A Decade of Work in Southeast Minnesota

by Amanda Blaschko

June 2025

Southeast Minnesota's labor market has enjoyed modest growth over the past decade, highlighted by a 4.9% increase in employment and 2.1% labor force expansion from 2014 to 2024. Health Care has emerged as the dominant economic driver, accounting for nearly 75% of regional job growth, while the region maintains competitive wages, ranking second among Minnesota's six planning regions.

- Southeast Minnesota experienced moderate labor force growth (2.1%) and employment growth (4.9%) from 2014-2024, with the Health Care & Social Assistance sector driving regional economic expansion by adding 8,672 jobs.

- The region has fully recovered from pandemic employment losses and maintains the second-highest median hourly wages ($24.82) among Minnesota's planning regions.

- Job vacancies surged 51% over the decade, with Healthcare Practitioners & Technical occupations experiencing a dramatic 245% increase to 1,716 openings, highlighting the region's increasingly tight labor market where demand for workers exceeds supply.

- Median wage offers for job vacancies rose dramatically from $11.19 in 2014 to $20.20 in 2024, representing an 81% nominal increase and 37% real increase after inflation adjustment.

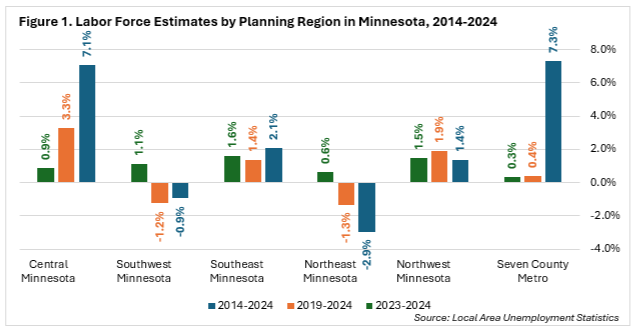

Stability in the Labor Force

Southeast Minnesota has seen moderate labor force change over the past decade, with renewed growth coming out of the pandemic. In 2024, the 11-county Southeast region reached 282,855 workers, a gain of 4,408 people or 1.6% since 2023, which was the largest annual percentage increase among the six planning regions in the state. However, examining the full 10-year trend reveals a more middling performance, with Southeast ranking third with an addition of 5,834 workers, or 2.1%, behind the Twin Cities (7.3%) and Central Minnesota (7.1%). Similarly, in the five years since 2019, prior to the pandemic disruption, the region ranks third in growth with an increase of 3,871 workers or 1.4% (Figure 1).

Like the economy overall, Southeast Minnesota's labor force has seen ups and downs over the past ten years. From 2014 to 2016, the region experienced a decline in available workers, followed by steady growth through 2019, a severe pandemic-related drop from 2020 to 2021, and then three consecutive years of recovery from 2022 to 2024. While growth has come in fits and starts, this pattern distinguishes Southeast from other regions like Northeast and Southwest Minnesota, which started trending downward. Both have fewer workers now than in 2014.

The 10-year perspective highlights Southeast Minnesota's position as neither the fastest-growing nor declining region in the state, but rather one maintaining a steady labor force despite the demographic challenges affecting much of Greater Minnesota. Even if there are short-term changes, the region is seeing long-term labor force growth.

All six planning regions in Minnesota experienced slight increases in unemployment rates from 2023 to 2024 as labor markets started to loosen. Southeast’s unemployment rate increased by just 0.1 percentage point, rising from 2.6% to 2.7%, matching the smallest increase among all regions and keeping it the lowest rate among the six regions in the state.

More significantly, the region's unemployment rate has decreased by 1.2 percentage points over the decade, falling from 3.9% in 2014 to just 2.7% in 2024. This long-term declining trend, which is consistent across all planning regions in the state, reflects a tightening labor market as the aging population exits the workforce without being fully replaced by younger workers.

