by Luke Greiner

November 2024

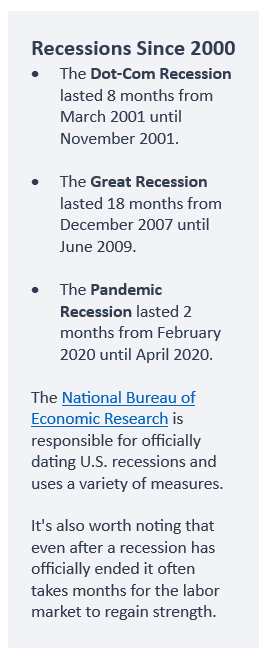

Over the past two decades Central Minnesota has proven itself a standout performer in weathering the ups and downs of economic cycles. While Minnesota and the U.S. as a whole experienced significant turbulence, from the Dot-Com bust to the Great Recession and the COVID-19 pandemic, Central Minnesota consistently outpaced both the state and nation in key economic measures. Boasting a diversified economic base and a strong labor market, the region has managed to maintain growth and adapt to changing economic conditions. This article explores the factors that have enabled Central Minnesota to fare better than its peers and highlights the lessons it offers for fostering economic stability in uncertain times.

Over the past two decades Central Minnesota has proven itself a standout performer in weathering the ups and downs of economic cycles. While Minnesota and the U.S. as a whole experienced significant turbulence, from the Dot-Com bust to the Great Recession and the COVID-19 pandemic, Central Minnesota consistently outpaced both the state and nation in key economic measures. Boasting a diversified economic base and a strong labor market, the region has managed to maintain growth and adapt to changing economic conditions. This article explores the factors that have enabled Central Minnesota to fare better than its peers and highlights the lessons it offers for fostering economic stability in uncertain times.

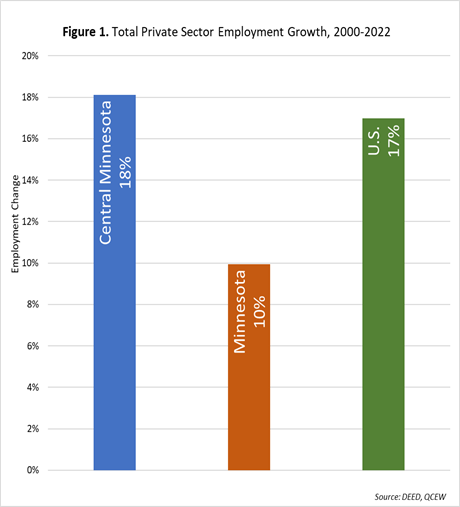

Central Minnesota grew nearly twice as fast as Minnesota over the past two decades and bested national growth by a percentage point. During the period highlighted in Figure 1, Central Minnesota gained 35,736 private sector jobs, about 16% of all net new jobs in Minnesota despite making up just 9% of total employment in the state. Public sector job growth was also strong (13%) over the period for Central Minnesota, more than doubling the statewide growth rate (6%). The largest amount of new public sector jobs in Central Minnesota was in Education (4,147 net new jobs), while Public Administration added jobs the fastest (35% from 3,437 net new jobs). Across the state the Public Administration sector grew the fastest and added the most jobs with a 20% increase from 21,913 net new jobs. To keep comparisons consistent, the remainder of this article will be analyzing only private sector employment data.

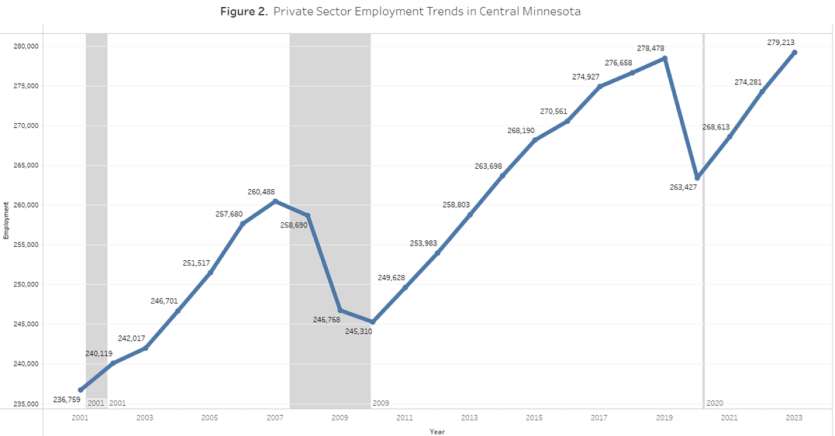

Central Minnesota largely avoided the 2001 Dot-Com recession and managed to grow employment until 2008, when the Great Recession finally took its toll. After bottoming out in 2010, employers in Central Minnesota began adding back jobs. That brought on the longest economic expansion in recent history, with substantial growth until the 2020 Pandemic Recession. Although that recession lasted just two months, the losses were deep, and it took three years before employment had fully rebounded (see Figure 2).

