The State of the Northwest Minnesota Labor Market: Cooling but Unfaltering

by Anthony Schaffhauser

June 2025

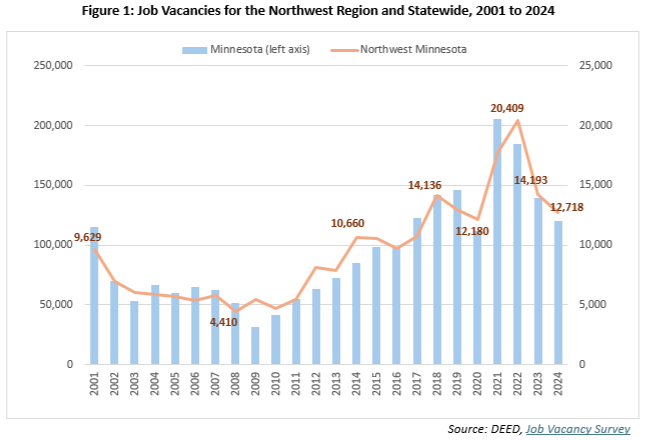

Northwest job vacancies are declining but job vacancy rates remain above the State average

With just over 12,700 vacancies in 2024, the number of job openings in Northwest Minnesota dropped to the lowest level since 2020, now sitting below 2019 pre-pandemic levels (Figure 1). However, that is still higher than any time prior to 2018, keeping up with population and job growth. According to Population Estimates from the U.S. Census Bureau, the population of the 26-county Northwest region is 3.2% larger in 2024 than in 2017, and according to Quarterly Census of Employment and Wages (QCEW), total jobs have increased by 2.6% during the same time, adding over 17,900 positions. This growth naturally requires higher vacancy levels to maintain the same labor demand intensity as previous years.

The current job vacancy rate of 5.6%, which is a measure of job vacancies divided by currently filled positions, represents significant cooling from the peak of 9.3% in 2022, a 3.7 percentage point decrease and a 0.8 percentage point drop from last year. While job vacancies decreased by 10.4% over the past year, this decline was less severe than the statewide drop of 13.4% (Table 1). Northwest Minnesota's job vacancy rate remains substantially higher than the statewide average of 4.3%.

| Table 1: Northwest Minnesota 2024 Job Vacancies and Vacancy Rates by Industry with Change from 2023 and 2024 Median Wage Offer | |||||

|---|---|---|---|---|---|

| NAICS Code | NAICS Industry Title | 2024 Job Vacancies | Percent Change from 2023 | 2024 Vacancy Rate | 2024 Median Wage Offer |

| 0 | Total, All Industries | 12,718 | -10.4% | 5.6% | $18.57 |

| 11 | Agriculture, Forestry, Fishing & Hunting | 196 | +232.2% | 3.4% | $20.61 |