Health Care Dominates Job Growth

From 2014 to 2024, regional employment grew by 4.9% (11,631 net new jobs), tied for third place with the Northwest, but behind Central and the seven-county Twin Cities Metro, which both expanded 7.3%. Industries with the strongest growth over the decade show clear patterns of economic transition. Specifically, already the largest employing industry in the Southeast, Health Care & Social Assistance added 8,672 jobs (+14.6%), representing nearly 75% of total job growth in the region. Management of Companies grew by 56.2%, adding 1,650 jobs to the region. Arts, Entertainment & Recreation expanded by 30.6%, contributing 1,077 new jobs. Mining increased by 59.0%, though the absolute gain was smaller at 79 jobs (Table 1).

However, not all sectors shared in this growth pattern. The Information sector contracted significantly in Southeast, losing 1,445 jobs, down 39.8% over the decade. Finance & Insurance declined by 31.6%, shedding 1,848 jobs. Administrative Support & Waste Management Services decreased by 22.8%, representing a loss of 2,131 jobs. Manufacturing, despite being one of the region's largest employers, lost 3.3% of its jobs, amounting to 1,227 fewer jobs.

| Table 1. Industry Employment Statistics, 2024 | ||||||||

|---|---|---|---|---|---|---|---|---|

| Southeast Minnesota | 2024 Annual Data | 2023-2024 | 2014-2024 | |||||

| NAICS Industry Title | Number of Firms | Number of Jobs | Total Payroll ($1,000s) | Avg. Annual Wage | Change in Jobs | Percent Change | Change in Jobs | Percent Change |

| Total, All Industries | 13,711 | 247,013 | $16,448,662 | $66,590 | +2,953 | +1.2% | +11,631 | +4.9% |

| Health Care & Social Assistance | 2,048 | 68,183 | $5,960,040 | $87,412 | +1,741 | +2.6% | +8,672 | +14.6% |

| Manufacturing | 659 | 35,955 | $2,785,157 | $77,462 | -446 | -1.2% | -1,227 | -3.3% |

| Retail Trade | 1,615 | 26,595 | $944,371 | $35,509 | +229 | +0.9% | -81 | -0.3% |

| Accommodation & Food Services | 1,198 | 20,328 | $493,965 | $24,300 | +291 | +1.5% | +1,934 | +10.5% |

| Educational Services | 286 | 20,084 | $1,131,415 | $56,334 | +349 | +1.8% | +919 | +4.8% |

| Public Administration | 358 | 11,653 | $800,519 | $68,696 | +416 | +3.7% | +1,298 | +12.5% |

| Construction | 1,508 | 10,357 | $774,298 | $74,761 | +193 | +1.9% | +1,831 | +21.5% |

| Transportation & Warehousing | 599 | 7,963 | $465,959 | $58,516 | +128 | +1.6% | +601 | +8.2% |

| Admin. Support & Waste Mgmt. Svcs. | 542 | 7,199 | $435,888 | $60,548 | -108 | -1.5% | -2,131 | -22.8% |

| Other Services | 1,402 | 6,671 | $248,811 | $37,297 | +21 | +0.3% | +203 | +3.1% |

| Wholesale Trade | 507 | 6,640 | $548,951 | $82,673 | -57 | -0.9% | -14 | -0.2% |

| Arts, Entertainment, & Recreation | 289 | 4,593 | $127,873 | $27,841 | +360 | +8.5% | +1,077 | +30.6% |

| Management of Companies | 63 | 4,585 | $539,912 | $117,756 | +88 | +2.0% | +1,650 | +56.2% |

| Finance & Insurance | 699 | 3,995 | $334,443 | $83,715 | -86 | -2.1% | -1,848 | -31.6% |

| Professional & Technical Services | 835 | 3,828 | $288,182 | $75,283 | +112 | +3.0% | +115 | +3.1% |

| Agriculture, Forestry, Fish & Hunting | 439 | 3,131 | $143,889 | $45,956 | -96 | -3.0% | +203 | +6.9% |