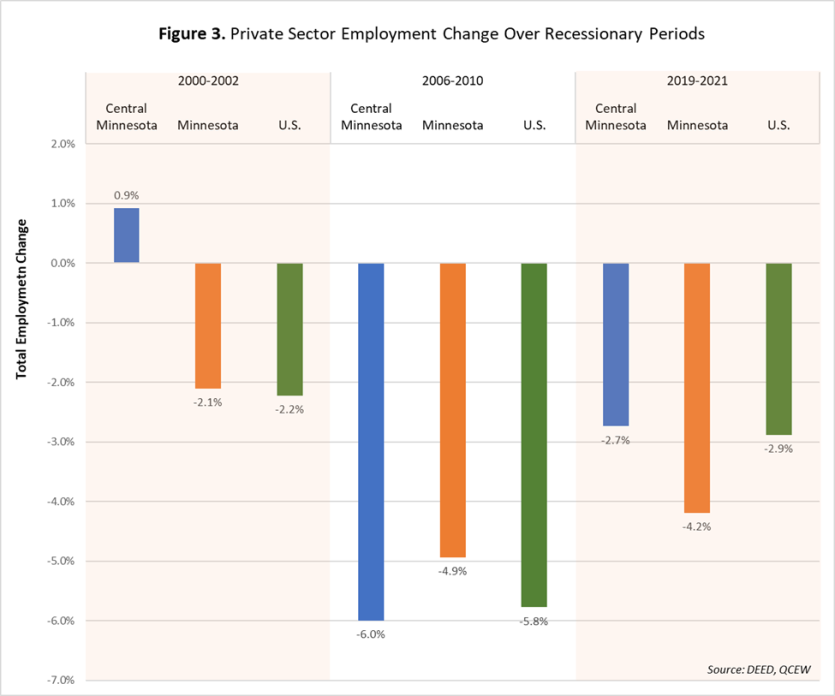

Even though the 2001 Dot-Com recession merely slowed down momentum of job growth in the region, Minnesota and the U.S. lost more than 2% of total private sector employment. In contrast the Great Recession, the deepest downturn since the Great Depression, was a much worse situation in Central Minnesota. The unique industry mix of the area, strong in Construction and Manufacturing, proved to be a problematic combination for the housing downturn. Central Minnesota lost jobs at a 6% rate, a full percentage point worse than the state and more in line with national employment losses.

The latest recession was short but left scars in many areas of the economy. Central Minnesota managed to do much better than Minnesota with a 2.7% loss compared to 4.2% statewide. Minnesota hemorrhaged 16% of jobs in Accommodation and Food Services in the Pandemic Recession, compared to 6.3% in the region and 13.4% across the country. Private sector losses were worse for Minnesota than the nation in 11 of the 19 major industries. On the other hand, Minnesota outperformed Central Minnesota in only seven of the 19 major industry sectors (see Figure 3).

