Projections vs. Models: Tools for Understanding the Future of Minnesota’s Clean Economy Workforce

By Molly Ingram

September 2025

Forward-looking employment estimates show up in more places than you might expect. You may encounter them in news headlines about job creation, but they are also used behind the scenes to guide education and training program planning and to help workforce development boards find programs that set people up for long-term opportunities. They can even sway which economic development projects get the green light and influence support for policies based on their potential job impacts.

Two of the most common ways that future job demand is estimated are:

- Projections - looking at recent trends to estimate what's most likely to happen if nothing major changes.

- Scenario models - exploring what could happen if we invest in new industries, pass specific policies or experience other big changes.

Both have strengths and limitations, and both can be useful—especially when planning for a clean economy and the workforce needed to build it.

In this article, we'll cover how these two methods work, where the data come from and what to keep in mind when interpreting the results. We'll also look at how these methods are applied to clean economy workforce planning and how Minnesota is using these tools to support climate and infrastructure goals through the Climate Action Framework (CAF) and related initiatives.

Key takeaways

- Two main tools for estimating future jobs: Projections show what's most likely if trends continue; scenario models test "what if" questions about new policies or investments.

- How they work: Both start from the same public data and account for known policy or funding changes where possible.

- Each has limits: Projections are most accurate in stable times; models depend heavily on assumptions. Both should be treated as guides, not predictions.

- Planning and policy examples: Michigan used modeling to align training with federal infrastructure funding; New Mexico tested job impacts of a Clean Fuels Standard; Minnesota Commerce analyzed federal policy shifts.

- Advocacy and media: Advocacy groups use modeling to highlight risks and opportunities, and media often lift these numbers into headlines — sometimes without context.

- Minnesota today: The Climate Action Framework (CAF) is modeling pathways to reduce carbon emissions and resulting workforce impacts; Powering Climate & Infrastructure Careers (PCIC) is estimating workforce needs for current and upcoming investments.

- Bottom line: Every climate action depends on people. Workforce planning links policy pathways with the trained workers needed to carry them out.

Projections

What they are

The Bureau of Labor Statistics (BLS) just released their 2024 – 2034 employment projections this August. They show nationwide employment is expected to grow by 5.2 million jobs from 2024 to 2034, led by increased strong demand for Health Care and Social Assistance services.

States, including Minnesota, build on the national projections to produce their own state and sub-state long-term projections . My colleagues in Minnesota's Labor Market Information (LMI) office will use the new BLS data as a starting point to prepare 2024–2034 projections for the state and each planning area, scheduled for release next summer.

This federal–state system runs on a two-year cycle: BLS publishes national 10-year projections in even-numbered years, and states release their corresponding projections the following year. Some states, including Minnesota when resources allow, also produce short-term (two-year) projections — but these are optional and not consistently available everywhere.

Note on Employment Statistics: When labor market reports talk about "employment," they usually mean jobs, not people. If someone holds two jobs, they're counted twice. The main exception is labor force participation, which counts individuals in the workforce.

How they're made

Long-term projections start with big-picture trends: how the population is changing, how much people work and how income and spending are expected to grow. Analysts combine those trends with historical production patterns to estimate future industry demand and the jobs needed to meet it. Projections also incorporate forecasts about key economic factors, including energy prices, federal spending and monetary policy and current trade agreements.

From industry-specific employment projections, BLS then estimates occupation-specific employment projections. To account for occupational changes not captured in past trends, BLS analysts review data and research from sources like news coverage, academic studies, external models and expert interviews. These estimated changes, called change factors, can raise or lower projections for specific jobs in specific industries or across all employment.