| Information | 211 | 2,190 | $136,067 | $62,131 | -243 | -10.0% | -1,445 | -39.8% |

| Real Estate & Rental & Leasing | 386 | 1,448 | $68,022 | $46,976 | +39 | +2.8% | -99 | -6.4% |

| Utilities | 48 | 1,399 | $203,143 | $145,206 | +9 | +0.6% | -106 | -7.0% |

| Mining | 23 | 213 | $17,758 | $83,372 | +13 | +6.5% | +79 | +59.0% |

| Source: DEED Quarterly Census of Employment & Wages (QCEW) program | ||||||||

Geographic Variation Across Counties (2014-2024)

Within the region's 11 counties, significant employment variations exist. Thanks to a strong concentration of Health Care employment, Olmsted County dominates with 103,870 jobs (42% of total jobs) and the highest average wage ($79,560). Having grown by 12.5% over the past decade, it drives much of the region's overall growth.

Rice County (26,188 jobs) and Winona County (24,003 jobs) rank second and third in job numbers, with Rice showing strong growth (12.3%) while employment in Winona has contracted by 3.1% over the past decade.

In sum, only six counties have grown during this 10-year period (Olmsted, Rice, Mower, Houston, Fillmore and Dodge), revealing that the region's employment gains are concentrated rather than broadly distributed. Mower County has added 650 jobs (4.0%), while Dodge County has grown by 6.1% (345 jobs). Among declining counties, Steele has experienced the most significant drop, losing 12.0% of its jobs (2,585 jobs) since 2014, while Wabasha County contracted by 5.2% (358 jobs).

Pandemic Recession and Recovery (2019-2024)

In the context of recovery from the Pandemic Recession, Southeast Minnesota has demonstrated strong resilience. The region has fully recovered and surpassed its pre-pandemic employment by 0.1% (205 jobs), placing the region third in recovery performance behind Northwest Minnesota (1.7%) and Central Minnesota (1.6%). Half of Minnesota's six planning regions have returned to pre-pandemic employment levels. Likewise, 12 of the region's 20 major industries have fully recovered from pandemic losses.

Over the Year Change (2023-2024)

Southeast Minnesota employers provided an average of 247,013 jobs in 2024, a 1.2% increase (2,953 jobs) from 2023, tying with Central Minnesota as the second-strongest growth among all planning regions over the year. As shown in Table 1, the leading sectors demonstrated a continuation of long-term patterns. Arts, Entertainment & Recreation led with 8.5% growth, followed by Mining at 6.5%, while Public Administration increased by 3.7%. Professional & Technical Services expanded by 3.0%. The region's dominant Health Care & Social Assistance sector added 1,741 jobs (2.6% growth), continuing its role as the primary economic driver.

At the county level, Dodge County showed the strongest percentage growth (2.5%, adding 145 jobs) from 2023 to 2024, followed by Rice County (2.3%, adding 585 jobs). Olmsted County demonstrated solid growth at 1.7% (adding 1,714 jobs), accounting for 58% of the region's total job gains. Freeborn County also performed well at 1.6% growth (190 jobs). Four counties showed small but positive growth: Mower (1.0%, 167 jobs), Goodhue (0.5%, 106 jobs), Wabasha (0.5%, 30 jobs) and Winona (0.4%, 90 jobs). Only two counties experienced employment declines over the year: Fillmore (-0.8%, -52 jobs) and Houston (-1.1%, -57 jobs). Meanwhile, Steele County, despite its significant long-term employment losses, stabilized with minimal growth (0.2%, 34 jobs).

Job Vacancy Analysis

As employment has grown and the labor force has not kept pace, Southeast Minnesota's job vacancies have increased substantially over the past decade. In 2024, employers in the region reported 9,737 job vacancies, a significant increase from 2014 when the region averaged 6,451 vacancies. This 51% growth in job openings indicates a progressively tightening labor market.

