Southwest Minnesota is a national leader in agricultural production, and renewable energy.

Southwest Minnesota is a national leader in agricultural production, and renewable energy.

The region's thriving manufacturing sector includes food processing, machinery, printing, metal products, and computers and electronic products.

Want the freshest data delivered by email? Subscribe to our regional newsletters.

Southwest Minnesota’s labor market is in the midst of a quiet but complex transformation.

7/3/2025 10:57:58 AM

Amanda Blaschko, Luke Greiner

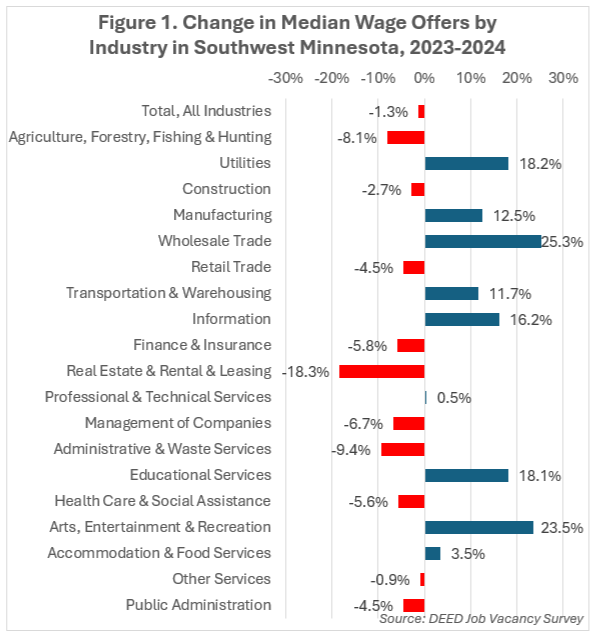

Southwest Minnesota's labor market is in the midst of a quiet but complex transformation. According to the latest Job Vacancy Survey data, the region saw a modest overall decline in job postings between 2023 and 2024, dropping by 4.0% from 9,546 to 9,168 vacancies. But that headline figure hides a whirlwind of industry-level change, as sectors like Construction, Professional & Technical Services and Finance & Insurance contracted dramatically, while Health Care, Wholesale Trade and Public Administration surged ahead. Wage trends also painted a mixed picture with some sectors offering significant pay increases and others showing surprising cuts despite rising demand.

The most dramatic shift was in the Construction industry, which saw job vacancies plummet by 624 positions over the year. This contraction may be linked to cyclical slowdowns or the completion of large projects in the region, as well as record high numbers over the past couple summers. The Construction sector's job vacancy rate is now just 2.4%, among the lowest across industries, suggesting that hiring pressures have eased considerably.

Similarly, Professional & Technical Services saw a major contraction, with vacancies down by 182 openings while Finance & Insurance dropped by 135. These white-collar sectors may be experiencing a post-pandemic rebalancing or reacting to changes in demand due to the influence of Artificial Intelligence. Even Administrative Support & Waste Management Services, typically a flexible employment sector that includes temporary staffing agencies, saw a 26.2% drop in vacancies.

On the other side of the ledger, Health Care & Social Assistance continued its relentless expansion, growing by 507 vacancies or 29.5%, reclaiming its place as the largest job-creating sector in the region with 2,225 open positions. Yet, this growth came with a puzzling twist: median wage offers fell by $1.20, a 5.6% decline, to $20.11 per hour. This may reflect a heavier concentration of lower-wage care roles like Nursing Assistants or Personal Care Aides in the current vacancy mix.

Wholesale Trade also showed strength, with job postings rising 25.8% and median wages soaring by 25.3%, the largest percentage wage gain of any sector. At $24.59 per hour, Wholesale Trade jobs now rival wages in Manufacturing and outpace many other office-based professions.

Public Administration likewise saw a 31.8% increase in job vacancies, adding 142 open positions, and provided a relatively high median wage offer of $21.90 in 2024. However, even here, wages declined slightly by 4.5%, possibly due to changes in the types of roles being recruited.

One of the most striking wage stories came from the utilities sector, which despite only adding 9 job vacancies over the year (up to 32 total), posted a $4.67 increase in median wages, an 18.2% jump to $30.31 per hour. This puts Utilities at the top of the wage offer ladder across all industries in the region. Similarly, Manufacturing wage offers climbed by 12.5%, or $2.74 per hour, hitting a median of $24.61, even as the industry shed 316 job vacancies over the year.

Educational services also posted a significant wage offer boost, with a median wage increase of 18.1%, or $3.20 per hour. This was despite just a 2% increase in vacancies, suggesting an increase in openings for teachers rather than support personnel, or that schools may be boosting pay to retain or attract more workers.

The Arts, Entertainment & Recreation sector saw a dramatic 23.5% bump in wages, up $3.39 per hour, but lost 37 job vacancies compared to 2023. While only a small sector in terms of total vacancies (123 in 2024), this signals a possible recalibration toward better pay for creative roles or seasonal hiring with more competitive rates.

Several other sectors also bucked the logic of supply and demand. Retail Trade, which had the highest number of job openings (1,588) overall, saw wage offers fall by 4.5% to just $15.01 per hour. This likely reflects continued challenges in improving job quality in lower-wage customer service roles, even as hiring demand persists.

Administrative and waste services also showed a troubling 9.4% wage decline, coupled with a 26.2% drop in job postings. These positions are often entry-level or temporary, so fluctuations may reflect broader labor market volatility in lower-skill occupations (Figure 1).

Despite the slight overall decline in job postings in Southwest Minnesota, the deeper story is one of industry realignment and wage volatility. Some sectors are expanding with strong wage incentives, such as Utilities and Wholesale Trade, while others are hiring more but offering lower pay, particularly in Health Care and Retail Trade.

These shifts raise important questions for workforce development:

With a regional vacancy rate of 5.2%, labor demand remains strong, especially in Education, Health Care and other public-facing roles. But to sustain growth, sectors will likely need to reconsider compensation strategies, enhance recruitment efforts and invest in upskilling workers for higher-paying positions. For job seekers, the current market offers many opportunities where wages are climbing. But for employers, the challenge is clear: to compete for talent not just on quantity of openings, but on quality of wages and work environments.

For more information about job vacancies in Southwest Minnesota, contact Luke Greiner at Luke.Greiner@state.mn.us or Amanda Blaschko at Amanda.Blaschko@state.mn.us.