On this page you will find the latest press releases and statements from the Office of Governor Walz and Lieutenant Governor Flanagan.

5/2/2019 4:46:54 PM

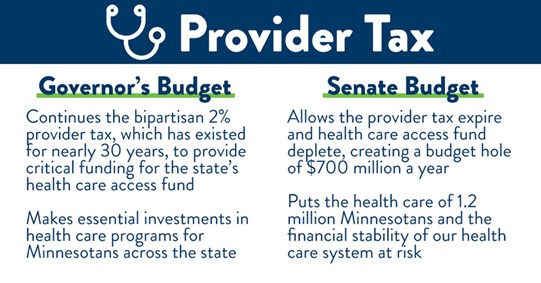

[ST. PAUL, MN] – More than 20 CEOs and executive leaders from hospitals and health systems across the state joined Governor Tim Walz and Lieutenant Governor Peggy Flanagan today to emphasize the critical importance of continuing a 2 percent tax on health care providers that helps ensure nearly 1.2 million Minnesotans receive essential health care services.

In a press conference at the State Capitol, the group called on lawmakers to extend the provider tax, which generates revenue for Minnesota’s health care access fund. A pillar of Minnesota’s health care financing since passed with bipartisan support in 1992, the provider tax is set to expire at the end of the year if the Legislature doesn’t take action. The health care access fund supports essential health care services and public health initiatives, including health care coverage provided through MinnesotaCare and Minnesota’s Medicaid program.

“Over one million Minnesotans from Winona to Wadena, from St. Paul to St. Cloud, are counting on us to maintain the health care access fund,” said Governor Walz. “This is about real people who will face real consequences if we allow the provider tax to sunset.”

The fund was created to increase access to care, contain health care costs, and improve the quality of health services for Minnesotans. In his recently proposed budget, Governor Walz called for a continuation of the fund, which will become insolvent in 2022 without legislative action.

“When Minnesotans have reliable access to preventative and primary care, health outcomes are better and costs decrease for everyone,” said Lieutenant Governor Flanagan. “Without the health care access fund, we will see our friends and neighbors delaying doctor’s appointments and treatments until the problem is so unbearable that they have to go to the emergency room at an astronomical cost. This isn’t how we take care of each other in Minnesota.”

Governor Walz and Lieutenant Governor Flanagan were joined by health care leaders from across the state who spoke to the critical importance of protecting the Health Care Access Fund. Speakers included Human Services Commissioner Tony Lourey; Minnesota Hospital Association President and CEO Lawrence Massa; Penny Wheeler, MD, president and CEO, Allina Health; Mary Maertens, Regional President and CEO, Avera Marshall; Steven Underdahl, president and CEO, Northfield Hospital. More than a dozen other health care leaders attended in support of the provider tax.

“Keeping our provider tax in place so we can continue providing health coverage for hundreds of thousands of Minnesotans isn’t merely a good thing to do, it’s the right thing to do,” said Dr. Penny Wheeler, president and chief executive officer, Allina Health. “What policymakers knew in 1992 is still true today: a reasonable health care provider tax can fund health coverage so low-income, working Minnesotans can get the care they need – primary care, mental and behavioral health care, prescription drugs, hospital care – at the most appropriate setting, without relying only on the emergency room.”

“If we care about providing health care in our rural communities – not just care in hospitals and emergency rooms, but in clinics and nursing homes and home health services – we need to make sure people have coverage to keep these services viable and sustainable over the long term,” said Mary Maertens, regional president and CEO, Avera Marshall Regional Medical Center. “Every one of us benefits from keeping the provider tax in place because all of our rural health care system depends on our residents having health coverage.”

“Minnesota has earned a strong national reputation for making the health of individuals and our communities a top priority. Our long tradition of providing coverage to low-income Minnesotans is a big part of what has made our state’s health care system so great for so long,” said Steven Underdahl, president and CEO, Northfield Hospital. “The provider tax is a key reason for our success in the past – and we need it for Minnesota’s success in the future.”

“The provider tax is a known, reliable, predictable and sustainable funding source that has allowed working families – people who couldn’t get health insurance through their employers and who couldn’t afford to buy it on their own – to obtain coverage through MinnesotaCare,” said Lawrence Massa, president and CEO, Minnesota Hospital Association. “I’m proud that MHA and our members support keeping the provider tax and putting the patients and the communities we serve first. Minnesotans don’t walk away from proven solutions like the provider tax, especially when doing so would leave our family members, friends and neighbors without access to the health care we all need at some point in our lives.”

Lourey echoed others’ concerns. “The provider tax has been a linchpin since 1992. Losing this source of revenue would significantly limit our ability to provide health care coverage to the more than 1 million Minnesotans covered by Medical Assistance and MinnesotaCare.”