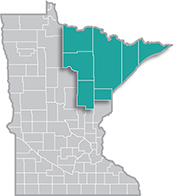

Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Home to the state's second-largest metro, the Northeast Region has a strong industrial sector, tied largely to the area's abundant natural resources.

Most of the manufacturing base centers on mining and forest products industries. More than half of the sector's employment is in paper and machinery manufacturing.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

Long-Term and Home Health Care Trends in Northeast Minnesota

5/20/2025 11:08:05 AM

Carson Gorecki

As the largest-employing industry and one of DEED's Drive for Five sectors of focus, Health Care & Social Assistance is this month's topic for the blog. More specifically, I will be focusing on Long-Term Care and Home Health Care trends and roles. Nursing & Residential Care Facilities alone accounted for over 9,250 jobs in Northeast Minnesota. With Home Health Care Services contributing an additional 700 jobs, the two sub-sectors combined to represent over 7% of total employment in the region in 2024 (Table 1).

| Table 1. Employment and Wage Detail for Select Health Care Industries, 2014-2024 | ||||

|---|---|---|---|---|

| Industry | Employment | Establishments | Average Annual Wage | 2014-2024 Percent Employment Change |

| Total, All Industries | 140,456 | 9,421 | $58,500 | -0.8% |

| Health Care and Social Assistance | 33,910 | 1,108 | $65,104 | +3.5% |

| Home Health Care Services | 699 | 24 | $31,356 | +3.4% |

| Nursing & Residential Care Facilities | 9,259 | 257 | $39,780 | -11.8% |

| Nursing Care Facilities (Skilled Nursing Facilities) | 2,498 | 35 | $43,472 | -12.9% |

| Residential Intellectual & Developmental Disability, Mental Health & Substance Abuse Facilities | 3,140 | 104 | $39,988 | -17.7% |

| Continuing Care Retirement Communities & Assisted Living Facilities for the Elderly | 2,136 | 73 | $36,660 | -13.2% |

| Other Residential Care Facilities | 1,485 | 46 | $37,544 | +5.5% |

| Source: DEED QCEW | ||||

Unlike the larger Health Care & Social Assistance sector, wages in Home Health Care Services and Nursing & Residential Care Facilities were well below the regional average. The Home Health Care Services industry average wage, at $31,356 in 2024, was less than half the overall Health Care sector average and about 54% of the average wage for all industries in the region. The average wages of the four Nursing & Residential Care Facilities sub-industries varied from around $36,500 to $43,500, 63% to 74%, of the all-industry average of $58,500.

The Health Care sector overall has been – on average – growing over the past decade, adding more than 1,100 jobs since 2014 (see Table 1). Home Health Care Services experienced a similar rate of growth as the larger sector. Nursing & Residential Care Facilities, however, faced a divergent trend, losing over 1,200 jobs and declining almost 13%. Job losses were concentrated in Skilled Nursing Facilities, many group homes and similar institutions, and Assisted Living Facilities.

Downward employment trends point toward factors other than simple demand for long term care, which has been increasing for decades and is expected to continue for several more. Almost all Baby Boomers are now of retirement age and an estimated 70% of those over 65 will need long term care at some point in their lives. As a result, the gap between demand and supply is widening throughout the state, but is particularly evident in many rural areas where the population and workforce are older than average.

According to staffing patterns that show the distribution of occupational employment by industry, the most common roles in these industries are Home Health & Personal Care Aides, Nursing Assistants, Registered Nurses, Food Servers and Licensed Practical & Licensed Vocational Nurses (LPNs). Those five occupations represented about 70% of all jobs in Home Health Care and Nursing & Residential Care Facilities. Home Health & Personal Care Aides alone accounted for an estimated two out of every five jobs in those industries.

From our latest Occupations in Demand ranking, Home Health & Personal Care Aides were ranked as the most in-demand occupation in the region, followed closely by Registered Nurses and Nursing Assistants. LPNs were also in the top ten of the more than 425 occupations we ranked in Northeast Minnesota. These occupations have been in high demand for many years, highlighting the integral roles they play in caring for our community members.

Demand for many Healthcare positions is expected to be sustained by an aging population and growing demand for health care. Our most recent employment projections show that employer demand alone is not a guarantee of growth. Demand for new jobs as Home Health & Personal Care Aides and Registered Nurses is expected to grow rapidly while LPNs and Nursing Assistants, which are commonly intermediate steps along a healthcare pathway, are forecasted to grow slower than the regional average (see Table 2). Of the 10 most common occupations in Home Health Care and Nursing & Residential Care Facility settings, only Registered Nurses and LPNs have median wages above the regional all-occupation median of $48,810.

| Table 2. Top Home Healthcare Services and Nursing and Residential Care Facilities Occupations, Northeast Minnesota, 2025 | ||||

|---|---|---|---|---|

| Occupation or Occupational Group | Total, All Industry Employment | Median Annual Wage | Projected Percent Change | Projected 10-yr Openings |

| Total, All Occupations | 139,940 | $48,810 | +3.3% | +178,526 |

| Healthcare Support Occupations | 10,020 | $38,039 | +8.9% | +15,223 |

| Healthcare Practitioners and Technical Occupations | 11,570 | $83,289 | +7.3% | +7,842 |

| Home Health and Personal Care Aides | 6,360 | $36,611 | +10.7% | +9,870 |

| Nursing Assistants | 1,770 | $43,783 | +1.9% | +2,679 |

| Registered Nurses | 4,700 | $84,451 | +5.0% | +2,768 |

| Food Servers, Nonrestaurant | 670 | $34,962 | +2.8% | +1,124 |

| Licensed Practical and Licensed Vocational Nurses | 800 | $57,976 | +3.0% | +665 |

| Residential Advisors | 430 | $46,636 | +1.2% | +572 |

| Recreation Workers | 450 | $36,204 | +4.2% | +865 |

| Cooks, Institution and Cafeteria | 530 | $39,776 | +3.4% | +825 |

| Maids and Housekeeping Cleaners | 1,320 | $34,787 | +3.9% | +2,437 |

| Social and Human Service Assistants | 990 | $45,644 | +6.3% | +1,199 |

| Sources: DEED OEWS, Employment Outlook | ||||

The industry and occupation trends of long-term care point toward a growing gap between supply and demand. Many long-term care providers have been feeling squeezed for years, exacerbated by the COVID pandemic, which hit these settings and their workforce especially hard. You can bet that these wage and employment dynamics will be followed closely by those organizations responsible for providing care to our family and neighbors.

Contact Carson Gorecki at carson.gorecki@state.mn.us.

If you’d like to find out more about Health Care & Social Assistance career opportunities in Minnesota or if you are an employer looking to hire workers, contact staff at a CareerForce location near you.