Slowing to Stability in Southwest

by Cameron Macht

June 2025

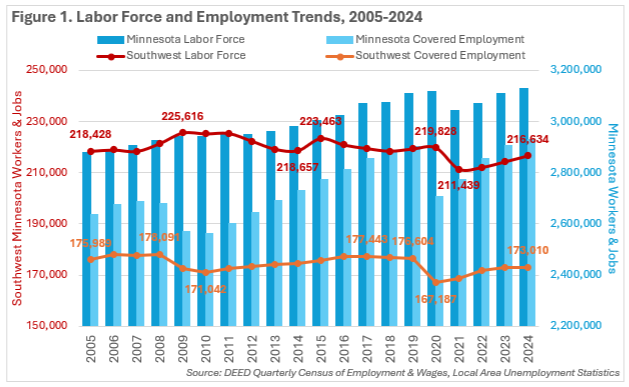

After three years of steady job growth, the economic recovery slowed in Southwest Minnesota in 2024, settling in at just over 173,000 jobs for the second year in a row. While that job count was nearly identical to the 2023 average, it was up by just over 5,800 jobs compared to 2020, but still down almost 3,600 jobs from the 2019 employment level.

Even as job growth stalled in 2024, the regional labor force continued to expand, adding about 2,350 additional workers over the year. There are now just over 216,600 available workers in the 23-county planning region, though that means the region was also still down about 3,200 workers compared to pre-pandemic levels.

Of the six planning regions in the state, the Southwest was one of just two that still had fewer workers than in 2020 – the other being the Northeast. Central Minnesota has seen the fastest workforce growth, followed by the Northwest, the Southeast and the Twin Cities metro area. Overall, the state's labor force is now slightly larger than it was in 2020, after adding about 84,500 workers from 2021 through 2024, up by about 12,000 workers compared to 2020.

Minnesota has seen strong job growth over the past year, adding nearly 23,700 jobs from 2023 to 2024, and re-gaining almost 225,000 jobs from the low point in 2021 through 2024. In 2023, the state surpassed it's 2019 employment level and is now up around 30,000 jobs compared to 2019. Southwest falls behind the state in job growth over each of those periods and has actually experienced a decline in both workers and jobs over the past 20 years (see Figure 1).

However, these employment patterns varied by county within the region, with a couple counties seeing strong job growth and others seeing continuing declines. In the past year, just over half of the 23 counties added jobs, led by Blue Earth County, which gained 950 jobs from 2023 to 2024. Rock, Le Sueur, Lyon and Jackson County also added more than 80 jobs over the past year. In contrast, Cottonwood County saw the biggest decline, dropping 588 jobs, with Nicollet and Nobles also experiencing notable job losses.

As noted, Southwest employers still have about 3,600 fewer jobs now than in 2019, prior to the pandemic, while the state fully recovered by 2023. Eight of the 23 counties have either broken even or seen job growth since 2019, again led by Blue Earth County. The fastest and second largest job growth occurred in Rock County, almost entirely due to a massive increase in Manufacturing. Swift, Watonwan and Faribault County all expanded faster than the state rate as well. The remaining 15 counties have lost jobs since 2019, with the biggest and fastest declines occurring in Nicollet, Brown, Nobles, Waseca, Chippewa, Yellow Medicine and Sibley County (see Table 1).

| Table 1. Southwest Minnesota Employment Statistics, Total All Industries | ||||||

|---|---|---|---|---|---|---|

| Geography | 2024 Annual Data | 2023-2024 Job Change | 2019-2024 Job Change | |||

