The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

The presence of such industry powerhouses as Polaris, Arctic Cat and New Flyer make Northwest Minnesota a hub of transportation equipment manufacturing.

From wheat and potatoes to soybeans and sugar beets, the region is a major producer and processor of food staples and specialty agricultural products.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

Good news for Northwest Minnesota

5/20/2025 11:40:37 AM

Anthony Schaffhauser

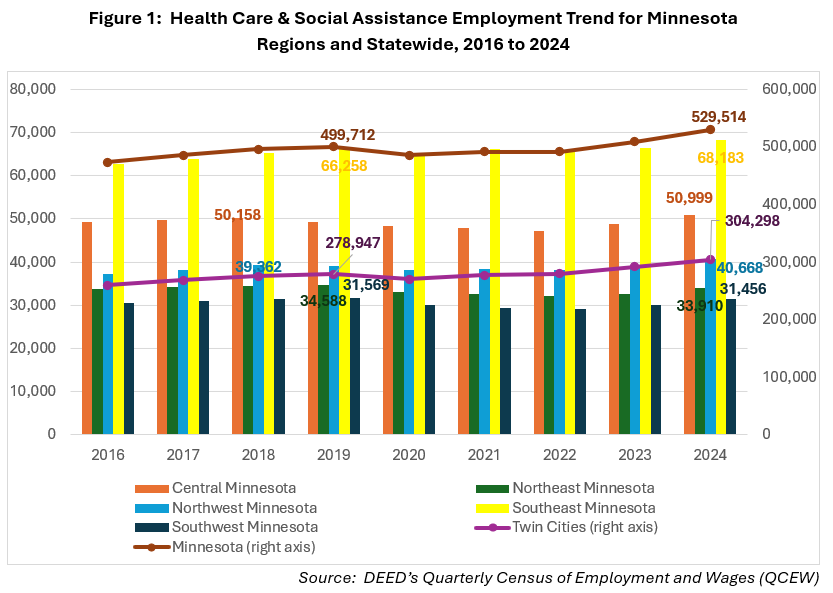

Good news for Northwest Minnesota: in 2024, the region's Health Care & Social Assistance employment finally surpassed pre-pandemic levels! As DEED celebrates Health Care month, let's examine the unique recovery patterns across Minnesota's regions, with special focus on Northwest Minnesota's strengths and ongoing challenges.

Three other regions – four of six total – also now have higher Health Care employment in 2024 than before the pandemic (Figure 1). The Twin Cities led the way, surpassing pre-pandemic employment first in 2022, followed by Southeast in 2023. Central and Northwest Minnesota reached this milestone in 2024, while Northeast and Southwest have yet to regain their pre-pandemic Health Care employment levels.

Minnesota's Health Care & Social Assistance sector now boasts 529,514 jobs in 2024 – an impressive 6.8% higher than the pre-pandemic peak of 499,712 jobs in 2019. The Twin Cities region outpaced all others with a blistering 10.5% growth rate. With 57.5% of the sector's statewide jobs concentrated in the Twin Cities region, it's clearly driving statewide employment growth.

The Twin Cities benefits from a diverse healthcare landscape with a vast array of specialties in the Ambulatory Health Care Services subsector, supported by its large population base. The Twin Cities stands out with Ambulatory Care comprising 31.1% of its healthcare employment. Uniquely, Social Assistance ranks as the second-largest subsector in the Twin Cities, accounting for 27.6% of total Health Care & Social Assistance jobs. This explains the region's quick recovery – Social Assistance rebounded more rapidly than other healthcare subsectors.

