Section 1332 State Innovation Waiver

About the Minnesota Premium Security Plan

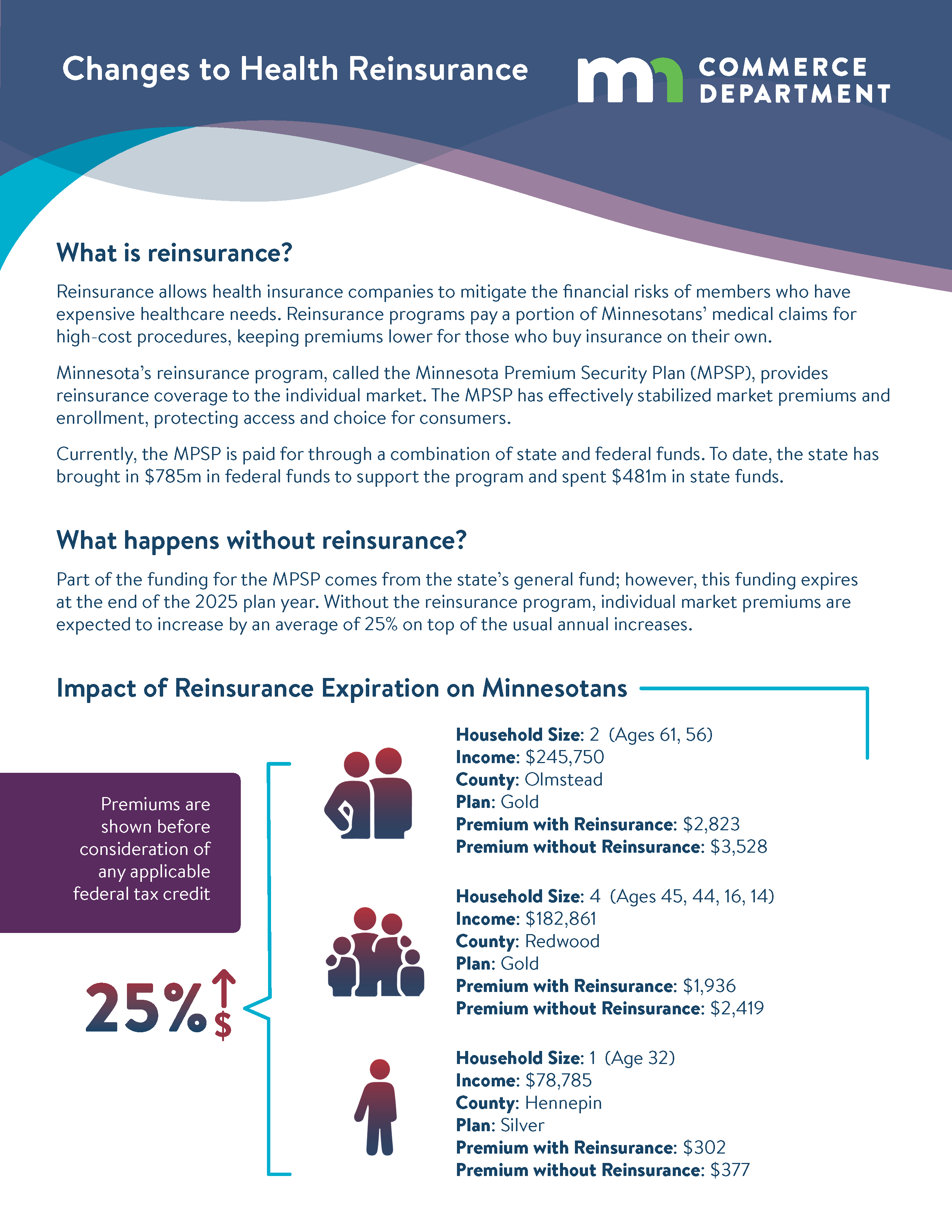

In 2017, to help stabilize high health insurance premiums in the individual insurance market, Minnesota established a state-run reinsurance program. This program, or the Minnesota Premium Security Plan (MPSP), reduces premiums and increases the affordability of health insurance in Minnesota’s individual health insurance market. As a result of the program, premiums for Minnesotans buying insurance on their own are about 20 percent lower on average than what they would otherwise would have been without reinsurance.

These lower premiums also lower the amount of money the federal government spends on tax credits provided to people who purchase coverage on MNsure. The federal government passes along these savings to Minnesota to help fund the state’s reinsurance program.

Reinsurance Program Authority

Minnesota received authority from the U.S. Department of Health and Human Services and the U.S. Department of Treasury to operate a state-run reinsurance program between 2018-2022 via a 1332 waiver. States must reapply to continue this program every five years. In July 2022, Commerce received permission to continue the Premium Security Plan through 2027.

Proposed Funding Source Change

The part of the MPSP funded by the state’s general fund expires at the end of the 2025 plan year. A new proposal would require insurance companies to pay an assessment to cover the portion of the program currently paid by the state. This would shift the financial responsibility from taxpayers to insurers.

See the fact sheet below for more information.

Comments on Minnesota’s 1332 waiver extension may also be submitted to MN1332PublicComments@state.mn.us