| Number of Firms | Number of Jobs | Numeric | Percent | Numeric | Percent | |

| EDR 6W- Upper MN Valley | 1,646 | 16,513 | -62 | -0.4% | -735 | -4.3% |

| Big Stone County | 220 | 1,694 | +46 | +2.8% | 0 | 0.0% |

| Chippewa County | 425 | 5,287 | -16 | -0.3% | -453 | -7.9% |

| Lac qui Parle County | 247 | 2,185 | +1 | 0.0% | -34 | -1.5% |

| Swift County | 367 | 3,735 | +15 | +0.4% | +186 | +5.2% |

| Yellow Medicine County | 386 | 3,612 | -107 | -2.9% | -434 | -10.7% |

| EDR 8 - Southwest | 4,196 | 52,094 | -526 | -1.0% | -1,139 | -2.1% |

| Cottonwood County | 447 | 4,846 | -588 | -10.8% | -295 | -5.7% |

| Jackson County | 366 | 5,019 | +81 | +1.6% | -111 | -2.2% |

| Lincoln County | 226 | 1,684 | +49 | +3.0% | +16 | +1.0% |

| Lyon County | 859 | 13,760 | +92 | +0.7% | -280 | -2.0% |

| Murray County | 341 | 2,913 | +69 | +2.4% | -37 | -1.3% |

| Nobles County | 638 | 9,787 | -364 | -3.6% | -685 | -6.5% |

| Pipestone County | 400 | 4,302 | -7 | -0.2% | -171 | -3.8% |

| Redwood County | 591 | 6,094 | +19 | +0.3% | +59 | +1.0% |

| Rock County | 329 | 3,687 | +123 | +3.5% | +365 | +11.0% |

| EDR 9 - South Central | 7,176 | 104,402 | +514 | +0.5% | -1,720 | -1.6% |

| Blue Earth County | 2,143 | 41,230 | +950 | +2.4% | +955 | +2.4% |

| Brown County | 902 | 13,212 | -21 | -0.2% | -786 | -5.6% |

| Faribault County | 492 | 4,549 | -59 | -1.3% | +53 | +1.2% |

| Le Sueur County | 788 | 8,662 | +106 | +1.2% | -93 | -1.1% |

| Martin County | 704 | 8,225 | -57 | -0.7% | -267 | -3.1% |

| Nicollet County | 849 | 14,609 | -416 | -2.8% | -808 | -5.2% |

| Sibley County | 403 | 3,882 | +58 | +1.5% | -402 | -9.4% |

| Waseca County | 553 | 5,527 | -6 | -0.1% | -498 | -8.3% |

| Watonwan County | 343 | 4,505 | -38 | -0.8% | +126 | +2.9% |

| Southwest Minnesota | 13,018 | 173,010 | -73 | 0.0% | -3,594 | -2.0% |

| Minnesota | 212,756 | 2,931,419 | +23,696 | +0.8% | +29,787 | 1.0% |

| Source: DEED Quarterly Census of Employment & Wages | ||||||

Loosening The Labor Market

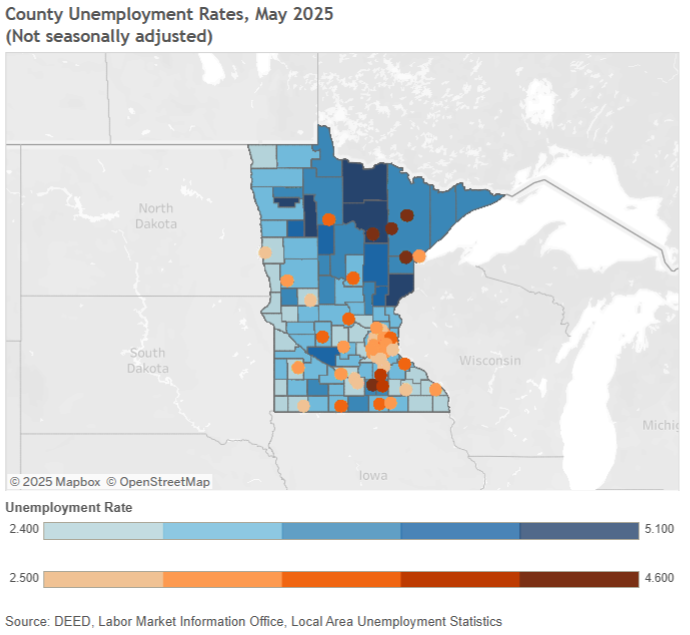

Despite the long-term declines in the region, the workforce growth in the past year suggests a slight loosening of the region's still tight labor market, with the unemployment rate inching up to 3.0% in 2024 from 2.9% in 2023 and the all-time low of 2.5% reached in 2022. While the rate is now climbing, those three unemployment rates are the three lowest on record in the region going back to 1990.