Here are a few examples of how BLS-adjusted occupational demand estimates in the 2024 – 2034 projections and why:

| Table 1: Selected BLS Occupation Change Factor Explanations | ||

|---|---|---|

| Occupation | Industry/Industries | Reason for Adjustment |

| Electricians | Electrical contractors; Power and communication line construction; Plumbing, heating, and air-conditioning contractors; Residential and nonresidential building construction | Share increases as demand grows for wind and solar installations, wiring for connected devices and electric vehicle (EV) charging infrastructure. |

| Structural iron and steel workers | Highway, street, and bridge construction; Other specialty trade contractors | Share increases as infrastructure spending increases to repair deficient bridges. |

| Solar Photovoltaic Installers | Solar electric power generation; Electrical contractors; Plumbing, heating, and air-conditioning contractors | Share increases due to expansion of utility-scale solar operations and new installation projects from public and private initiatives. |

| Refuse and recyclable material collectors | Waste collection; Waste treatment and disposal; Local government, excluding education and hospitals | Share decreases as technological improvements enable more efficient collection routes, allowing collection work to be done with fewer workers |

| Hazardous materials removal workers | Remediation and other waste management services | Share decreases as remediation activities decrease with less stable funding. |

What to keep in mind

Projections are best understood as an estimate of what's most likely to happen if nothing major changes. They are most accurate when the economy is relatively stable and free of big shocks. Usual business cycle fluctuations are built into the estimation procedures.

Known changes are factored in

Projections do account for known policy and funding shifts. For example, investments under the Infrastructure Investment and Jobs Act (IIJA), incentives from the Inflation Reduction Act (IRA) and other changes in public spending can all influence projections. These effects can show up in "change factor" adjustments like those in Table 1 as well as through other data-inputs. Policies that affect trade, tariffs, global demand or domestic income and consumption are also incorporated. But because the national-to-state projection cycle spans roughly two years, the effects of policy changes can take time to appear in the data. For instance, BLS analysts will continue to review data to decide whether to adjust projections for electricians, boilermakers and other energy-related occupations in the next release (2026–2036, scheduled for 2027).

Unexpected shocks can throw projections off

Events like the COVID-19 pandemic or the Great Recession show how quickly reality can diverge from projections.