| 21 | Mining | 9 | +28.6% | 3.6% | $23.97 |

| 22 | Utilities | 15 | -60.5% | 1.2% | $24.87 |

| 23 | Construction | 471 | -40.1% | 3.6% | $24.52 |

| 31 | Manufacturing | 779 | -28.4% | 2.6% | $22.74 |

| 42 | Wholesale Trade | 537 | +15.2% | 4.6% | $20.23 |

| 44 | Retail Trade | 2,383 | -10.5% | 8.4% | $15.63 |

| 48 | Transportation and Warehousing | 202 | -46.8% | 3.3% | $22.43 |

| 51 | Information | 47 | +23.7% | 1.8% | $25.58 |

| 52 | Finance and Insurance | 99 | +16.5% | 1.7% | $19.58 |

| 53 | Real Estate and Rental and Leasing | 49 | +122.7% | 3.1% | $13.93 |

| 54 | Professional and Technical Services | 298 | +127.5% | 6.5% | $36.43 |

| 55 | Management of Companies and Enterprises | 56 | -34.9% | 9.2% | $20.60 |

| 61 | Educational Services | 1,099 | -14.3% | 4.6% | $19.84 |

| 62 | Health Care and Social Assistance | 2,589 | -24.5% | 6.6% | $20.21 |

| 71 | Arts, Entertainment, and Recreation | 620 | +43.2% | 16.8% | $16.01 |

| 72 | Accommodation and Food Services | 2,166 | +2.1% | 9.9% | $15.22 |

| 81 | Other Services, Ex. Public Admin | 234 | +143.8% | 3.5% | $19.30 |

| 92 | Public Administration | 858 | +18.0% | 5.5% | $18.89 |

| Source: DEED, Job Vacancy Survey | |||||

Industry Variations: Uneven cooling across sectors

Mixed job vacancy data reveal sector-specific dynamics, with key service sectors showing growth against the trend, while Health Care remains the vacancy leader despite significant cooling. Within goods-producing industries, only Agriculture bucked the downward trend, showing remarkable 232.2% growth in job vacancies; by rising from 59 vacancies in 2023 to 196 vacancies in 2024. In contrast, Construction and Manufacturing experienced steep declines of 40.1% and 28.4% respectively, aligning with broader employment trends in these sectors discussed later in this article.

Six service sectors maintained growth in job vacancies over the year: Accommodation & Food Services (+2.1%), Public Administration (+18.0%), Arts, Entertainment & Recreation (+43.2%), Wholesale Trade (+15.2%), Professional & Technical Services (+127.5%) and Other Services (+143.8%). Each maintained over 200 open positions in 2024.

Health Care & Social Assistance, the region's largest employment sector, continues to lead with 2,589 job vacancies and a 6.6% vacancy rate, though this represents a substantial 24.5% year-over-year decline. Retail Trade ranks second with 2,383 vacancies while Educational Services (1,099) ranks fourth, with both showing declines from the previous year.

Occupational Hotspots: Persistent demand despite overall cooling

As shown in Table 2, Health Care and Service occupations dominate the top 15 vacancy list in the region. In sum, the occupations with the highest demand are concentrated in Health Care, Retail Trade and Food Service, though it’s worth noting that Housekeeping Cleaners, Food Preparation Workers and their Supervisors are also employed in Health Care facilities.

Nursing Assistants show the highest vacancy rate at 19.9%, while Retail Salespersons have the highest number of vacancies at 760. These patterns reflect the region's industry composition, with Health Care representing the largest employment sector.

| Table 2: Top 15 Occupations in Northwest Minnesota by Number of Vacancies | |||||

|---|---|---|---|---|---|

| Occupation Title | Number of Job Vacancies | Regional Employment | Job Vacancy Rate | Median Wage Offer ($/hour) | Median Wage of Filled Jobs ($/hour) |

| Retail Salespersons | 760 | 5,460 | 13.9% | $14.63 | $16.70 |

| Fast Food & Counter Workers | 620 | 5,410 | 11.5% | $14.82 | $14.55 |

| Nursing Assistants | 589 | 2,960 | 19.9% | $18.18 | $20.54 |

| First-Line Supervisors of Retail Sales Workers | 436 | 2,190 | 19.9% | $18.27 | $22.20 |

| Cooks, Restaurant | 403 | 2,460 | 16.4% | $13.02 | $17.63 |

| Cashiers | 384 | 7,250 | 5.3% | $14.34 | $14.38 |

| Waiters & Waitresses | 342 | 3,340 | 10.2% | $15.05 | $11.28 |

| Maids & Housekeeping Cleaners | 340 | 1,750 | 19.4% | $20.19 | $16.77 |

| Food Preparation Workers | 321 | 2,240 | 14.3% | $14.55 | $16.05 |

| Registered Nurses | 298 | 4,600 | 6.5% | $33.30 | $41.91 |

| Personal Care Aides | 295 | #N/A | #N/A | $17.14 | #N/A |

| First-Line Supervisors of Food Prep & Serving Workers | 293 | 1,840 | 15.9% | $18.68 | $21.48 |

| Licensed Practical & Vocational Nurses | 218 | 1,630 | 13.4% | $25.90 | $28.01 |

| Heavy & Tractor-Trailer Truck Drivers | 217 | 3,830 | 5.7% | $22.29 | $27.72 |

| Teaching Assistants | 217 | 4,490 | 4.8% | $37,294/yr | $37,546/yr |

| Source: DEED, 2024 Job Vacancy Survey and Occupational Employment & Wage Statistics | |||||

Heavy & Tractor-Trailer Truck Drivers stand out as the only industrial occupation in the top 15, with 217 vacancies and a 5.7% vacancy rate. This persistent demand exists despite overall employment declines in associated industries like Transportation & Warehousing, highlighting occupation-specific labor market challenges.

