by Luke Greiner

June 2025

Despite the increased uncertainty introduced so far in 2025, most indicators point to a stable and healthy economy in the 13-county Central Minnesota region. While challenges remain, particularly with employment declines in certain sectors, the region's labor market continues to show resilience.

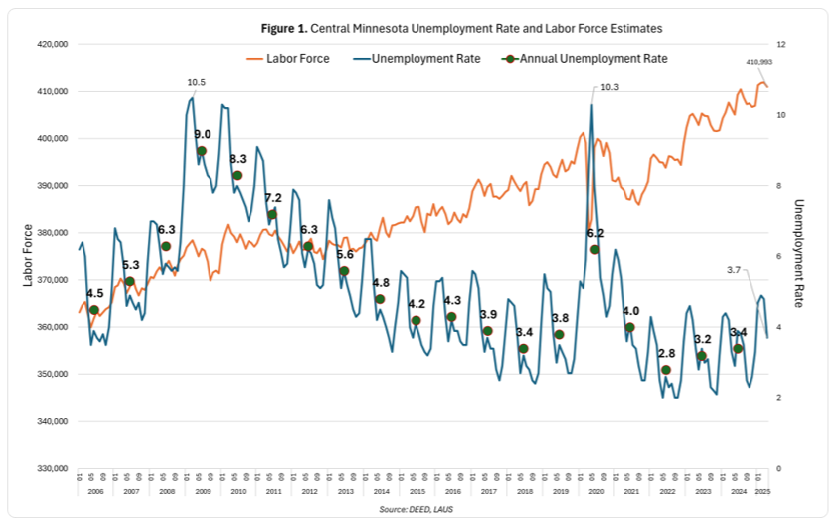

As of April 2025, Central Minnesota's unadjusted unemployment rate stood at 3.7%. This marks an increase from the previous April (3.3%) and from the all-time low of 2.8% in 2022. But it is still relatively low compared to the previous decade, when rates hovered between 7.2% and 4.0% from 2011 to 2021, respectively (Figure 1). The region's rate continues to be above the statewide average of 3.2% as well. Compared to the state's other regions, Central Minnesota has a higher unemployment rate than Southeast (2.8%), the Twin Cities (2.8%), and the Southwest (3.2%), but a lower rate than both Northwest (4.2%) and Northeast Minnesota (4.4%), indicating relatively tight labor market conditions and robust employer demand.

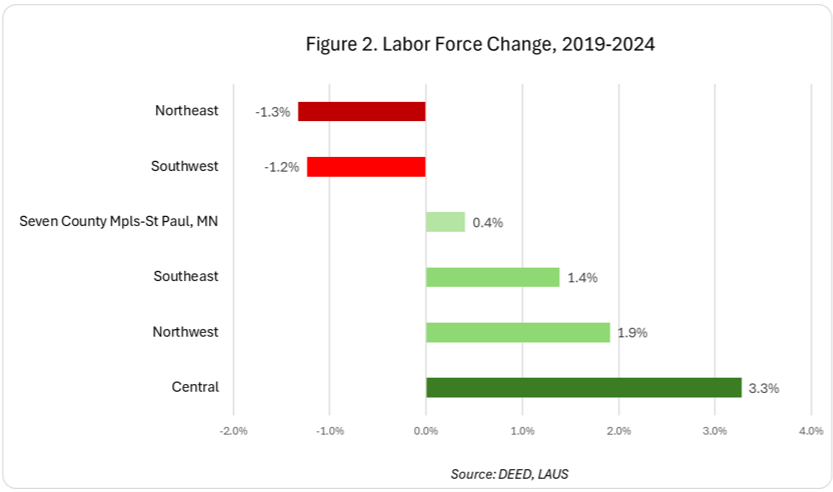

The region's labor force surged past 410,000 participants in early 2025, well above the pre-pandemic level of 400,000 recorded in early 2020. As an annual average, the region had about 407,200 participants in the labor force in 2024, roughly 11,750 more workers than the pre-pandemic level in 2019. At that level, the region boasts the fastest labor force recovery in the state, gaining 3.3% more workers by 2024 compared to 2019 (Figure 2).

The region had 395,655 employed workers in April 2025, leaving approximately 15,350 unemployed individuals who are actively seeking work. This rapid workforce growth and moderate unemployment rate, combined with a relatively low job vacancy rate, indicates Central Minnesota's tight labor market has eased and the supply of unemployed workers is possibly better aligned with regional opportunities compared to other areas of the state.

Data from the Quarterly Census of Employment & Wages (QCEW) confirms that 2024 saw modest but widespread job growth. Central Minnesota ended the year with an average of 282,951 jobs — about 3,300 more than in 2023. This 1.2% growth is on par with the state average, and reflects a stable recovery after the more rapid post-pandemic rebound. Of the six planning regions, only Northeast Minnesota experienced faster job growth (+1.3%) during this time, while Southeast matched Central Minnesota's rate.