In fact, low unemployment rates are a signature of the Southwest economy – annual rates in the region have been below the state rate 21 times going back to 1990, and equal to the state another four times, accounting for just over 70% of the time in the last 35 years. With the exception of the spike to 5.3% during the Pandemic Recession in 2020, the region's unemployment rate has been 3.5% or lower for the past eight years, demonstrating an on-going tight labor market.

At 2.0%, Rock County had the lowest annual average unemployment rate of the 87 counties in the state in 2024. At 2.6% and 2.7%, four other Southwest counties—Blue Earth and Nicollet, Lac qui Parle and Nobles, respectively—had among the 10 lowest unemployment rates, and four more— Lyon, Redwood, Pipestone and Jackson—were also below 3.0% in 2024. At 4.1%, Le Sueur was the only county in the region with a rate above 4.0%.

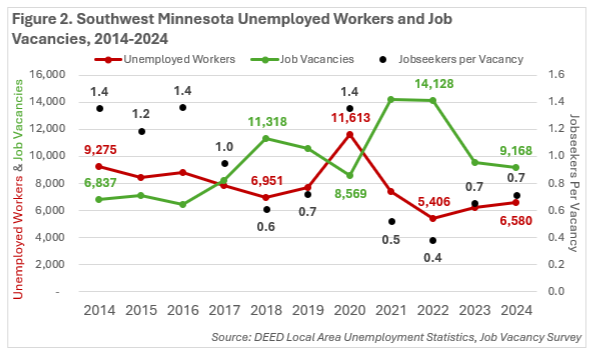

In 2024, the region had an average of 6,580 unemployed workers in a total labor force of 216,634 active participants. Over the previous 10 years, Southwest averaged about 8,000 unemployed workers, making it easier for employers to find the workers they needed to fill open jobs. While 6,580 unemployed workers is still a historically small number for the region, it is well up from the low of 5,287 unemployed people in 2022. While still tight, adding 1,300 available jobseekers from that regional low has expanded the pool that employers can draw from.

Job Vacancy Survey

The Job Vacancy Survey provides another sign of a tight but loosening labor market, as employers in Southwest Minnesota reported about 9,200 job vacancies in 2024, down about 400 compared to the previous year. The region's job vacancy rate, which is the number of jobs available for every 100 jobs that are filled, fell from 5.5% in 2023 to 5.2% in 2024.

However, the region still had less than one unemployed jobseeker for every available opening, continuing a streak started in 2018 and only temporarily interrupted by the Pandemic Recession in 2020. Coming out of the Great Recession in 2011, employers in the region could choose from 3.5 jobseekers per vacancy, making it easier to find workers and fill jobs. But from then on, the number of job vacancies continued to increase, while the number of unemployed workers kept dropping, causing their trajectories to cross.

By 2017, the region had more vacancies than available workers, making it much more difficult for employers to grow. In 2021 and 2022, there were more than two jobs available for every unemployed worker, highlighting the mismatch between supply and demand in the region (see Figure 2).

Overall, there were 9,168 job vacancies reported by Southwest Minnesota employers in 2024, with a median wage offer of $19.48 per hour. After two years with more than 14,000 vacancies coming out of the Pandemic Recession, this was a return to pre-pandemic vacancy levels. But while the number of vacancies was more in line with trends in 2017, 2018 and 2019, the median wage offer skyrocketed from around $13.00 to $14.00 per hour in those years to nearly $20 per hour in 2024. This increase outpaced inflation, signifying real wage gains for workers in the region.

