Questions

651-539-1600 (local)

800-657-3602 (Greater Minnesota)

consumer.protection@state.mn.us

File a Complaint

Contact Commerce Consumer Service Center

consumer.protection@state.mn.us

Request an External Review

Each year, the departments of Commerce and Health review plans and rates submitted by insurance companies that offer individual and small group health plans. The departments must approve the rates before the plans can be sold to Minnesota consumers.

Minnesotans may submit public comments as part of the rate review process by emailing them to HealthInsurance.DivisionRequests@state.mn.us

What do the departments consider when reviewing rate proposals?

The departments do not set health insurance rates. Rather, they review information submitted by insurers to determine whether their proposed rates are justified. Rates must be justified both by the benefits that consumers receive for their premiums and by the insurance company’s ability to pay expected medical claims costs. Premium rates typically rise each year due to increasing costs and usage of medical care and prescription drugs.

The departments’ reviews also ensure that policies comply with state and federal laws that protect consumers – including coverage of pre-existing conditions and no-cost preventive care, an adequate provider network, and how individuals can enroll or have a claim paid.

In addition, the Affordable Care Act limits the factors that insurers can use to charge higher health insurance rates. Rates can vary based only on an individual’s age, tobacco use, family size and geography.

The departments may deny proposed rates or require insurers to modify them (down or up) if the departments determine that they are excessive or inadequate for the benefits offered.

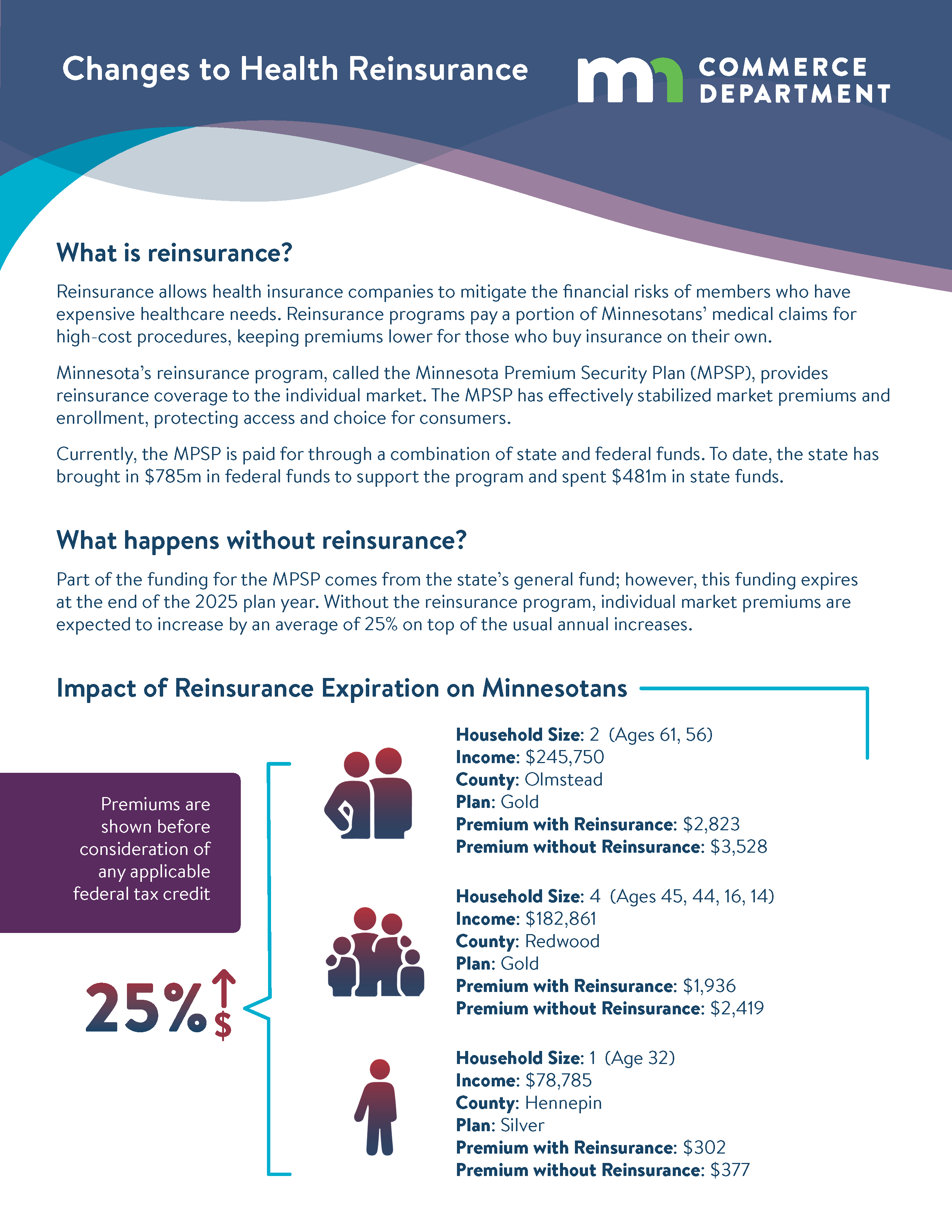

Proposed Funding Source Change

The part of the MPSP funded by the state’s general fund expires at the end of the 2025 plan year. A new proposal would require insurance companies to pay an assessment to cover the portion of the program currently paid by the state. This would shift the financial responsibility from taxpayers to insurers.

See the fact sheet below for more information.

Timeline for health insurance rate reviews

Under state law, insurers’ proposed rate changes for individual and small group health plans must be made public within 10 business days of the submission deadline to the departments.