Regional Comparison: Growth-driven demand, not labor shortage

When compared to other Minnesota regions, Northwest's 5.6% job vacancy rate appears driven by strong job growth rather than labor supply constraints. The region has maintained the highest job growth rate (+1.7%) since 2019 and the second-highest labor force growth (+1.9%), trailing only the Central region (Table 3).

In fact, a clear pattern emerges in regional comparisons: rural regions with declining labor forces (Northeast and Southwest) show high vacancy rates (6.2% and 5.2%), while metropolitan areas with labor force growth (Twin Cities and Southeast) have lower vacancy rates (3.8% and 4.0%). Northwest and Central stand out as Greater Minnesota regions achieving both labor force and job growth.

| Table 3: Regional Comparison of Job Vacancy Rates, Labor Force Growth, and Job Growth | |||

|---|---|---|---|

| Minnesota Region | 2024 Job Vacancy Rate | 2019-2024 Labor Force Growth | 2019-2024 Job Growth |

| Central | 5.0% | +3.3% | +1.6% |

| Northwest | 5.6% | +1.9% | +1.7% |

| Southeast | 4.0% | +1.4% | +0.1% |

| Twin Cities | 3.8% | +0.4% | -0.7% |

| Southwest | 5.2% | -1.2% | -2.0% |

| Northeast | 6.2% | -1.3% | -2.2% |

| Minnesota | 4.3% | +0.6% | +1.0% |

| Sources: DEED, Job Vacancy Survey, Local Area Unemployment Statistics (LAUS), and Quarterly Census of Employment & Wages (QCEW) | |||

Demographic Edge: In-Migration fuels labor force growth

Northwest Minnesota has benefited from population shifts, with a net gain of 2,182 residents aged 25-54, offsetting a net loss of 2,152 younger residents (15-24). This may seem like a wash at first glance, but the labor force participation rate (LFPR) is “highest among those aged 25 to 54 years. According to the U.S. Census Bureau's 2018 to 2022 American Community Survey 5-year estimates, the 25- to 54- year- old LFPR was 87%, compared to 71% for 16- to 24- year- olds...” This means Northwest added more people who were in their prime working years, rather than in school or not yet ready to join the labor force.

The Northwest also saw a net migration gain of 1,753 people in the 55 to 64 age group, with a LFPR of 69%. Thus, even with only a bit over 20% of the net migration in the traditional working age group, it still provided a substantial boost to the region's labor force. Furthermore, the LFPR for those 65 years and over has been increasing, suggesting population gains for seniors can be expected to have a greater labor force impact in the future.

This labor force growth driven by net in-migration places Northwest Minnesota with the second-fastest labor force growth behind Central, yet the region has been keeping job vacancy rates between those of the Southwest and Northeast. So, despite having the fastest job growth since 2019 of any region, workers moving in keeps the Northwest's propensity to fill open positions on par with the other two most rural regions.

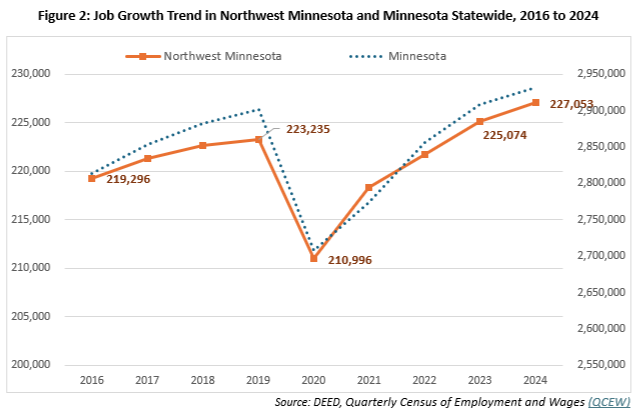

Employment Trends: Resilient growth despite moderation

Northwest Minnesota has experienced accelerated job growth since the pandemic recovery, though the pace has moderated recently. The region achieved 4.0% growth from 2021 to 2024, more than double the 1.8% growth seen from 2016 to 2019. Current annual employment growth has slowed to 0.9% from the 1.5-1.6% annual rates of 2022 and 2023 (Figure 2).

