Spotlight: Northwest Minnesota Wages: Beating Inflation and Narrowing the Gap

by Anthony Schaffhauser

September 2025

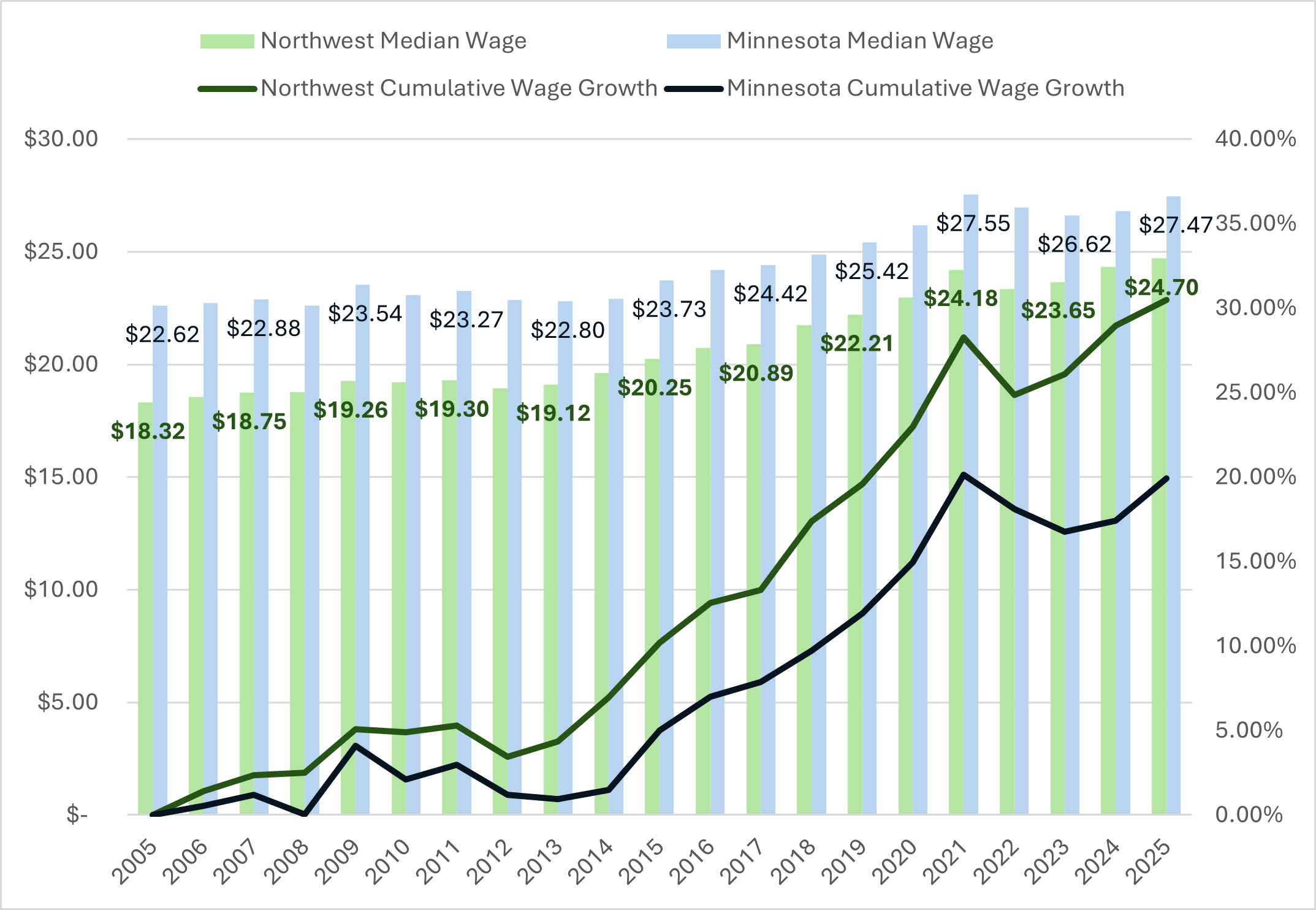

Not only have Northwest wages outpaced inflation, but the wage gap with Minnesota statewide has been cut in half. Twenty years ago Northwest wages lagged statewide wages by 23.5%. Today that gap is just 11.2%.

Figure 1 shows cumulative wage growth looking dramatically faster for Northwest Minnesota. As I'll describe, most of the difference occurred around the last two recessions, but the lasting impact is clear in the narrowing gap between regional and statewide wages.

Figure 1: Median Wage and Cumulative Wage Growth, First Quarter 2005 to 2025

(Wages are inflation-adjusted first quarter 2025 constant dollars*)

* Inflation adjustment from the U.S. Bureau of Labor Statistics, C-CPI-U, and author's calculations.

Source: DEED, Quarterly Employment Demographics

The Great Recession Era (2007-2014)

Inflation-adjusted wages were stagnant in Minnesota from 2007 to 2014 during the Great Recession and its aftermath. This was also the case for the entire U.S. as the worst labor market since the Great Depression put downward pressure on both wages and prices during an overall deflationary period.