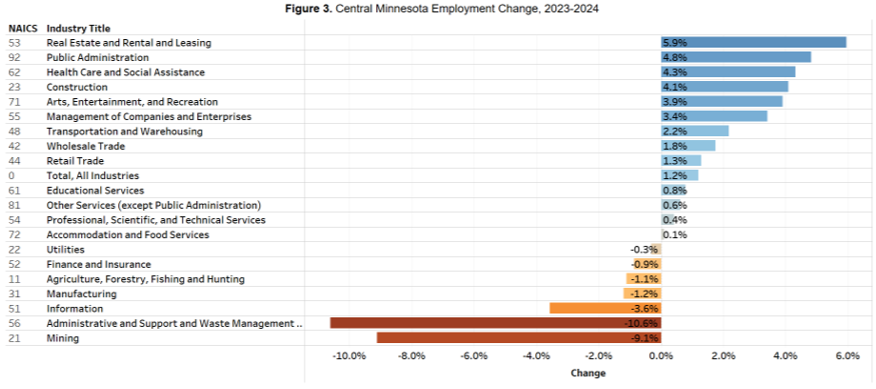

This growth continues a stable recovery trend since 2019. Among Minnesota regions, only Northwest has added jobs at a faster rate over that five-year period. While most sectors in Central Minnesota have added employment, a few have substantially fewer jobs: Administrative Support & Waste Management Services (-1,379 jobs), Manufacturing (-712) and Information (-368) have lost the most.

More recently, 14 of the 20 industry super sectors gained jobs in Central Minnesota from 2023 to 2024, while six lost jobs. The fastest job gains from 2023 to 2024 were in Real Estate & Rental & Leasing (6%), Public Administration (4.8%), Health Care & Social Assistance (4.3%) and Construction (4%). Mining, Administrative Support & Waste Management Services and Information declined by the largest shares. The second largest sector in the region's economy, Manufacturing, also shed payroll employment by 1.2% (Figure 3).

At a more detailed level, several industry subsectors saw substantial growth. Miscellaneous Manufacturing grew 14.2%, Securities & Commodity Contracts (+13.8%) and Nursing & Residential Care Facilities (+11%) both jumped more than 10%, and Heavy & Civil Engineering Construction and the related Construction of Buildings subsector grew by roughly 9%. The largest losses were in Performing Arts, Spectator Sports & Related Activities (-19%), Administrative Support Services (which includes Temporary Help & Staffing Agencies) (-12.4%), and Internet Publishing & Broadcasting (-11%).

Average annual wages in the region rose to $56,940 in 2024, up from $54,652 the previous year, for a gain of 4.2%. Wage gains were evident in several sectors, though some industries stand out. For example, average wages in Administrative Support & Waste Management Services grew by 6.5% despite the job losses, Construction and Educational Services were both up 5.7%, and Manufacturing increased wages by 5% over the year.

While overall wage growth outpaced inflation in some sectors, others continued to lag; such as Accommodation & Food Services (+2.1%) and Arts, Entertainment & Recreation (+2.3%), though both have historically offered much lower hourly pay and more part-time schedules than other industries. A few high wage industries also demonstrated slower growth in average wages, including Management of Companies (2.3%) and Finance & Insurance (2.5%).

While wages have increased, the data reinforces the notion that pay alone may not be sufficient to address persistent vacancies, especially when many jobs also require specific certifications, experience or working conditions that are less appealing to today's job seekers.

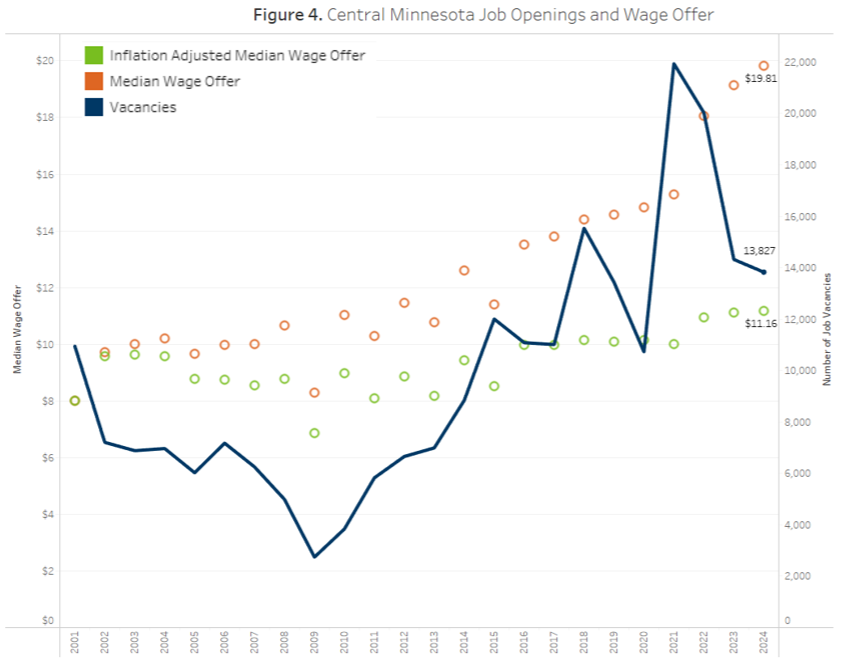

DEED's Job Vacancy Survey reported more than 13,800 openings in Central Minnesota in 2024, yielding a regional job vacancy rate of 5.0%, compared to 4.3% statewide. The median hourly wage offer was nearly $20, a huge jump from pre-pandemic levels (Figure 4). This points to a tight labor market, though marginally less strained than the peak of the labor crunch in 2021 when vacancy rates were above 8% in the region. Employer demand remains high across key sectors, particularly in health care, skilled trades and transportation.

