Records Required

Keep a signed federal W-4 withholdings form and all required state and federal forms for each gambling employee. Form I-9 must be kept with the organization’s records for 3½ years. Federal W-2 withholdings forms are required at the end of the calendar year.

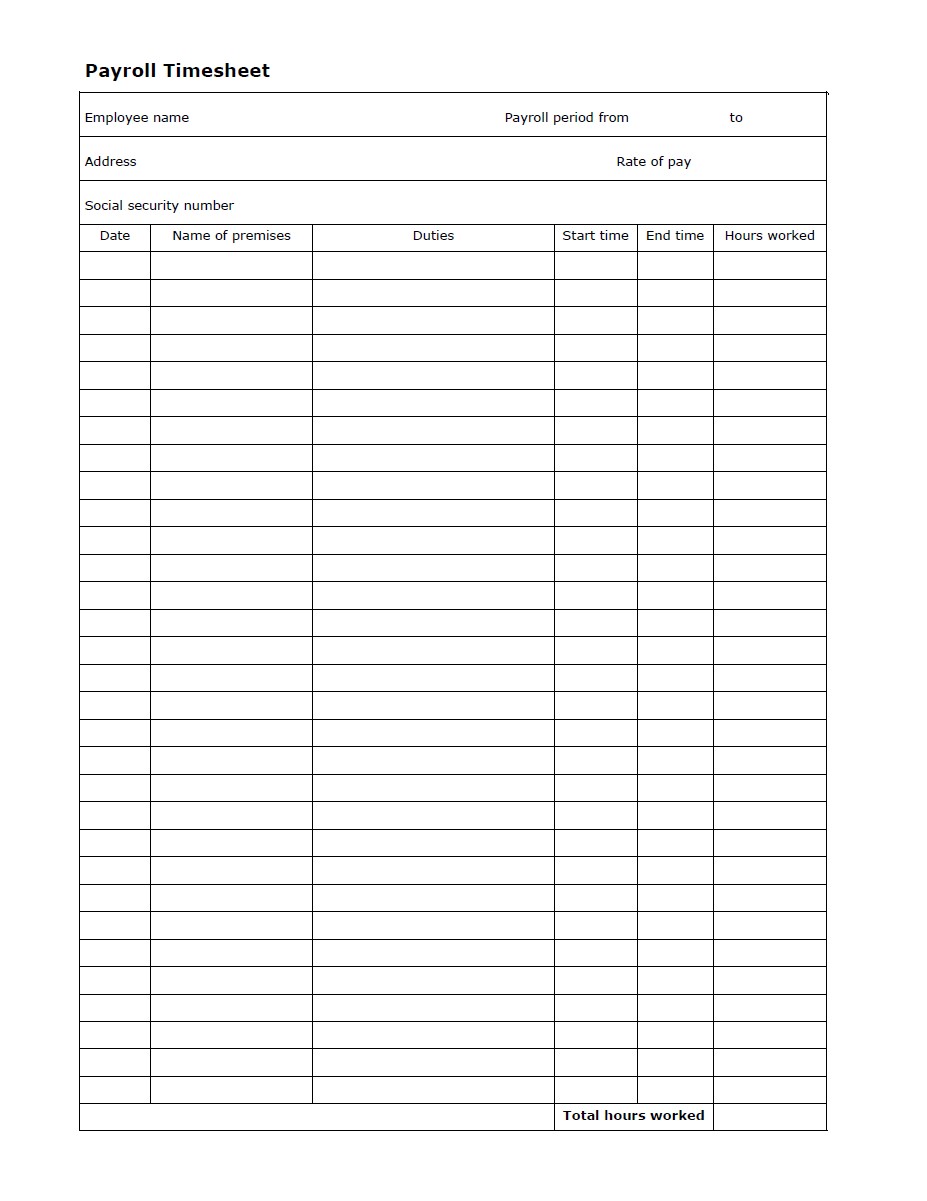

Payroll timesheets must be kept as part of an organization’s permanent records and should include:

- Employee name, address, and social security number.

- Name of premises.

- Payroll period dates.

- Duties and rate of pay.

- Dates worked and total hours worked for each date.

- Total hours worked for the payroll period.

- Starting and ending time.

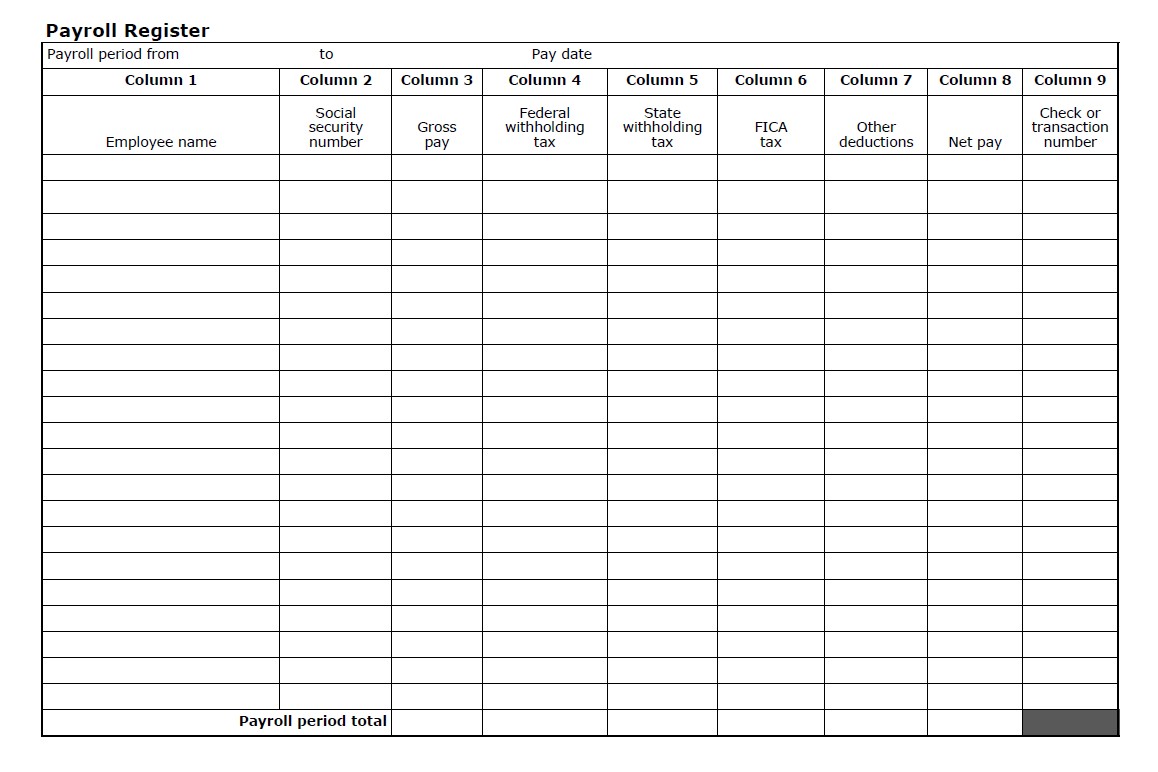

For each payroll period, maintain a Payroll Register that includes:

- Employee name and social security number.

- Gross pay.

- Federal and state withholding tax based on employee’s signed W-4 form.

- FICA withholding.

- Other deductions, such as health insurance and/or life insurance.

- Net pay.

- Check or electronic transaction number.

Timesheet and Payroll Register Examples