Only the portion of the advertisement directly related to your organization's conduct of charitable gambling may be paid from gambling funds.

EXAMPLE: If the promotional material advertises:

pay only the portion of the advertisement related to bingo from the gambling account.

If the cost of advertising is paid by a licensed organization from its gambling account, then advertising materials such as signs, newspaper ads, flyers, banners, website, online advertising, and promotional materials must contain the:

Items for visual enhancement, such as lights in a booth or on a paper pull-tab dispenser, do not have to contain organization information.

Copies of all ads, such as newspaper, online ads, flyers, magazine, radio, TV, etc. must be kept to support the advertising expenditure. Questions? For questions regarding advertising expenses, contact your Compliance Specialist at the Gambling Control Board.

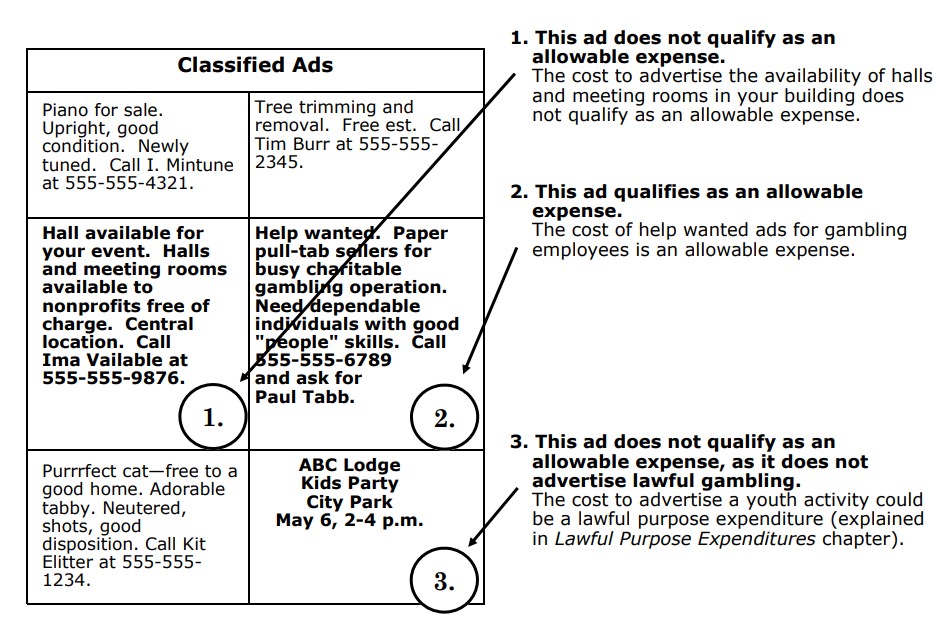

Which of the following classified ads may be paid from gambling funds as an allowable expense?

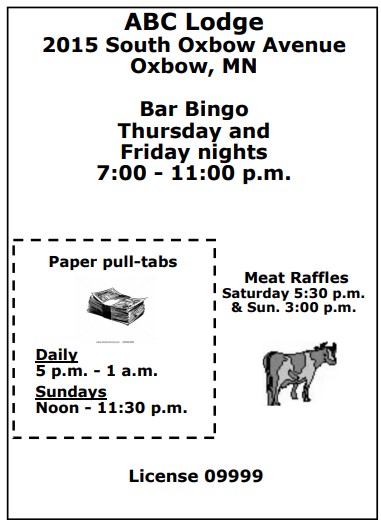

The ad below publicizes both charitable gambling and other organization activities. Only the cost of the top half of this ad (50%) may be paid as an allowable expense. The remainder of the cost must be paid with funds from a non-gambling source.

Q. If we place a radio or TV spot to advertise our Friday night meat raffle, will the cost be an allowable expense?

A. Yes. Keep a written copy of the ad with the invoice to support paying for the ad from gambling funds.

Q. May our organization use gambling funds to pay for an ad in a convention program?

A. Yes, but only the percentage of the cost directly related to the conduct of charitable gambling may be taken as an allowable expense.

Q. May our organization use gambling funds to pay for an ad listing how gambling funds were spent for lawful purposes?

A. Yes. The cost of the ad could be an allowable expense. Check with your Compliance Specialist.