The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

From wheat and potatoes to soybeans and sugar beets, the region is a major producer and processor of food staples and specialty agricultural products.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

Construction has experienced nearly continuous job growth over the past decade

11/19/2025 1:32:47 PM

Anthony Schaffhauser

Construction added the most jobs (+1,999) and grew the fastest (+17.6%) of any industry sector in Northwest Minnesota from 2019 to 2024.

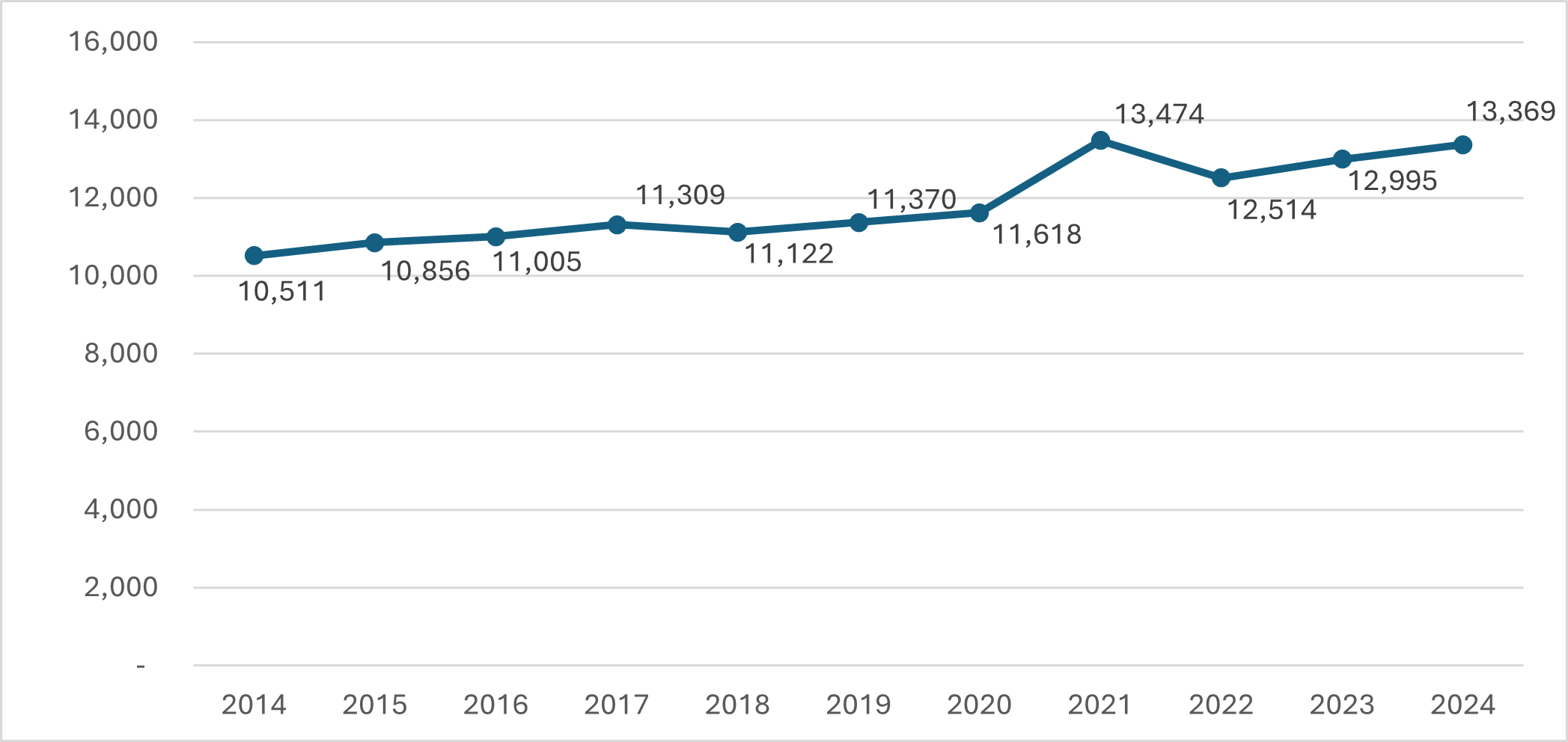

Construction has experienced nearly continuous job growth over the past decade, with declines in only two years (Figure 1). Since 2019, Construction led all Northwest Minnesota industry sectors in both total job gains and growth rate, adding just under 2,000 jobs, a 17.6% increase.

Figure 1: Northwest Minnesota Construction Employment, 2014-2024

Source: DEED Quarterly Census of Employment and Wages

The Health Care & Social Assistance sector was second in employment gains, with 1,513 jobs added from 2019 to 2024. However, since it is already Northwest's largest sector, this represented just 3.9% growth, bringing total employment to nearly 40,700 jobs by 2024.