Looking at the entire period from 2019 (pre-pandemic) to 2024, the Northwest had the fastest job growth of any region in the state (Table 3), primarily due to a less severe -5.5% job contraction from 2019 to 2021 compared to -6.7% statewide. This required faster statewide job growth to surpass the 2019 employment level by 2023 than in the Northwest. Moreover, Northwest job growth from 2023 to 2024 is 0.9% compared to 0.8% statewide. Compared to the state as a whole, the Northwest's higher job vacancy rate and smaller drop in job vacancies is driven by less severe pandemic job declines followed by slightly faster recent growth.

Sector Divergence: Uneven recovery across industries

Only three sectors have shown accelerated post-pandemic growth. While overall employment growth accelerated after the pandemic, only three sectors followed this pattern: Agriculture (+10.0%), Accommodation & Food Services (+10.8%), and Other Services (+7.2%). These sectors not only recovered but are experiencing stronger growth than before the pandemic (Table 4).

| Table 4: Industry Sector Employment Change, 2016-2019 and 2021-2024 | ||||||||

|---|---|---|---|---|---|---|---|---|

| Industry Title | Employment (Number of Jobs) | 2016 to 2019 Change | 2021 to 2024 Change | |||||

| 2016 | 2019 | 2021 | 2024 | Jobs | Percent | Jobs | Percent | |

| Total, All Industries | 219,296 | 223,235 | 218,305 | 227,053 | +3,939 | +1.8% | +8,748 | +4.0% |

| Health Care & Social Assistance | 37,281 | 39,185 | 38,492 | 40,668 | +1,904 | +5.1% | +2,176 | +5.7% |

| Manufacturing | 28,447 | 29,478 | 28,899 | 29,702 | +1,031 | +3.6% | +803 | +2.8% |

| Retail Trade | 28,479 | 27,844 | 27,199 | 28,037 | -635 | -2.2% | +838 | +3.1% |

| Educational Services | 21,928 | 22,683 | 21,322 | 22,446 | +755 | +3.4% | +1,124 | +5.3% |

| Accommodation & Food Services | 20,863 | 22,294 | 20,239 | 22,428 | +1,431 | +6.9% | +2,189 | +10.8% |

| Public Administration | 15,324 | 16,466 | 15,257 | 15,844 | +1,142 | +7.5% | +587 | +3.8% |

| Construction | 11,005 | 11,370 | 13,474 | 13,362 | +365 | +3.3% | -112 | -0.8% |

| Wholesale Trade | 11,186 | 11,150 | 11,509 | 11,504 | -36 | -0.3% | -5 | -0.0% |

| Other Services | 6,616 | 6,731 | 6,519 | 6,989 | +115 | +1.7% | +470 | +7.2% |

| Transportation & Warehousing | 6,393 | 6,117 | 6,179 | 6,041 | -276 | -4.3% | -138 | -2.2% |

| Finance & Insurance | 5,782 | 5,961 | 5,872 | 5,833 | +179 | +3.1% | -39 | -0.7% |

| Agriculture, Forestry, Fish & Hunt | 5,101 | 5,288 | 5,227 | 5,748 | +187 | +3.7% | +521 | +10.0% |

| Professional & Technical Services | 4,526 | 4,751 | 4,689 | 4,640 | +225 | +5.0% | -49 | -1.0% |

| Admin. Support & Waste Mgmt. | 4,836 | 4,075 | 4,115 | 3,912 | -761 | -15.7% | -203 | -4.9% |

| Arts, Entertainment & Recreation | 4,779 | 3,539 | 3,198 | 3,753 | -1,240 | -25.9% | +555 | +17.4% |

| Information | 2,804 | 2,600 | 2,552 | 2,610 | -204 | -7.3% | +58 | +2.3% |

| Real Estate & Rental & Leasing | 1,460 | 1,510 | 1,527 | 1,455 | +50 | +3.4% | -72 | -4.7% |

| Utilities | 1,320 | 1,283 | 1,244 | 1,328 | -37 | -2.8% | +84 | +6.8% |

| Management of Companies | 919 | 695 | 581 | 516 | -224 | -24.4% | -65 | -11.2% |

| Mining | 244 | 210 | 208 | 233 | -34 | -13.9% | +25 | +12.0% |

| Source: DEED, Quarterly Census of Employment and Wages (QCEW) | ||||||||

Health Care & Social Assistance showed similar growth for both time periods, though deeper analysis reveals this was largely driven by a surge in the Social Assistance subsector that offset declines in Nursing & Residential Care and Ambulatory Health Care Services.