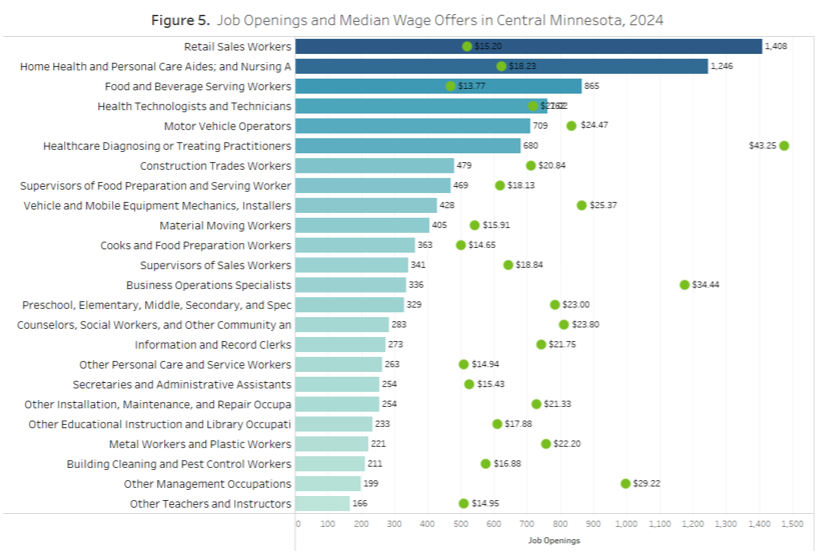

Health care occupations remain in high demand, particularly Home Health Aides, Personal Care Aides and Nursing Assistants. Food Preparation, Sales and Transportation roles also show consistent vacancy levels. At a more detailed level, Retail Sales Workers posted the largest number of openings, of which 39% were part-time and only 1% required postsecondary education (Figure 5).

Educational requirements for openings are mixed: overall, 27% of vacancies required postsecondary education and 37% required at least one year of work experience. Employers continue to struggle most with filling roles that blend soft skills, credentials and availability – a theme common over the past few decades, but especially in a tight labor market.

Anecdotal data from job counselors suggests that many job seekers continue to be selective, often weighing flexibility, work-life balance and benefits more heavily than in the past. This mutual recalibration between worker expectations and employer offerings is reshaping regional job design and recruitment strategies. Even with fewer openings than the past few years, historically high levels of opportunity remain.

Some employers continue posting openings even after positions are filled, using listings to build a pool of potential candidates. This practice, rooted in strategies developed during periods of labor scarcity, can create confusion and frustration among job seekers if they don't receive callbacks or get interviews. Many employers have confirmed they keep postings active even after the position has been filled in order to build a stockpile of potential applicants. As employers compile a trove of applications for potential "future hires", the unintended consequence is that many job seekers are discouraged by a labor market saturated with job postings for a position that doesn't currently exist. Typically, job seekers report not ever hearing back from employers after applying for these openings.

But the problems in matching qualified jobseekers and interested employers don't stop there. Ironically, technology intended to streamline hiring now contributes to applicant overload and false leads, with bots submitting fake resumes and employers struggling to sort real candidates from automated noise. Despite a healthy number of job openings, the result from this situation is employers and jobseekers often struggle to connect with the real matches.

Central Minnesota enters the second half of the 2020s with a solid labor market foundation, but continued progress depends on adaptability. Wage gains and job openings signal opportunity – but also emphasize the importance of workforce alignment and retention. With labor force growth over the coming decade (+5.9%) projected to be similar to the previous (+5.5%), the region has reason for optimism, as it has already been successfully navigating the "new normal" of labor force growth for almost 15 years.

The brief, yet incredibly volatile, pandemic period caused pain points in the labor market with lasting impacts. The dilution of "real" job openings combined with a change in job seeker preferences are examples of how a shifting labor market can create challenges for some employers and jobseekers, while those who adopt new strategies can thrive.

Ongoing collaboration between local employers, educational institutions and community organizations will be critical to addressing the matchmaking process that is entering a new era, thanks to Artificial Intelligence. Despite increasingly sophisticated advances in helpful technology, a paradox is also being formed – one that affirms the age-old adage that a personal connection between jobseeker and employer is the best way to get a job. It appears that "who you know" will matter for the next generation, potentially more than the previous.