For the third year in a row, only about one-third of the vacancies in the region required postsecondary education, including 15% that required a bachelor's degree or higher, 10% that required an associate's degree and 7% that required vocational training. The remaining 68% can be started with a high school diploma or less, which is almost identical to the percentage that require one year or less of prior work experience. This suggests that employers are casting a wide net to find applicants for their openings and removing or lowering barriers to entry.

By industry, nearly one-fourth of the job vacancies in Southwest Minnesota were in Health Care & Social Assistance, similar to the trend over the past five years. With 2,225 job vacancies in 2024, Health Care hiring demand increased in Southwest compared to 2023, which is notable because the number of Health Care vacancies fell statewide. Across the industry, just over half the positions required postsecondary education, with a median wage offer of $20.11 per hour.

On a more specific occupational level, there were just under 1,000 openings for Healthcare Support occupations such as Nursing Assistants, Personal Care Aides and Home Health Aides, with a median wage offer of $14.95. Almost half of these jobs were part-time, and only 20% required education past high school. In addition, there were 750 postings for Health Care Practitioners & Technical occupations, including Registered Nurses, Licensed Practical Nurses, Emergency Medical Technicians and Occupational and Physical Therapists. Combined, these occupations had a median wage offer of just over $30 per hour, and all require postsecondary education and a certificate or license.

Demand for workers to sell consumer goods continued to climb in 2024, as Retail Trade had the second largest number of openings, with nearly 1,600 vacancies, also up slightly compared to the year prior. Hiring demand ticked up in Accommodation & Food Services as well, which registered just over 1,000 openings in 2024. However, median wage offers hovered between $15 and $16 per hour in these industries, which was among the five lowest wage levels in the region.

At the occupational level, this was reflected in hundreds of openings for Retail Salespersons, Cashiers, Fast Food & Counter Workers, Food Preparation Workers and First-Line Supervisors of Food Preparation & Serving Workers and First-Line Supervisors of Retail Sales Workers. Demand also remained high for Restaurant Cooks and Waiters & Waitresses. Most of these jobs do not require postsecondary education and can be learned through on-the-job training.

Back at the industry level, after peaking at more than 3,000 vacancies in 2022, the biggest drop occurred in Manufacturing, which recorded just under 650 vacancies in 2024. Instead, the characteristics of these postings changed: in 2022, just 16% required postsecondary education and the median wage offer was $17.46. But in 2024, 34% required postsecondary education and the wage offer jumped to $24.61—a 40% increase; suggesting a shift in the type of workers needed.

Educational Services reported around 800 vacancies for the third straight year, which is up from pre-pandemic levels. From 2015 to 2019, the Educational Services industry averaged just under 500 vacancies per year, showing the challenges that local school districts were and continue having in finding Teaching Assistants (also known as Paraprofessionals), Special Education Teachers and Elementary, Middle School and Secondary Teachers. One hundred percent of the teaching jobs require postsecondary education, compared to just 21% of the teaching assistant openings.

Vacancies in Public Administration reached 589 in 2024, the second highest number recorded going back to 2001. Though job counts declined in both state and federal government in the region over the past ten years, employment increased 16.5% in local government, specifically in Executive, Legislative & General Government, as well as Administration of Human Resource Programs. As such, hiring demand and hiring activity both increased over the past year at the local level.