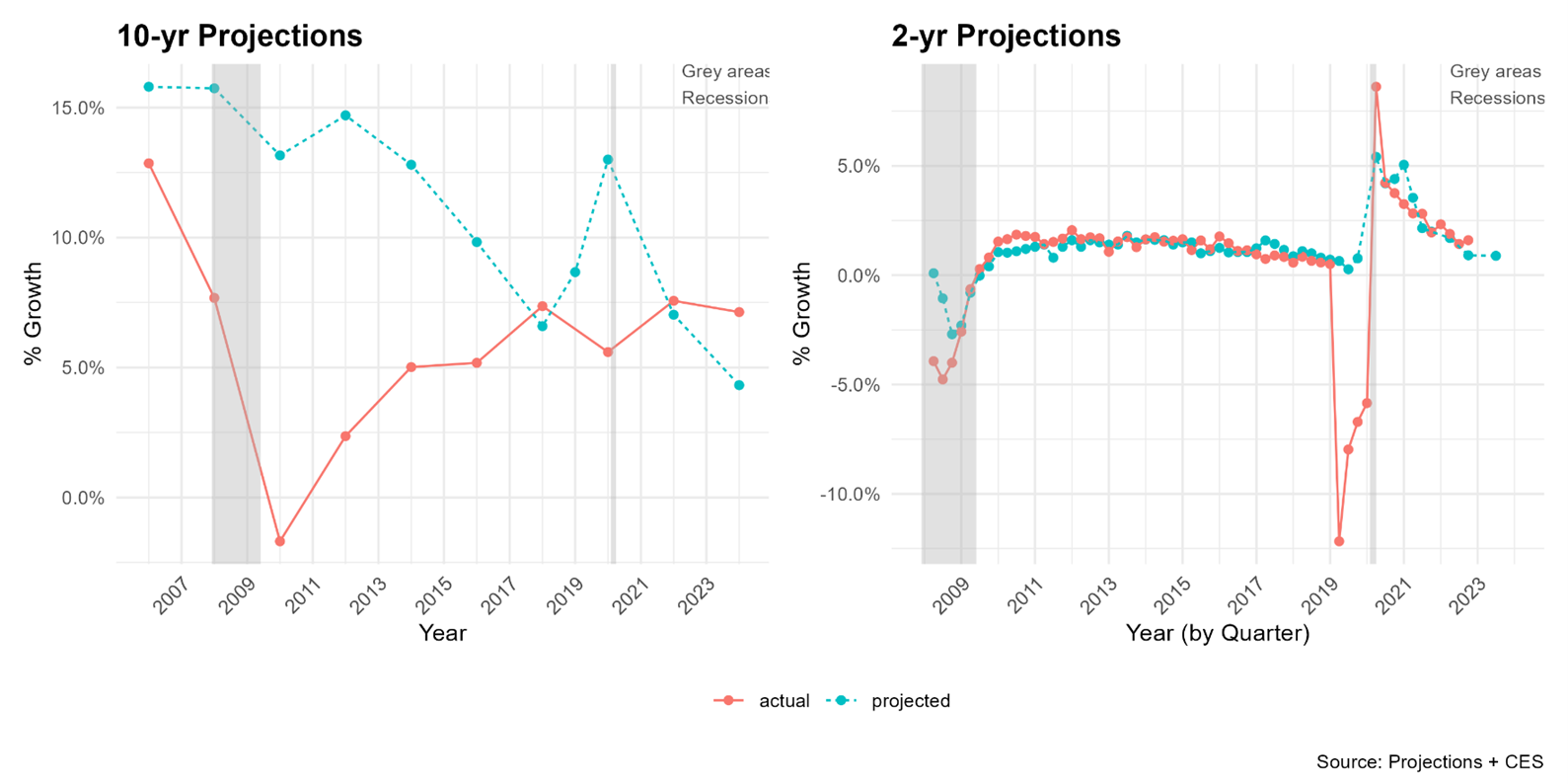

- Long-term (10-year) projections (Figure 1 left): These line up better in stable times but were far off after the 2008 recession. It took several cycles before the data reflected slower post-recession growth. COVID caused a smaller but still visible disruption.

- Short-term (2-year) projections (Figure 1, right): These tend to be closer to actual outcomes because fewer surprises occur in two years than in 10. Short-term projections picked up the slowdown during the 2008 recession more quickly. By contrast, COVID created a much larger immediate gap because it was an unexpected public health shock, not an economic trend.

Figure 1: Statewide Employment: Projections vs Actual

Regional caveats

Projections can also be disrupted by local events, even if statewide totals stay steady. The entry or exit of a major employer, or natural disasters such as floods, fires or tornadoes, may not move state-level employment but can reshape local economies.

Other things to keep in mind

- Seasonal and cyclical variation – Annual average numbers can mask spikes or drops in industries like construction, retail and tourism.

- Demand vs. supply – Projections measure demand, not the supply of qualified workers. Although labor force availability is factored in to keep estimates realistic.

- Level of detail – Projections are generally more reliable for broad industry or occupation groups than for narrow, specific categories.

Despite these limitations, projections remain a valuable tool for understanding where job opportunities are likely to grow or shrink. The key is to use them alongside other information — such as wages, education requirements and local economic conditions — to get the full picture.

Scenario Models

A complement to the standard employment projections are models that estimate what might happen if we invest, regulate or innovate.

Most studies that estimate job impacts rely on input–output (IO) models, or on extensions of them. Other approaches exist to study economic impacts — such as computable general equilibrium (CGE) models, integrated assessment models or agent-based models— but those are less common in workforce and policy discussions, especially when industry- or occupation-level detail is needed. For this article, we'll focus on IO-based models , since they're behind most of the 'jobs created or lost' estimates you'll see in practice. You may also see them referred to as economic impact models, multiplier models or by the names of specific tools.

