LG100C, Lawful Purpose Expenditures

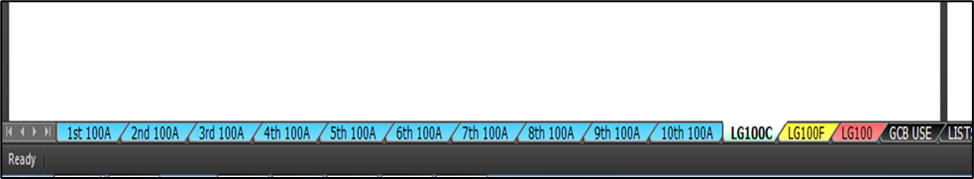

LG100C is used to report all of your organization’s lawful purpose expenditures.At the bottom of your screen, you’ll see tabs for each of the forms to be completed. Click on the green “LG100C” tab.

LG100C Formatting Problems

The LG100C is designed in “landscape” format (11” width and 8.5” height). If the form does not appear on your screen correctly, click on the “Page Layout” tab at the top of your screen. Then click on “Orientation”. Then click on “Landscape”. The page should now display correctly.

If the form is split into two pages:

- Under the “Page Layout” tab, select “Margins” from the menu.

- Then select “Custom Margins”.

- Reset the top, bottom, left, and right margins at .25".

- The header and footer should be set at .2”.

- The page should now view correctly.

All of the organization information at the top of LG100C will already be completed based on the information you entered on the “1st 100A”. If this information is incorrect, you must go back to “1st 100A” and correct the information on that form.

Lawful Purpose Codes

Minnesota Statute 349.12, Subdivision 25(a)(1) through (a)(26) describe the 26 different types of expenditures that qualify as a lawful purpose. For example, “(a)(1)” says that an expenditure to or by a 501(c)(3) organization is a lawful purpose expenditure (lawful gambling funds may be spent for this purpose). For reporting purposes, each of these different 26 areas is given a corresponding code. Subdivision 25(a)(1) is code “1”. Expenditures qualifying as lawful purpose under Subdivision 25(a)(16) are coded “16”, and so on.

Lawful Purpose Expenditure Categories

For statistical purposes, lawful purpose expenditures are divided into the following three categories:

- “Charitable contributions” are defined by statute as expenditures falling under lawful purpose codes 1 – 7, 10 – 15, and 19.

- “Taxes and fees” are defined as codes 8 and 18.

- “Other lawful purposes” are defined as codes 9, 16, 17, and 20 – 26.

- The top section of LG100C shows the total amount spent by your organization for each lawful purpose expenditure category each month. These totals are based on the code you entered in the “Lawful Purpose Code” column for each expenditure listed on the LG100C.

All allowable expenses and lawful purpose expenditures must be reported on a cash basis. The cash basis method of accounting means that expenses are recognized when they are paid (when the check is written or the when the electronic payment is made).

Complete the LG100C

For each expenditure listed, enter:

- The membership approval date. All expenditures require membership approval prior to being made.

- If applicable, the date the expenditure was specifically approved by the Gambling Control Board. Certain expenditures, such as a donation to another licensed organization, require the prior written approval of the Gambling Control Board.

- The date the check was issued or the electronic payment was made. All of the dates in this column should be in month being reported.

- The check number. For electronic transfers enter “ET”.

- The amount of the expenditure.

- The payee as listed on the check, or for electronic transfers, as listed on the bank statement.

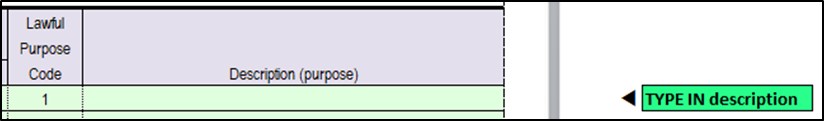

- The lawful purpose code. Only the numbers 1-26 may be entered in this column.