Wholesale Trade, Other Services and Transportation & Warehousing also saw strong upticks in vacancy activity over the past year, all increasing more than 14% compared to 2023, and with relatively high wage offers across the job openings. In contrast, Construction, Professional & Technical Services and Finance & Insurance, all high wage industries, saw declines in job vacancies over the year. Wage offers remained high, but employers posted less openings in 2024 (see Table 2).

| Table 2. Southwest Minnesota Job Vacancy Results, 2024 | ||||||

|---|---|---|---|---|---|---|

| Industry | Number of Job Vacancies | Job Vacancy Rate | Percent Part-time | Percent Requiring Post-Secondary Education | Percent Requiring 1+ Years Experience | Median Hourly Wage Offer |

| Total, All Industries | 9,168 | 5.2% | 26% | 32% | 31% | $19.48 |

| Health Care & Social Assistance | 2,225 | 7.3% | 37% | 54% | 29% | $20.11 |

| Retail Trade | 1,588 | 8.2% | 29% | 3% | 18% | $15.01 |

| Accommodation & Food Services | 1,006 | 8.3% | 28% | 0% | 22% | $15.92 |

| Educational Services | 805 | 4.8% | 49% | 64% | 14% | $20.85 |

| Manufacturing | 648 | 2.0% | 2% | 34% | 65% | $24.61 |

| Public Administration | 589 | 5.7% | 40% | 35% | 58% | $21.90 |

| Wholesale Trade | 492 | 6.3% | 11% | 59% | 51% | $24.59 |

| Other Services | 423 | 8.7% | 13% | 26% | 10% | $19.67 |

| Transportation & Warehousing | 375 | 5.3% | 59% | 14% | 42% | $23.53 |

| Admin. Support & Waste Mgmt. Services | 270 | 9.5% | 19% | 1% | 3% | $15.22 |

| Construction | 198 | 2.4% | 0% | 10% | 68% | $23.88 |

| Arts, Entertainment & Recreation | 123 | 6.1% | 65% | 27% | 36% | $17.81 |

| Agriculture, Forestry, Fishing & Hunting | 95 | 1.7% | 0% | 26% | 22% | $19.94 |

| Professional & Technical Services | 93 | 2.4% | 19% | 91% | 69% | $30.27 |

| Management of Companies | 92 | 6.5% | 13% | 39% | 56% | $24.06 |

| Finance & Insurance | 52 | 0.9% | 1% | 44% | 64% | $24.98 |

| Real Estate, Rental & Leasing | 41 | 3.0% | 18% | 22% | 24% | $14.69 |

| Utilities | 32 | 3.5% | 0% | 71% | 70% | $30.31 |

| Information | 16 | 0.8% | 0% | 48% | 92% | $18.59 |

| Source: DEED Job Vacancy Survey | ||||||

A Time of Transition

In summary, Southwest Minnesota is now navigating a period of economic transition. Though the region has not yet regained all the jobs lost since 2019 and employers are still facing challenges in attracting and retaining workers, particularly in high-demand sectors such as health care, manufacturing and education, the labor force did grow in the past year. With unemployment remaining low and job vacancies still outpacing the number of available jobseekers, the labor market remains tight, and competition for talent is fierce.

This means employers will need to remain proactive and adaptive in their hiring strategies. Raising wage offers, lowering entry barriers, offering on-the-job training and providing flexible schedules will continue to be essential tools to attract and retain workers. The data shows that many employers have already begun increasing wages and adjusting qualification requirements, but long-term success will depend on sustained investments in workforce development and strong partnerships with educators and training providers to build pipelines into critical industries.

For jobseekers, this transitional period brings opportunities in several expanding industries across the region. Health Care & Social Assistance continues to drive demand, especially for both support roles and licensed professionals, with strong wage growth and a wide range of openings. Educational Services has also seen sustained hiring needs, reflecting ongoing challenges in filling teaching and support positions.

Meanwhile, sectors like Wholesale Trade, Transportation & Warehousing and Public Administration have all experienced notable increases in vacancies, many with competitive wage offers. Even in Manufacturing, despite fewer total openings, employers are offering significantly higher wages and more skilled roles, signaling a shift toward quality over quantity. Jobseekers who target these growing industries and align their skills accordingly will be well-positioned to take advantage of higher-wage, in-demand opportunities.