What are they

At its core, an IO model is like a recipe: it shows how industries use inputs such as labor, materials and services to produce outputs, and who consumes them—all measured in dollars. These relationships are fixed, meaning the model assumes the same mix of inputs is always needed to produce a given output. From these relationships, multipliers are calculated: if demand grows in one industry, the model estimates how much additional demand ripples to suppliers, distributors and workers, and how increased worker income can spur further growth (more jobs → more income → more spending → more jobs). This ripple effect is why policy studies often talk about "multiplier effects."

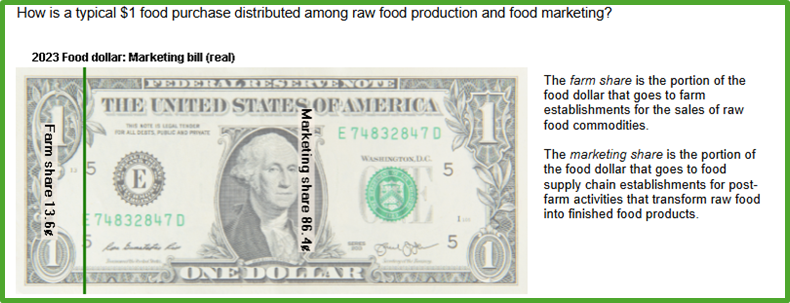

IO models can also be adapted to suit the needs of different studies. Some are tailored to specific industries—like NREL's JEDI model, which focuses on energy. Others extend the framework to include environmental "inputs" such as land, water or emissions, as in the EPA's US Environmentally-Extended Input-Output (USEEIO) models. In addition to jobs, IO models estimate impacts on income and production, and they can be used descriptively to show how money currently flows through the economy. For example, USDA's Food Dollar analysis uses IO data to break down how each dollar spent on food is split among farmers and other supply chain businesses like processors, transportation, retail stores and restaurants, see Figure 2 below.

Figure 2 : UDSA Food Dollar

Source: Food Dollar Application

Because the "fixed relationship" assumption is strong—especially over longer time frames when technology, prices, and demographics shift—some models mix additional methods with an IO model that allow these underlying relationships to evolve. The multipliers, which are based on those relationships, evolve along with them. Dynamic model like these can also adjust for productivity growth, wage changes or migration, and include feedback loops over time.

Common IO-based tools include IMPLAN, REMI, RIMS II and JEDI. Each has different features and assumptions, but all share the IO foundation.

How they work

No matter which tool is used, these models all start from official federal statistics. Input–output tables from the Bureau of Economic Analysis (BEA) describe how industries are linked through buying and selling goods and services, while labor market data from the BLS and state LMI offices anchor employment and wages. Researchers then decide how to adapt the national data to represent a state, region or county. Tools recalibrate national data to reflect local conditions in varying ways, but government statistics are critical inputs for all.

This economic and employment data forms a baseline scenario (sometimes called "business as usual") that reflects expected industry and employment trends without the new policy or investment. It's the scenario model equivalent of employment projections: what's most likely to happen if nothing major changes. Analysts then define a policy variable to represent the change they want to study — for example, a $500 million infrastructure investment, a new manufacturing plant or an energy-efficiency program. The model compares the "with policy" scenario to the baseline, estimating the difference in jobs, income and output that can be attributed to the policy.

Job impacts show up in three main channels: direct effects (jobs in the targeted industries), indirect effects (jobs at suppliers) and induced effects (jobs supported by the household spending of affected workers). Industry-level results are then translated into occupations using staffing pattern data, again grounded in BLS and state LMI statistics.

Dynamic modeling tools take these same steps but add more moving parts by incorporating changes over time such as productivity and population growth. Such models also let analysts make choices about key assumptions. For example, you can decide whether to assume governments must balance budgets (new spending must be offset) or whether local competition for workers will limit hiring. Features like these are designed to give a more realistic picture of both the immediate "shock" and how impacts may play out over time.