- After entering a number (other than “8” or “10”) in the “Lawful Purpose Code” column, you’ll be prompted to enter a description of your expenditure in the “Description (purpose)” column. For example, you might enter “repair honor guard uniforms”, “purchase bats for Little League baseball team”, “food for homeless shelter”, etc.

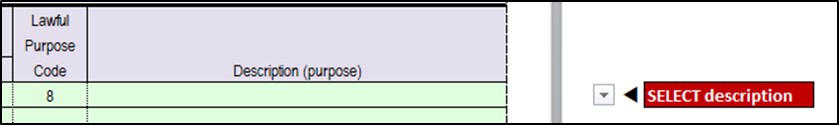

Special Instructions for Codes “8” and “10”

After entering an “8” or a “10” in the “Lawful Purpose Code” column, a drop-down menu icon will appear to the right of the “Description (purpose)” column.

Click on the drop-down icon and a list of different payment descriptions will appear. Highlight the description that matches your payment and hit “Enter” on your keyboard. Your selection will then be entered into the “Description (purpose)” box. Do not type in your own description or edit the listed descriptions. These pre-set descriptions allow the Gambling Control Board to better track how much of your lawful gambling profits are going to which units of government and for what purpose.

NOTE TO SOFTWARE PROVIDERS: Please use the following codes when GCBREPORTS are filed using a comma-separated values (.CSV) file format. For users of the GCB Excel file, when the user selects a description on the LG100C, these codes are automatically entered on the “GCB Use” worksheet.

- 8T State tax and regulatory fee

- 8U State franchise tax (M-4NP)

- 8L Local regulatory tax (up to 3%)

- 8F Federal 730, 990-T, and 11-C taxes

- 10R Required payment to city-administered fund (up to 10%)

- 10V Voluntary contribution to a city

- 10 Contribution to a non-city unit of government

DO NOT LEAVE ANY EMPTY ROWS BETWEEN EXPENDITURES.

Report Expenditures in Month Paid (Cash Basis)

Report all expenditures of lawful gambling funds in the month the expenditure was made, not in the month the expense was incurred. For example, rent for the month of July is paid in August. Report the rent check for July on the August GCBREPORTS because the check was issued in August.

Gambling Taxes

On the Minnesota Department of Revenue’s Monthly Lawful Gambling Tax Return, form G1, the state gambling tax and regulatory fee amount is computed and reported for the month it was incurred. In other words, the tax is shown on the same month’s G1 as the receipts upon which the tax is based. For example, the state gambling tax and regulatory fee amount calculated and reported on the Department of Revenue’s G1 tax return for June is actually paid in July. However, because the tax wasn’t paid in June, but was paid in July, it is reported on the Gambling Control Board’s LG100C for July. Occasionally, an organization may receive a separate refund check for taxes that were overpaid. Report the refund as a negative amount on the LG100C in the month that the refund was received. Every lawful purpose payment made or refund received during the month must be reported on the LG100C.

Penalty and Interest

If, along with the state gambling tax and regulatory fee, your organization also paid penalty and/or interest related to state gambling taxes, these amounts should be reported on the LG100A, line 13, and NOT on the LG100C.

Records

Organizations must keep supporting documentation for each expenditure for at least 3½ years. The organization is responsible for providing proof that each expenditure listed qualified as a lawful purpose. If an expenditure is determined not to qualify as a lawful purpose, the organization will be required to reimburse its gambling account for the amount of the expenditure with funds from a nongambling source.

Complete All Columns

All columns must be completed for each expenditure except that the GCB approval date is only entered when applicable.

More Than 58 Expenditures

There are enough lines to enter up to 58 expenditures (29 on each of the two pages). If you made more than 58 expenditures during the month, contact your Compliance Specialist for instructions on how to combine multiple expenditures onto a single line.

Termination of License

Even after the Gambling Control Board approves your organization’s license termination plan, you are required to continue filing GCBREPORTS until all gambling funds have been spent.

Reimbursements

A disallowed expenditure that was reported as a lawful purpose expenditure in a previous month is entered as a negative amount on the LG100C in the month the reimbursement was made.