9.7% | 13.7% | +463 | 1,148 | |

| Agric., Forestry, Fishing & Hunting | 8.4% | 11.0% | +11 | 63 | |

| Some college or associate degree | Agric., Forestry, Fishing & Hunting | 26.3% | 28.9% | +4 | 166 |

| Educational Services | 27.6% | 28.7% | +170 | 3,639 | |

| Accommodation and Food Svcs. | 20.8% | 20.7% | -58 | 2,884 | |

| High school or equivalent, no college | Prof., Scientific, &Technical Svcs. | 17.5% | 20.1% | +226 | 1,002 |

| Educational Services | 18.0% | 20.4% | +327 | 2,590 | |

| Utilities | 19.0% | 21.3% | +6 | 383 | |

| Less than high school | Utilities | 2.6% | 6.3% | +61 | 113 |

| Educational Services | 3.3% | 6.1% | +355 | 774 | |

| Public Administration | 4.7% | 7.5% | +293 | 708 | |

| Educ. attainment not available (24 or younger) | Educational Services | 3.8% | 6.3% | +318 | 799 |

| Construction | 9.0% | 14.7% | +593 | 1,227 | |

| Information | 12.1% | 17.8% | -59 | 170 | |

| Source: US Census Quarterly Workforce Indicators | |||||

What these data appear to indicate is a slight hollowing out of the middle of the educational attainment spectrum in the regional workforce. Increases in the least and most educated workers have combined with declines in those that have high school alone or some college or associate degrees. Sectors that traditionally had less-educated workforces are – on average – becoming more educated, and those that had the most-educated workforces are seeing those shares decrease. Some of these changes are likely from evolving preferences and practices by employers as skills-based hiring has become more popular and emphasis on degrees alone wanes. These trends may also reflect changes in the preferences of young people. High school graduates in the region are more likely to enter the workforce, and less likely to enroll in college, than they were 10 years ago.

Our regional workforce is changing. In many ways it reflects changes in the overall population, as it ages and becomes more racially and ethnically diverse. Sectors that were traditionally dominated by workers with specific characteristics have been more likely to see shifts toward a more balanced and varied workforce. These changes in industrial employment patterns contributed to increased opportunities for groups that were once much more on the fringes: women in Construction; people of color in sectors that pay above the regional average like Construction, Manufacturing, Professional, Scientific, and Technical Services, and Finance and Insurance; teen workers in non-Leisure and Hospitality sectors; the oldest workers in every sector other than Mining and Management; and workers without degrees in high-paying sectors like Utilities, Health Care and Social Assistance, and Professional, Scientific, and Technical Services. The evolution of our regional workforce is not a new phenomenon. The aging and racial and ethnic diversification of our workforce has been unfolding for quite some time, beginning well before 2013. These trends are likely to continue for at least the medium term and are not likely to change course quickly. Employment trends by gender and education are arguably more responsive to and dependent on changing preferences and policies such as minimum hiring requirements, perceived value of postsecondary education, childcare accessibility and more. How these employment trends will unfold is an open question, but history makes it clear that our workforce will continue to change. Regional employers and organizations that anticipate and adapt to these changes the quickest will be best positioned to benefit from our workforce of the future.

Footnotes

1 Mining also saw it's share of 65+ workers decline, but data were not available for all age groups in 2013, skewing the results and rendering them inconclusive.

2 For more detail on the racial and ethnic breakdown by sector, please see the Northeast Minnesota Regional Profile, page 17.

3 QWI suppressed data for Mining. According to DEED's Quarterly Employment Demographics, women made up 8% of the workforce in 2022. The same share as in 2013.