Similarly, Southeast Minnesota (home to Mayo Clinic) has the largest share of its Health Care & Social Assistance employment in the Ambulatory Care subsector at 50.9% (Table 1). In contrast, Northwest saw a huge job gain in Social Assistance, against declines in Ambulatory Health Care and Nursing & Residential Care Facilities.

| Table 1: Subsector Percent of Jobs and Change from 2019 to 2024 | ||||

|---|---|---|---|---|

| Region/ Industry | 2024 Jobs | 2024 Percent of Jobs | Change from 2019 | |

| Jobs | Percent | |||

| Central Minnesota | ||||

| Health Care & Social Assistance | 50,999 | 100.0% | +1,834 | +3.7% |

| Ambulatory Health Care Services | 12,756 | 25.0% | +90 | +0.7% |

| Hospitals | 13,859 | 27.2% | -432 | -3.0% |

| Nursing & Residential Care Facilities | 14,848 | 29.1% | +647 | +4.6% |

| Social Assistance | 9,534 | 18.7% | +1,527 | +19.1% |

| Northeast Minnesota | ||||

| Health Care & Social Assistance | 33,910 | 100.0% | -678 | -2.0% |

| Ambulatory Health Care Services | 6,249 | 18.4% | +690 | +12.4% |

| Hospitals | 12,876 | 38.0% | -881 | -6.4% |

| Nursing & Residential Care Facilities | 9,259 | 27.3% | -1,209 | -11.5% |

| Social Assistance | 5,524 | 16.3% | +720 | +15.0% |

| Northwest Minnesota | ||||

| Health Care & Social Assistance | 40,668 | 100.0% | +1,483 | +3.8% |

| Ambulatory Health Care Services | 8,295 | 20.4% | -101 | -1.2% |

| Hospitals | 12,583 | 30.9% | +202 | +1.6% |

| Nursing & Residential Care Facilities | 11,746 | 28.9% | -390 | -3.2% |

| Social Assistance | 8,043 | 19.8% | +1,771 | +28.2% |

| Twin Cities | ||||

| Health Care & Social Assistance | 304,298 | 100.0% | +25,351 | +9.1% |

| Ambulatory Health Care Services | 94,677 | 31.1% | +6,803 | +7.7% |

| Hospitals | 67,886 | 22.3% | -366 | -0.5% |

| Nursing & Residential Care Facilities | 57,673 | 19.0% | +5,399 | +10.3% |

| Social Assistance | 84,062 | 27.6% | +13,516 | +19.2% |

| Southeast Minnesota | ||||

| Health Care & Social Assistance | 68,183 | 100.0% | +1,925 | +2.9% |

| Ambulatory Health Care Services | 34,677 | 50.9% | +1,497 | +4.5% |

| Hospitals | 15,598 | 22.9% | +806 | +5.4% |

| Nursing & Residential Care Facilities | 11,074 | 16.2% | -525 | -4.5% |

| Social Assistance | 6,832 | 10.0% | +146 | +2.2% |

| Southwest Minnesota | ||||

| Health Care & Social Assistance | 31,456 | 100.0% | -113 | -0.4% |

| Ambulatory Health Care Services | 6,795 | 21.6% | -936 | -12.1% |

| Hospitals | 8,346 | 26.5% | +660 | +8.6% |

| Nursing & Residential Care Facilities | 10,755 | 34.2% | -93 | -0.9% |

| Social Assistance | 5,558 | 17.7% | +255 | +4.8% |

| Minnesota | ||||

| Health Care & Social Assistance | 532,896 | 100.0% | +31,900 | +6.4% |

| Ambulatory Health Care Services | 165,512 | 31.1% | +9,297 | +6.0% |

| Hospitals | 131,544 | 24.7% | +245 | +0.2% |

| Nursing & Residential Care Facilities | 115,617 | 21.7% | +3,937 | +3.5% |

| Social Assistance | 120,223 | 22.6% | +18,422 | +18.1% |

| Source: DEED's Quarterly Census of Employment and Wages (QCEW) | ||||

The distribution of healthcare employment looks quite different outside the metropolitan areas:

While Minnesota as a whole shows growth in every Health Care & Social Assistance subsector since 2019, no individual region shares this across-the-board growth. The Twin Cities comes closest, with just a half-percent drop in Hospital employment compared to the slight 0.2% statewide growth.

