LG100F is used to determine whether your month-end bank balance reconciles with your profit carryover. The profit carryover figure represents the cumulative total value of your organization’s gambling assets less liabilities. It is calculated based on the amounts reported on the organization’s monthly reports filed since the organization was first licensed.

An LG100A for each site and the LG100C must be completed prior to completing the LG100F.

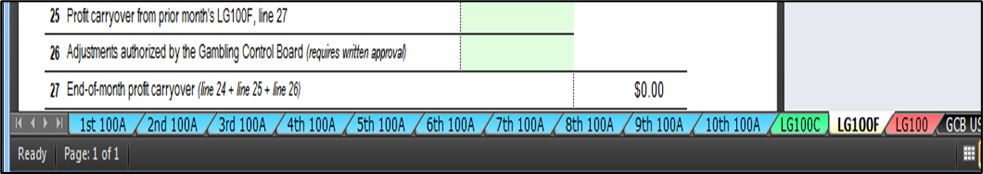

At the bottom of your screen, you’ll see tabs for each of the forms to be completed. Click on the yellow “LG100F” tab.

Complete each applicable green-shaded cell on the LG100F. Green-shaded cells that are left blank will automatically calculate as “$0”.

Lines 1 through 4

If done correctly, line 4 will equal the month-end balance in your gambling account check register. If not, double check the amounts on lines 1, 2, and 3 and the accuracy of your check register balance. If your organization uses multiple gambling checking accounts, combine the amounts of all accounts on lines 1, 2, and 3. Note that it works best to have your bank statement close on the last day of each month. If it doesn’t, contact your bank and ask them to make this change.

Line 5

The net end-of-month starting cash banks amount is calculated automatically based on the amounts reported on the LG100A for each site. If the amount on LG100F is incorrect, double check the amounts reported on lines 25 and 26 of each LG100A.

Line 6

Use this line to report cash received from games reported on LG100A that has not yet been deposited.

Line 7

Report all gambling funds kept in a savings or other non-checking account, such as a certificate of deposit (CD). Note that all gambling funds must be deposited in a bank, credit union, or savings and loan. It is not lawful to invest gambling funds in stocks, bonds, treasury bills, etc.

Enter the value of month-end merchandise prize inventory based on the actual cost to the organization of the merchandise prizes. If all prizes were donated, enter $0. Merchandise prize inventory is tracked on form LG830, Merchandise Prize Perpetual Inventory.

Line 11

This line is used to account for unique circumstances affecting the gambling account balance. Contact your Compliance Specialist to ensure the accuracy of any amounts reported on this line. In the space below line 29, explain the “other additions” included on line 11.

Line 12

The “Total additions” line is included for accounting purposes.

Line 13

If your organization conducts linked bingo, it’s likely that you will owe additional prize money to the linked bingo game provider at the end of each month. This is because the amount your organization actually paid for prizes during the month was less than your organization’s share of the total prizes awarded. If so, enter the amount owed as a positive number on this line.

Occasionally, your organization will have actually paid out more than its share of the total prizes awarded during the month. If so, the linked bingo game provider owes your organization and the amount owed should be entered as a negative number on line 13.

The monthly statement provided to each participating organization by the linked bingo provider will indicate the amount to be reported on line 13.

Line 14

The most common use of this line is to report cash deposited from raffle sales in a month prior to the raffle drawing date. However, any amounts deposited into the gambling account for gambling activity not yet reported on lines 1 through 9 of an LG100A must be reported on LG100F, line 14.

Electronic Pull-tabs: Electronic pull-tabs are reported based on the total value of electronic tickets sold less the prizes awarded for all games in play during an electronic game occasion (typically one business day). Electronic game occasion deposits should always include receipts from a complete occasion. The deposit of proceeds from a partial game occasion is not allowed. As such, no amounts relating to electronic pull-tab games should be reported on the LG100F, line 14.

Line 15

Use this line to report original start-up loan amounts or emergency loans that have not yet been repaid.

Line 16

If your organization awarded any merchandise prizes or had any merchandise prizes in its possession that had not yet been paid for at the end of the month, enter the amount owed on line 16.

Line 17

This line is used to report raffle and other prizes reported on an LG100A that had not yet been paid to the winner(s) at month end. For example, if your organization’s raffle drawing was on April 30, the cash prizes would be reported on April’s LG100A. However, since the prize checks weren’t written to the winners until the next day, May 1, the amount of the checks would be reported on the April LG100F, line 17.

Line 18

This line is used to account for unique circumstances affecting the account balance. Contact your Compliance Specialist to ensure the accuracy of any amounts reported on this line. In the space below line 29, explain the “other subtractions” included on line 18.

Line 19

The “Total subtractions” line is included for accounting purposes.

Lines 20 through 24

These amounts are calculated based on amounts reported on LG100A, LG100C, and previous lines of the LG100F. They are used to calculate your organization’s profit carryover and the profit carryover variance, if any.

Line 25

Enter the profit carryover amount from the previous month’s LG100F, line 27.

COMMON ERROR ALERT! – The amount reported on LG100F, line 25, must equal the amount reported on LG100F, line 27, in the prior month.

Line 26

Do not include any amount on this line unless you have received written approval from the Gambling Control Board. The written approval may be a compliance review report, letter, email, or other form of written authorization. Keep the approval letter or other written documentation with your records. Adjustments may be a negative amount.

Line 27

This is the organization’s month-end profit carryover figure. It’s the amount that must be included on line 25 of next month’s LG100F.

Line 28

The amount on line 28 is calculated by subtracting the amount on line 27 (End-of-month profit carryover) from the amount on line 20 (Reconciled gambling fund balance). The amounts on lines 20 and 27 should be the same, and line 28 should be $0. If the amount on line 28 is not zero, either:

Profit carryover variance

If the amount on line 28 isn’t $0, but it equals the previous month’s line 28, it’s likely that the errors were made in a prior month. Correct the prior month’s GCBREPORTS file, and then enter the revised profit carryover figure from LG100F, line 27, on the current month’s LG100F, line 25. The amount on the current month’s LG100F, line 28, should now be $0. If the profit carryover variance (LG100F, line 28) differs from the previous month’s profit carryover variance, check your reports for errors. Common errors include:

Make every effort to find errors before submitting your reports to the Gambling Control Board or the Department of Revenue. The longer errors remain unresolved, the more difficult it becomes to find and correct them.