Two of the region's other larger services sectors, Educational Services and Public Administration, have been growing in both time periods, but have not yet regained 2019 levels. Wholesale Trade employment was the most stable, while Manufacturing had a downshift in growth from 2023 to 2024 and is now 138 jobs (-0.5%) below its 2022 level.

Four sectors reversed from decline to growth. Mining (+12.0%), Utilities (+6.8%), Retail Trade (+3.1%) and Arts, Entertainment & Recreation (+17.4%) all shifted from pre-pandemic declines to post-pandemic growth, showing remarkable turnarounds.

Three sectors declined less since the pandemic recovery but nonetheless remain below 2019 levels: Transportation & Warehousing, Management of Companies and Administrative Support & Waste Management.

Finally, the Construction and Real Estate sectors face headwinds. Four sectors that were growing before the pandemic now show decline: Construction (-0.8%), Finance & Insurance (-0.7%), Real Estate & Rental & Leasing (-4.7%) and Professional & Technical Services (-1.0%). Rising interest rates have significantly impacted these interconnected sectors causing a drastic curtailment of loans and real estate transactions, while lower demand for architectural, engineering and design services weighed down the Professional & Technical Services sector.

Labor Supply Challenges: Worker shortages mask demand

A lack of workers can also stall employment growth. Some sectors showing employment declines may actually face significant worker shortages rather than reduced demand. Transportation & Warehousing, for example, remains 76 jobs (-1.2%) below its 2019 level. However, there are 217 regional vacancies for truck drivers alone. Filling a portion of these open positions in this sector could push it above pre-pandemic employment levels.

This underscores the critical importance of the Job Vacancy Survey to identify and quantify occupational demand. Without it, one might mistakenly conclude that the Transportation & Warehousing sector's lack of growth means that Truck Driver demand is much lower than it is. Similarly, without the Job Vacancy Survey, demand for Teaching Assistants (also known as Paraprofessionals) might be underestimated based solely on Educational Services employment being lower than pre-pandemic levels.

The value of the Job Vacancy Survey stems from Northwest Minnesota's increasingly tight labor markets for many occupations. Even as the general labor market loosens - evidenced by decreasing job vacancies and increasing unemployment rates - the top five occupations in Table 2 all have increased vacancies from 2023. Moreover, Nursing Assistants have the highest number of vacancies and vacancy rate in 2024, even as Nursing & Residential Care Facilities employment remains well below pre-pandemic levels.

Boomer labor market exits keep tension on the labor market

The labor market is responding to labor force exits (e.g., retirements) and occupational transfers (e.g., career progression) as well as job growth. The supply of workers for an occupation impacts job vacancies, and this would not be discovered and quantified without DEED's Job Vacancy Survey.

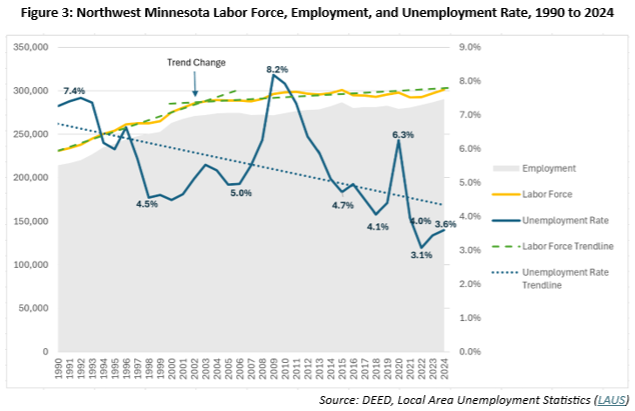

Figure 3 illustrates labor force exits. The slowed labor force growth since 2002 and declining unemployment rate trends maintain tension on the labor market even as overall job vacancy rates drop and employment growth moderates.