The most recent job vacancy data shows a slight decline from 2023, when the region reported 13,711 vacancies with a 5.7% vacancy rate. This 29% decrease mirrors the statewide trend, where Minnesota as a whole experienced a 13.4% reduction in job vacancies between 2023 and 2024.

When examining occupational groups with the highest number of vacancies in 2024, Healthcare Practitioners & Technical occupations lead with 1,716 job openings, representing 17.6% of all regional vacancies. This marks a dramatic 245% increase from 2014, when the occupational group averaged 498 vacancies. This aligns with statewide patterns, where Health Care & Social Assistance also had the most job vacancies of any industry in Minnesota during 2024. Food Preparation & Serving Related occupations rank second with 1,556 vacancies (16.0% of total), followed by Sales & Related occupations with 993 vacancies (10.2%).

The distribution of job vacancies by occupation has remained relatively stable since 2014, with one notable exception: Healthcare Practitioners & Technical occupations have surged from 498 vacancies (fourth place) in 2014 to 1,716 vacancies (first place) in 2024, a 245% increase. This includes Registered Nurses, Physical Therapists, Licensed Practical Nurses, Clinical & Laboratory Technologists & Technicians, Physician Assistants, Radiologic Technologists, Pharmacy Technicians and all other Physicians and Surgeons. Food Preparation & Serving Related and Sales & Related occupations maintained their positions in the top three, while Production occupations showed minimal change, moving from third to fourth place.

Wage growth stands as one of the most significant changes observable in the Job Vacancy Survey results over the decade. The median wage offered across all vacancies increased from approximately $11.19 in 2014 (averaged from Q2 and Q4 data) to $20.20 in 2024, representing an 81% increase. Adjusting for inflation, this still represents a substantial 37% real wage increase, suggesting employers have significantly raised compensation to attract workers in a competitive labor market. Southeast Minnesota's median wage offer ($20.20) was slightly below the statewide median of $20.67.

Certain occupational groups demonstrated particularly high median wage offers in 2024, including Computer & Mathematical ($39.56), Healthcare Practitioners & Technical ($37.89), Legal ($37.78) and Management occupations ($36.87). These higher wage vacancies are often positions requiring more education and experience, highlighting the wage premium for specialized skills.

When comparing job vacancy data to labor force and employment trends, a clear picture emerges of a labor market where demand for workers exceeds supply. The 4.0% vacancy rate in 2024 represents a significant portion of potential employment, particularly when considered alongside the region's low 2.7% unemployment rate in 2024. This mismatch between available workers and open positions suggests that labor supply constraints may increasingly limit economic growth potential in Southeast Minnesota, particularly in high-demand sectors like Health Care, Food Service and Sales.

Competitive Wages

Southeast Minnesota stands out with higher median wages than most other regions in the state. In the first quarter of 2025, the median hourly wage across all occupations in Southeast Minnesota was $24.82, ranking it second highest among Minnesota's six planning regions (Table 2). While this falls below the statewide median of $26.22 and the Twin Cities Metro Area ($28.48), it sits well above the medians for Central ($23.85), Northeast ($23.47), Southwest ($23.24) and Northwest Minnesota ($22.98).

When comparing median wages at a more detailed level, Southeast exceeds statewide wages in seven of the 22 major occupational groups. Computer & Mathematical occupations show the largest difference (+$1.68) compared to the state median, followed by Community & Social Service (+$1.17), Healthcare Practitioners & Technical (+$1.06), Protective Service (+$0.60), Farming, Fishing & Forestry (+$0.56), Healthcare Support (+$0.29) and Education, Training & Library occupations (+$0.10). These higher wages in select fields make the region more competitive for attracting and retaining specialized talent.