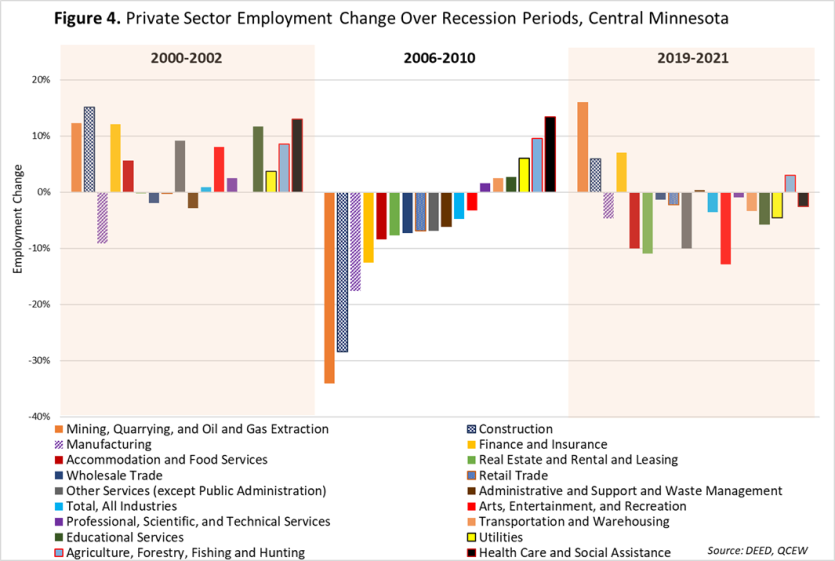

The forces of each recession have pushed and pulled on different segments of the economy and the overall shift is the result of regional employment dynamics. Workforce planning for future business cycle changes can be guided by understanding how the industry mix of Central Minnesota performed over these periods.

Central Minnesota enjoyed widespread growth over this recession caused by the geographic concentration of impacted industries on the coasts. However, Central Minnesota manufacturers shed 9% of their workforce and ended 2002 with almost 4,200 fewer jobs in Manufacturing. Administrative Support and Waste Management Services declined by 3%, and Wholesale Trade ticked down 2%. These losses were more than offset by the large gains in Health Care and Social Assistance (13%), Construction (15%), Mining (12%), Finance and Insurance (+12%), and Educational Services (12%).

Deeper analysis into the more detailed subsectors shows that many segments of Manufacturing struggled, from the obvious Computer and Electronic Product Manufacturing to Food Manufacturing. Unlike most recessions, Construction did well over this period, with Specialty Trade Contractors building employment up by 17%. Also unusual is the expansion of Food and Drinking Places, which added almost 1,300 jobs (8%). All components of Health Care and Social Assistance added large numbers of jobs, epitomizing the idea of it as a "recession proof" sector.

Figure 4 provides an excellent illistration of the vast and deep job cuts that permeated the Great Recession. Six of the 18 major industry sectors in Figure 4 added jobs, with Health Care and Social Assistance growing a susbtantial 17% from 5,861 net new jobs. Agriculture added 348 net new jobs for a 10% increase, and Utilities grew by 6% with 139 net new jobs. Although small in numbers, Mining suffered the largest decline at 34% from 134 fewer jobs. The Construction and Manufacturing sectors took the brunt of job losses during this period, with 30% and 18% declines, respectively. With one in three Construction jobs erased, the region had 4,862 fewer jobs. Manufacturers lost almost one in five jobs and removed 7,593 jobs from the economy. Together, Manufacturing and Construction losses equaled nearly the entire amount of net job loss in Central Minnesota during the Great Recession.

But losses didn't stop there. Retailers shed 7% of employment (2,448 jobs), and Accommodation and Food Services lost 1,759 jobs (8%). The detailed trends pull out some more nuances: Apparel Manufacturing declined by 61% similar to Internet Service Provider employment (60%). Many other types of Manufacturing also drew down employment including; Furniture (52%), Textiles (48%), Computer and Electronic Products (48%), Printing (38%), and Wood Products (27%)

Bright spots in an otherwise dim time of economic history include: Warehousing and Storage showed strong growth (128%), as did Publishing (33%), Chemicial (inluding ethanol) Manufacturing (28%), Broadcasting (except internet) (2%), and Beverage Manufacturing (22%). All components of Health Care and Social Assistance grew faster than 10%, again reinforcing the strategy of workforce development programsto attempt to transition laid off Construction and Manufacturing workers into a growing Health Care sector.

This short and strange recession offers a view into a very different recession. Strict government lockdowns and social distancing measures contributed to supply and demand shocks that are more typical with economic downturns, but the disruptions occurred in less typical places. Construction added an impressive 1,132 jobs for a 6% growth, an odd trend during a recession with unprecedented unemployment. Finance and Insurance grew by 7%, and Mining increased by 16%.

Manufacturing still fell by 5% from a loss of nearly 2,000 jobs, similar to the Great Recession. However, Health Care and Social Assistance lost nearly 800 jobs in the region, creating a situation where the two largest industries in the region were shrinking. The largest losses were found in Accomodation and Food Services (6%) and Arts, Entertainment and Recreation (13%), both industries that were subject to the strictest pandemic-related policies and general avoidance by large numbers of consumers in 2020.