Mining posted the second-fastest growth rate at 11%, though it remains a small sector with only 233 jobs in 2024. These positions primarily support sand and gravel extraction to supply the Construction industry, meaning the 23 jobs added since 2019 directly reflect growing Construction demand.

Agriculture showed the third-fastest growth at 9.6% and ranked third in total jobs added, increasing by 507 to reach 5,795 jobs in 2024.

Notably, beyond Construction and Health Care, no other industry sector added more than 1,000 jobs. Construction and Mining were the only sectors achieving double-digit growth, with Mining clearly tagging along with Construction's momentum.

This growth engine fuels the entire regional economy. Construction demands services and supplies from multiple industries, including architectural and engineering services, equipment rental and repair, and safety and security. Building materials, tools and equipment parts also flow through regional supply chains. Additionally, workers spent a substantial portion of the nearly $966 million in total wages paid in 2024 within the region.

The Northwest's Construction growth becomes even more impressive when compared to other Minnesota regions; it outpaced every other area in the state (Table 1).

| Table 1: Construction Employment by Region, 2019-2024 | ||||

|---|---|---|---|---|

| Region | 2019 Jobs | 2024 Jobs | 2019-2024 Change | |

| Jobs | Percent | |||

| Central Minnesota | 18,836 | 21,757 | +2,921 | +15.5% |

| Northeast Minnesota | 7,007 | 7,455 | +448 | +6.4% |

| Northwest Minnesota | 11,370 | 13,369 | +1,999 | +17.6% |

| Twin Cities Metro | 75,713 | 80,031 | +4,318 | +5.7% |

| Southeast Minnesota | 9,985 | 10,367 | +382 | +3.8% |

| Southwest Minnesota | 8,290 | 8,285 | -5 | -0.1% |

| Minnesota | 134,309 | 145,183 | +10,874 | +8.1% |

| Source: DEED Quarterly Census of Employment and Wages | ||||

Given the population growth from in-migration and that the region's housing growth has lagged population growth, you might assume residential construction drives the boom. That's not the case.

While Residential Construction grew 5.4% from 2019 to 2024 – faster than most other sectors – this was the slowest growth of any industry within the construction sector (Table 2). However, this still exceeded the 4.9% Residential Construction growth rate of the prior five years from 2014 to 2019.

| Table 2: Northwest Minnesota Construction Industry Employment, 2019-2024 | ||||

|---|---|---|---|---|

| Industry | 2019

Jobs |

2024 Jobs | 2019-2024 Change | |

| Jobs | Percent | |||

| Residential Building Construction | 1,552 | 1,636 | +84 | +5.4% |

| Nonresidential Building Construction | 836 | 1,093 | +257 | +30.7% |

| Utility System Construction | 1,108 | 1,307 | +199 | +18.0% |

| Land Subdivision | 11 | 12 | +1 | +9.1% |

| Highway, Street and Bridge Construction | 2,274 | 2,435 | +161 | +7.1% |

| Other Heavy and Civil Engineering Construction | 95 | 149 | +54 | +56.8% |

| Foundation, Structure and Building Exterior Contractors | 1,117 | 1,409 | +292 | +26.1% |

| Building Equipment Contractors | 2,470 | 3,013 | +543 | +22.0% |

| Building Finishing Contractors | 740 | 841 | +101 | +13.6% |

| Other Specialty Trade Contractors | 1,165 | 1,474 | +309 | +26.5% |

| Source: DEED Quarterly Census of Employment and Wages | ||||

Building Equipment Contractors, including plumbing, HVAC and electrical, added the most jobs. Other Heavy and Civil Engineering Construction grew the fastest at 56.8%, though this represented only 54 jobs. This industry includes mostly outdoor projects such as flood control, parks and trails, and railroad construction. Overall, the region's construction boom is driven by trades contractors and infrastructure development.

While infrastructure projects employ local workers and regional contractors win many bids, they often rely more heavily on labor from outside the region than residential and commercial building. For example, a major 2021 project employed a number of Texas contractors. While the project was ongoing, Utility System Construction employment jumped from 1,142 in 2020 to 2,546 jobs in 2021, then returned to 1,088 jobs in 2022 once the project was finished.

From an economic development perspective, infrastructure projects – even when bringing in outside workers – deliver multiple benefits: outside investment, wages spent locally and lasting regional infrastructure improvements. The long-term trend for the region remains clear: Construction sector employment has grown decisively, adding 2,858 jobs since 2014.

Construction provides well-paying and growing employment opportunities across the region. /deed/newscenter/publications/review/april-2024/spotlight.jspRegional workforce development agencies have responded with targeted training and employment services to enable more workers to access these opportunities.

To learn more about employment trends in Northwest Minnesota, contact Anthony Schaffhauser at Anthony.schaffhauser@state.mn.us.