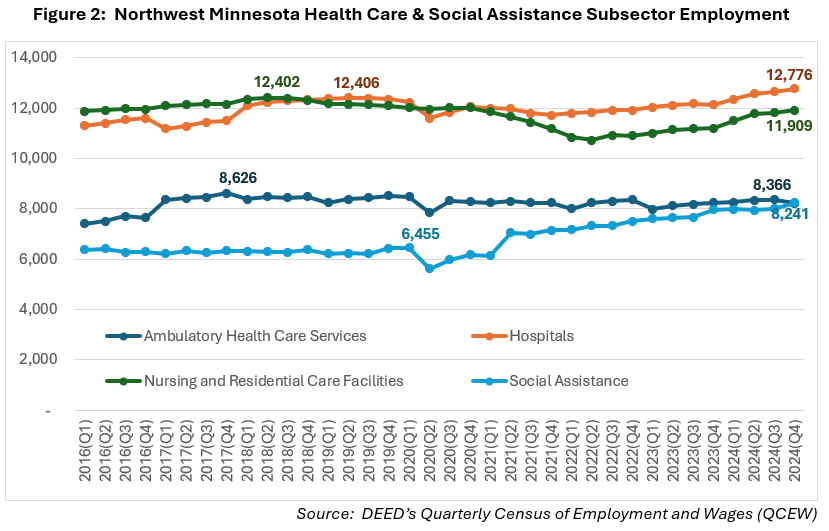

While Northwest Minnesota has recovered its pre-pandemic Health Care & Social Assistance employment levels, the recovery shows striking differences across subsectors (Figure 2). Social Assistance has been the star performer, growing an impressive 28.2% since 2019 – the fastest growth rate of any Health Care subsector in any Minnesota region.

Looking at the quarterly trend data since 2016 reveals some important patterns:

It's particularly noteworthy that these declines began well before the pandemic. While the more urban regions of the Twin Cities and Southeast have expanded their ambulatory care services, Northwest Minnesota – along with the Southwest – has struggled to recruit the specialists needed to grow this subsector.

Ambulatory Care declined a slight 1.2% in Northwest Minnesota, while Southwest experienced a much steeper 12% drop. As Minnesota's most rural regions, both face significant challenges recruiting specialists that drive Ambulatory Care growth in regions with Minnesota's larger cities. It is notable that the Twin Cities and Southeast have the lowest job vacancy rates in the state, suggesting these regions have an advantage in recruiting healthcare workers of all kinds from other regions and states.

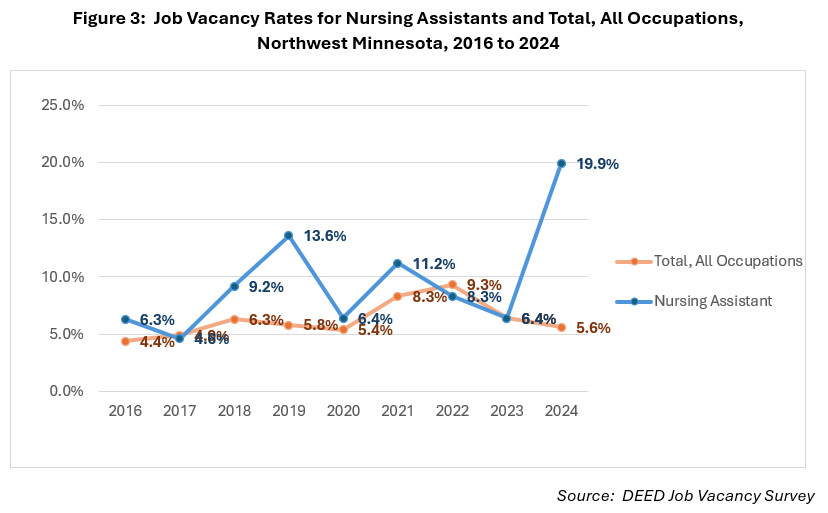

The challenge is particularly acute in Nursing & Residential Care Facilities, where unfilled positions – especially for Nursing Assistants – are preventing facilities from operating at capacity despite growing demand from the region's aging population.

In Northwest, Social Assistance drove overall healthcare employment growth while Nursing & Residential Care Facilities continue to struggle with hiring challenges. This disparity tells an important story for workforce development efforts.