Northwest Minnesota is approaching the labor force growth trendline from 2002 after dipping below it in 2021. The slower labor force growth since 2002 stems from the Baby Boomers aging out of the so-called prime working years (age 25-54), where labor force participation is highest. This large cohort's decreasing labor force participation flattened the labor force growth trend and continues to put tension on the labor market as Boomer exits continue.

Looking ahead, a key question emerges: will long-term demographic trends maintain sufficient tension on the labor market to perpetuate the unemployment rate downtrend? Or will declining consumer demand in a topping business cycle overwhelm these demographic factors?

Wage growth of lower wage workers is a welcome benefit of the region's tight labor market

One significant benefit from Northwest's tight labor market is that wages for many lower-paid occupations grew significantly more than inflation over the decade. Table 5 shows the change in wages for occupation groups with median wages lower than total, all occupations, which is $22.98 per hour in first quarter 2025.

| Table 5: Northwest Minnesota Change in Real (Inflation Adjusted*) Wages for Selected Occupational Groups, 2016 (expressed in 2025 Q1 dollars) to 2025 | |||||

|---|---|---|---|---|---|

| Occupation Group** | 2025 Employment | 2016 | 2025 | 2016 - 2025 Change | |

| $/hour | Percent | ||||

| Total, All Occupations | 223,320 | $20.82 | $22.98 | $2.16 | +10.4% |

| Office & Administrative Support | 25,830 | $20.11 | $22.86 | $2.75 | +13.7% |

| Food Preparation & Serving Related | 21,870 | $12.18 | $14.60 | $2.42 | +19.9% |

| Sales & Related | 20,090 | $14.65 | $17.09 | $2.44 | +16.7% |

| Transportation & Material Moving | 19,570 | $20.35 | $21.94 | $1.59 | +7.8% |

| Production | 18,300 | $21.17 | $22.73 | $1.56 | +7.4% |

| Healthcare Support | 12,950 | $16.42 | $18.61 | $2.19 | +13.3% |

| Personal Care & Service | 4,970 | $14.27 | $16.69 | $2.42 | +17.0% |

| Arts, Design, Entertainment & Media | 1,850 | $22.00 | $22.22 | $0.22 | +1.0% |

| * 2016 wages are adjusted to first quarter 2025 dollars using the Chained Consumer Price Index for All Urban Consumers (C-CPI-U)** These Occupation Groups were selected because they all have a median wage less than the median for all occupations.

Source: DEED, Occupational Employment and Wage Statistics (OEWS) |

|||||

Real, inflation-adjusted wages for most of these lower-wage occupation groups grew well above the average 10.4% for all occupations. The occupation groups with 2025 wages below $20 per hour all experienced above-average growth. While Transportation & Material Moving and Production occupations had below average growth, they are relatively higher paying compared to the groups with the fastest wage growth. Arts, Design, Entertainment & Media had a higher wage than all occupations in 2016, but dropped below that threshold by 2025 due to wage growth that barely exceeded inflation.

Combined, these lower-wage occupation groups in Table 5 employ an estimated 130,700 workers in Northwest Minnesota, or 58.5% of all jobs in the region. This real wage growth represents a significant improvement for the lowest-earning workers in the region, as well as a boon to overall regional prosperity.

Conclusion

Northwest Minnesota's labor market is cooling, but with distinct resilience compared to other regions of the state. The region's unique combination of faster job growth, robust labor force expansion through in-migration and a diversified industry landscape has created a more balanced adjustment than elsewhere in Minnesota.

While overall job vacancies are declining, the persistent high demand in key occupations like nursing, retail and food service suggests structural challenges that may extend beyond the current business cycle. Furthermore, the significant wage growth for lower-earning workers represents a positive development that improves economic opportunity across the region.

As Northwest Minnesota navigates this transition phase, economic development professionals should focus on addressing occupation-specific shortages rather than pursuing broad expansion strategies. Workforce development efforts to increase labor force participation and boost labor productivity are key in this tight labor market. The region's ability to attract working-age migrants should also be leveraged further, along with initiatives to retain aging workers who can fill critical roles. With thoughtful, targeted approaches, Northwest Minnesota can maintain its economic momentum even as the broader labor market continues to cool.