The Northwest weathered this storm somewhat better. Stifled wage growth started later here—in 2009 rather than 2007—and ended a year sooner in 2013. Northwest wages remained stable from 2009 to 2011, while statewide wages declined in 2010.

The Northwest's smaller Financial Activities sector played a large role in this greater stability. This sector was the epicenter of the financial crisis. In 2007 Financial Activities accounted for 3.6% of total Northwest jobs and 4.3% of total Northwest payrolls, compared to 6.6% of jobs and 10.6% of payrolls statewide.

Part of the much greater overall cumulative wage growth in the Northwest traces back to these Great Recession differences. From 2014 through 2017 both the Northwest and Minnesota statewide had identical 6.4% cumulative wage growth. Through 2017, the only difference between the two remained the Northwest's more stable wages during the Great Recession and its aftermath.

Pulling Ahead (2018-2024)

The Northwest pulled further ahead in 2018 with notably stronger wage growth – 4.1% versus 1.8% statewide. From 2019 to 2024, the Northwest continued outpacing the state in three of those five years, achieving 9.4% cumulative wage growth compared to just 5.5% statewide. This stronger performance in the years leading up to and following the pandemic pulled Northwest wages significantly closer to statewide levels.

The Pandemic Recovery

Minnesota Inflation-adjusted wages declined in 2022 and 2023 in the recovery from the Pandemic Recession – the first time real wages declined since the last recession. However, this time the wage declines were caused by inflation, not deflation. Annual inflation surged to 7.4% in 2022 followed by a still-elevated 5.7% in 2023 (measured for first quarter over-the-year with the chained consumer price index). The monthly over-the-year headline CPI reached a peak of 9.1% in June 2022 – the highest since 1981.

Northwest Minnesota also saw real wages decline in 2022. However, Northwest nominal wages (unadjusted for inflation) grew a blistering 7% from 2022 to 2023, outpacing the 5.7% inflation rate. This was the fastest nominal wage growth in at least 20 years. Northwest workers thus lost purchasing power to inflation for a shorter period than their statewide counterparts, adding to the region's already faster cumulative wage growth.

The Northwest lagged Minnesota from first quarter 2024 to 2025 with 1.5% wage growth compared to 2.5% statewide. Nonetheless, from first quarter 2020 (when the pandemic hit) through first quarter 2025, Northwest wage growth outpaced Minnesota overall: 7.6% real wage growth compared to 4.9% statewide.

Why the Northwest Outperformed

Unlike the Great Recession, there is no simple industry difference that that accounts for the Northwest's greater wage growth in the Pandemic Recession recovery. While the Goods Producing domain grew faster in the Northwest from 2022 to 2023, the Services Producing domain grew more slowly than statewide. Faster Northwest growth in the large, high-paying sectors of Manufacturing and Construction was offset by slower growth in large, high-paying service sectors of Health Care and Social Assistance, Educational Services, and Public Administration. Overall, Northwest had slightly slower job growth – 1.5% from 2022 to 2023 compared to 1.8% statewide.

Instead, the larger share of low-paying occupations in the Northwest appears to have played a prominent role. DEED's Alessia Leibert demonstrated that wage increases following the pandemic were distributed more heavily to lower-wage workers: ". . . [wages for] the bottom 25% grew much faster than others even after accounting for inflation." Industry wage analysis in one of my prior blogs showed that lower wage workers also gained more in the Northwest.

Consider this alongside the fact that Minnesota's wage distribution largely reflects the Twin Cities, where the majority of Minnesota's jobs are located. The Twin Cities has a much larger percentage of high-paying occupations than the Northwest. To illustrate that the Northwest has a larger percentage of lower-paying occupations: Cashiers, one of the lowest-paying occupations, represent 3.2% of total Northwest employment but only 2% of statewide employment. Similarly, Fast Food and Counter Workers are 2.4% of Northwest employment compared to 2% statewide.

Combining these facts, it is reasonable to conclude that the faster wage growth in Northwest Minnesota during the pandemic recovery stems from a larger percent of low paying jobs, which experienced faster wage growth during this period.

This conclusion is reinforced by the difference between average and median wage growth. Nominal average wages grew 4% in the Northwest from 2022 to 2023, while median wages grew 7%. Statewide, average wages grew 2.5% and median wages grew 4.3%. Since half of workers earn less than the median and half earn more, the fact that median wages increased faster than average wages indicates that more wage growth accrued to lower-wage workers.

What This Means for the Northwest

This narrowing wage gap tells an encouraging story for Northwest Minnesota. Not only have median wages caught up significantly to statewide levels, but the gains have been concentrated among lower-wage workers – exactly where our region needed it most. With Northwest Minnesota employing a higher proportion of workers in lower-paying occupations, these wage increases represent a significant boost to regional prosperity.