What to keep in mind

Models can be powerful tools, but they aren't crystal balls. As the statistician George Box, a long-time professor at the University of Wisconsin, famously put it: "All models are wrong, but some are useful." The usefulness depends on what questions you want answered, whether the model's structure and assumptions are relevant to those questions, and how thoughtfully the results are interpreted. If you see job-impact numbers in a report or the media—or if you're thinking about commissioning a study—these are the areas to pay attention to.

Level of Detail & Purpose

The level of detail matters, and it should match the question being asked. If you're studying the economy-wide impact of something like Medicare or SNAP, a high-level model may be enough, even if it lumps industries together. But if you're studying energy policy, looking only at a broad "utilities" category might hide critical differences between fossil fuels, wind and solar. That's why specialized tools like JEDI exist — they break out energy subsectors so the results better reflect reality. Of course, more detail comes with tradeoffs: more assumptions, and sometimes more uncertainty. Sensitivity analysis can help test how results shift under different assumptions or model parameters, showing the range of possible outcomes.

Caveats when interpreting results

Even with the model appropriate to the questions being studied, there are still things to keep in mind when interpreting results.

- Uncertainty and over-interpretation - Results are usually presented as single point estimates (e.g., "5,000 jobs created"), without a margin of error, which can make the results seem more certain than they are. Out of context, the numbers can also be misinterpreted. For example, treating temporary construction jobs as permanent gains, or forgetting that "jobs" means positions, not people.

- Baselines shape comparisons - Baselines are typically grounded in the same national statistics used in projections (BEA input–output tables, BLS employment projections), but they can differ across tools or models, which helps explain why studies of the same policy may show different results. Additionally, because the impacts are the differences between the policy and the baseline scenarios, it can be helpful to consider whether recent changes are included: did it account for new funding, recent business exits or only the status quo?

- Assumptions matter most where they interact with policy - There will always be something "wrong" when modeling complex economic and human systems, but when comparing scenarios, some inaccuracies cancel out. However, assumptions that impact policy implementation, or decisions about how to represent the industries and consumers impacted, can really matter. Some examples would be government budget assumptions, regional supply chain assumptions, labor and capital substitution assumptions or assumption about labor market constraints.

None of this means the models should be dismissed. When used carefully, they provide a structured way to test "what if" questions and explore what economic impacts investments or policies could have. The key is to treat them as tools for insight, not precise predictions. If the stakes are high, don't be afraid to check the technical appendix or reach out to researchers (or your friendly neighborhood expert) to ask what assumptions were made and how sensitive the results could be.

Application to Workforce and Policy Planning

Workforce planning is about making sure people have the right skills, at the right scale and at the right time. Both standard projections and scenario models help with this — but it is still a task that's especially hard in industries affected by climate and energy policy, where technologies, markets and funding can shift quickly. Workforce needs can change because of planned policies like Minnesota's 2023 clean energy bill or infrastructure bonding, or external shocks like new federal funding, market swings or natural disasters.

Workforce systems have to stay nimble, and timely projections or modeling estimates — along with real-time job posting data — can help planners, policymakers, training providers and employers see bottlenecks early. This matters because training timelines vary widely: some jobs take eight weeks of coursework, while others require a four-year degree.

The following examples show the range of ways projections and scenario models are being applied — from state planning and industry-specific policy design to headline-driven debates about federal budgets.

- Michigan's Infrastructure Workforce Plan modeled how federal funding would boost demand for specific occupations, then compared that with the state's existing workforce. The analysis identified gaps to help align training programs with the timing and scale of new jobs.

- In 2021, New Mexico commissioned an economic impact analysis of a proposed Clean Fuel Standard. The study estimated construction, direct and indirect jobs tied to transportation fuel projects. Policymakers used it to understand the job impacts of specific investments — short-term construction versus longer-term operations.