Looking at wage variations within the region, the highest-paying occupational groups are Management ($53.29), Computer & Mathematical ($51.70) and Healthcare Practitioners & Technical ($47.57), all offering median wages substantially above the region's median of $24.82. At the other end of the spectrum, Food Preparation & Serving Related ($14.99), Personal Care & Service ($17.18) and Sales & Related ($17.30) occupations represent the lowest-paying groups in the region, all falling more than $7.50 below the regional median. This wage disparity reflects differences in skill requirements, education levels and market demand across occupations.

| Table 2. Occupational Employment & Wage Statistics, 2025 | ||||||

|---|---|---|---|---|---|---|

| Occupational Group | Southeast Minnesota | State of Minnesota | ||||

| Median Hourly Wage | Estimated Regional Employment | Share of Total Employment | Median Hourly Wage | Estimated Statewide Employment | Share of Total Employment | |

| Total, All Occupations | $24.82 | 244,290 | 100.0% | $26.22 | 2,920,470 | 100.0% |

| Management | $53.29 | 13,010 | 5.3% | $59.38 | 200,060 | 6.9% |

| Business & Financial Operations | $38.96 | 10,780 | 4.4% | $39.95 | 208,210 | 7.1% |

| Computer & Mathematical | $51.70 | 5,900 | 2.4% | $50.02 | 97,460 | 3.3% |

| Architecture & Engineering | $43.11 | 3,400 | 1.4% | $45.03 | 57,950 | 2.0% |

| Life, Physical & Social Science | $38.18 | 5,540 | 2.3% | $38.33 | 32,150 | 1.1% |

| Community & Social Service | $30.99 | 4,740 | 1.9% | $29.82 | 59,290 | 2.0% |

| Legal | $39.41 | 770 | 0.3% | $49.52 | 20,750 | 0.7% |

| Education, Training & Library | $27.94 | 14,850 | 6.1% | $27.84 | 170,270 | 5.8% |

| Arts, Design, Entertainment & Media | $26.54 | 2,200 | 0.9% | $28.84 | 36,030 | 1.2% |

| Healthcare Practitioners & Technical | $47.57 | 26,980 | 11.0% | $46.51 | 187,480 | 6.4% |

| Healthcare Support | $18.96 | 12,930 | 5.3% | $18.67 | 176,750 | 6.1% |

| Protective Service | $29.97 | 4,130 | 1.7% | $29.37 | 46,960 | 1.6% |

| Food Preparation & Serving Related | $14.99 | 21,890 | 9.0% | $16.05 | 240,830 | 8.2% |

| Building, Grounds Cleaning & Maint. | $18.41 | 7,160 | 2.9% | $19.16 | 81,700 | 2.8% |

| Personal Care & Service | $17.18 | 5,210 | 2.1% | $17.54 | 63,300 | 2.2% |

| Sales & Related | $17.30 | 18,530 | 7.6% | $18.66 | 244,780 | 8.4% |

| Office & Administrative Support | $23.47 | 27,940 | 11.4% | $24.07 | 340,040 | 11.6% |

| Farming, Fishing & Forestry | $24.04 | 240 | 0.1% | $23.48 | 3,300 | 0.1% |

| Construction & Extraction | $32.20 | 8,560 | 3.5% | $34.20 | 114,050 | 3.9% |

| Installation, Maintenance & Repair | $29.51 | 9,110 | 3.7% | $30.40 | 105,650 | 3.6% |

| Production | $23.22 | 21,360 | 8.7% | $23.56 | 205,220 | 7.0% |

| Transportation & Material Moving | $21.98 | 19,050 | 7.8% | $22.85 | 228,260 | 7.8% |

| Source: DEED Occupational Employment & Wage Statistics, Qtr. 1 2025 | ||||||

Summary

Over the past decade, Southeast Minnesota's labor market has maintained steady growth and successfully recovered from the pandemic disruption. The Health Care sector has been the primary economic driver, accounting for three-quarters of regional job growth and leading in job vacancies. Employers have responded to labor shortages by substantially increasing wages well above inflation. Looking ahead, Southeast Minnesota's economic future will depend on addressing the growing gap between job openings and available workers, a fundamental challenge that could limit future growth potential in this otherwise stable regional economy.