Nursing Assistant has the third largest number of job vacancies of any occupation in the Northwest, just behind Fast Food Workers and Retail Salespersons (Table 2). However, both retail and fast food occupations have significant seasonal demand and are much larger occupations overall.

| Table 2: Top 15 Occupations in Northwest Minnesota by Number of Vacancies, 2024 | ||||||

|---|---|---|---|---|---|---|

| SOC | Occupation Title | Number of Job Vacancies | Regional Employment (Currently Filled Jobs) | Job Vacancy Rate | Median Wage Offer ($/hour) | Median Wage of Filled Jobs ($/hour) |

| 412031 | Retail Salespersons | 760 | 5,460 | 13.9% | $14.63 | $16.70 |

| 353023 | Fast Food & Counter Workers | 620 | 5,410 | 11.5% | $14.82 | $14.55 |

| 311131 | Nursing Assistants | 589 | 2,960 | 19.9% | $18.18 | $20.54 |

| 411011 | First-Line Supervisors of Retail Sales Workers | 436 | 2,190 | 19.9% | $18.27 | $22.20 |

| 352014 | Cooks, Restaurant | 403 | 2,460 | 16.4% | $13.02 | $17.63 |

| 412011 | Cashiers | 384 | 7,250 | 5.3% | $14.34 | $14.38 |

| 353031 | Waiters & Waitresses | 342 | 3,340 | 10.2% | $15.05 | $11.28 |

| 372012 | Maids & Housekeeping Cleaners | 340 | 1,750 | 19.4% | $20.19 | $16.77 |

| 352021 | Food Preparation Workers | 321 | 2,240 | 14.3% | $14.55 | $16.05 |

| 291141 | Registered Nurses | 298 | 4,600 | 6.5% | $33.30 | $41.91 |

| 311122 | Personal Care Aides | 295 | #N/A | #N/A | $17.14 | #N/A |

| 351012 | First-Line Supervisors of Food Preparation & Serving Workers | 293 | 1,840 | 15.9% | $18.68 | $21.48 |

| 292061 | Licensed Practical & Licensed Vocational Nurses | 218 | 1,630 | 13.4% | $25.90 | $28.01 |

| 533032 | Heavy & Tractor-Trailer Truck Drivers | 217 | 3,830 | 5.7% | $22.29 | $27.72 |

| 259045 | Teaching Assistants | 217 | 4,490 | 4.8% | $37,294/yr | $37,546/yr |

| Source: DEED's 2024 Job Vacancy Survey and Occupational Employment and Wage Statistics | ||||||

In fact, Nursing Assistant employment is only about 55% the size of Retail Salespersons and Fast Food Workers yet has nearly comparable vacancy numbers. This translates to a vacancy rate of 19.9% for Nursing Assistants – tied for the highest among the top 15 occupations with vacancies in Northwest Minnesota. This elevated vacancy rate signals intense, unmet hiring demand.

Nursing & Residential Care Facilities also employ other occupations with high vacancy rates, including Housekeeping Cleaners, Food Preparation Workers, Registered Nurses, Personal Care Aides, Supervisors of Food Prep Workers and Licensed Practical Nurses – all appearing in the top 15 occupations by number of vacancies.

However, Nursing Assistants play a particularly critical role, providing daily care for nursing home residents. The vacant positions in this occupation are directly preventing facilities from admitting residents to open beds, creating a bottleneck in the Health Care system.

While job vacancy rates for most occupations have been trending downward since the pandemic recovery, Nursing Assistant vacancies were significantly higher than average before the pandemic and have widened the gap even further in 2024 (Figure 3).

This analysis provides a detailed look at current labor market conditions (as of the end of 2024) in Northwest Minnesota's Health Care & Social Assistance sector. For workforce development professionals, the data points to clear priorities: increasing the pipeline of Nursing Assistants should be at the top of regional workforce strategies.

Next month, I'll project future demand conditions in the Nursing & Residential Care subsector and examine the fundamental drivers of the persistent worker shortage. This will provide a data-driven perspective that workforce development agencies, educational institutions, and healthcare providers can use to address this critical need.

For more information about Health Care employment in Northwest Minnesota, contact Anthony Schaffhauser at Anthony.schaffhauser@state.mn.us

Contact Anthony Schaffhauser at Anthony.schaffhauser@state.mn.us.

If you’d like to find out more about Health Care & Social Assistance career opportunities in Minnesota or if you are an employer looking to hire workers, contact staff at a CareerForce location near you.