In contrast, fast growth during the Pandemic Recession was found in: Internet Service Providers (54%), Support Activities for Agriculture (28%), Couriers and Messengers (25%), Beverage Manufacturing (20%), Textile Mills (18%), Transportation Support (16%), and Wood Product Manufacturing (13%).

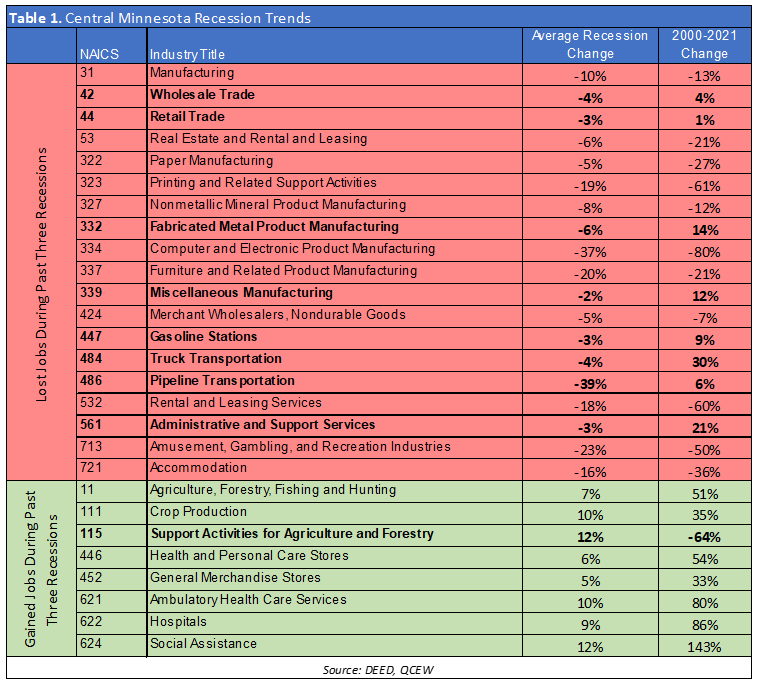

Over the past three recessions a few industries consistently lost jobs: Manufacturing, Wholesale Trade, Retail Trade, and Real Estate and Rental and Leasing. Of those sectors, Real Estate and Rental and Leasing experienced losses during all of the recessions but it was in line with long-term employment declines in the region. The others have been growing or recovering during the expansion periods between recessions, only to shed jobs again at the next downturn.

Although Manufacturing overall is prone to employment declines during recessions, Fabricated Metal Product and Miscellaneous Manufacturing continue growing between recessions and often exhibit growth despite recessionary setbacks. This is an example of temporary losses that are quick to rebound. The same trends are found at Gasoline Stations, Truck Transportation, and Administrative Support Services.

Just as some portions of the economy often lose jobs, others pick up steam and add jobs. At the broad industry level this has only occured in Agriculture in Central Minnesota, yet there are subsectors outside of Agriculture that have managed to grow during the past three recessions; including: Health and Personal Care Stores, General Merchandise Stores, Ambulatory Health Care Services, Hospitals, and Social Assistance.

Table 1 organizes the consistent winners and losers over the past three recessions. Industries in bold indicate the impacts of recessions are divergent from the long term trends. It's easy to see that many industries that declined during each of the past three recessions are simply continuing their decline, while others are acutely affected by the downturns. Similar to the industries that gained jobs over the past three recessions, only Support Activities for Agriculture and Forestry gained jobs during the recessions, but lost jobs over the long run.

The economic landscape of Central Minnesota has demonstrated remarkable resilience amid the challenges posed by various recessions over the past two decades. While the region faced significant job losses during downturns such as the Great Recession and the COVID-19 pandemic, the region's diversified economic mix has allowed it to recover more swiftly than both state and national averages.

The consistent employment performance of sectors like Health Care, Construction, and certain Manufacturing industries highlights the importance of adaptability in navigating economic cycles. As Central Minnesota continues to evolve, understanding the dynamics of its labor market will be crucial for workforce planning and fostering long-term economic stability. By learning from past experiences, stakeholders can better prepare for future challenges and capitalize on opportunities that arise in times of uncertainty.