Locally, the Minnesota Department of Commerce has relied on scenario models to test how federal policy shifts could affect state energy markets and related jobs. These studies give policymakers a way to gauge what's at stake — and to plan accordingly — even as federal rules change.

Advocacy groups also rely on modeling. The BlueGreen Alliance estimated job losses under potential rollbacks of clean energy incentives, showing how vulnerable clean manufacturing jobs could be. These numbers gave advocates a grounded way to back their case.

Media often lift job impact numbers directly from such studies. Reuters, for example, reported that the U.S. could lose 1.7 million clean energy jobs under the proposed "One Big Beautiful Bill", citing research from the Center for Climate and Energy Solutions. Because these articles are written for a general audience, they often skip important context about the methods behind the numbers. As discussed above, this underscores why it's important to treat job impact figures as starting points and dig into the methods when stakes are high.

The key is not to treat these tools as crystal balls, but as structured ways of testing 'what if' questions. For workforce planners, the real value is helping researchers ask the right questions—not just 'how many jobs.'

Minnesota's Current Efforts

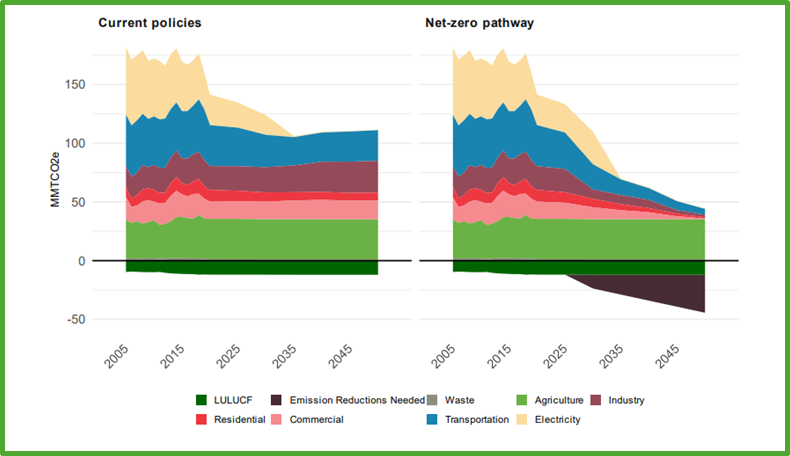

Minnesota is already using both projections and scenario models to guide its transition to a clean economy. The state is currently updating the Climate Action Framework (CAF) and using a set of modeling tools to evaluate how Minnesota could meet its goal of net-zero emissions by 2050. That work combines emissions forecasting, health impact analysis and economic modeling. Together, these tools give the state a picture of how different policy pathways could reduce emissions, improve health, and affect jobs. Draft results, including workforce analysis, will be available for public review later this fall.

Figure 3 shows emissions forecasts shared last winter, comparing current policies to a net-zero by 2050 pathway. Running "what-if" scenarios like this is helping state agencies and policymakers evaluate different strategies. But every downward slope in the graph assumes that workers are ready to build, operate and maintain the projects that make it possible.

Figure 3 : Preliminary GHG Emissions Forecasting

Source: GHG forecasting technical support, Dec 2024

That's why workforce planning matters: the emissions modeling assumes projects will be completed, but it takes workers to turn projects into reality.

While the CAF focuses on potential policy pathways, the Powering Climate & Infrastructure Careers (PCIC) initiative, led by the Governor's Workforce Development Board, is focused on today's workforce needs for current policies and upcoming investments. To guide such efforts, the state is estimating the workforce needed to deliver on federally-funded — and potentially state-funded — projects and identifying potential gaps to support local and regional workforce planning. The goal is to help training providers, local workforce boards and employers prepare for projects before workers are in short supply. The emphasis is not only on how many jobs, but also on job quality, equity and readiness of training systems.

Together, these efforts are beginning to link Minnesota's climate policy scenarios with concrete workforce planning. In practical terms: every action in the Climate Action Framework requires people to carry it out, and these projects help the state understand and prepare for that reality .